Car Insurance Rates For New Drivers

Thursday, June 15, 2023

Edit

Car Insurance Rates For New Drivers

What is Car Insurance?

Car insurance is a type of insurance policy that helps protect you, your family, and your vehicle from financial hardship if you have an accident or your vehicle is damaged. It can also provide coverage for medical expenses, legal costs, and other damages. Most states require that drivers have some form of car insurance before they can legally drive on public roads.

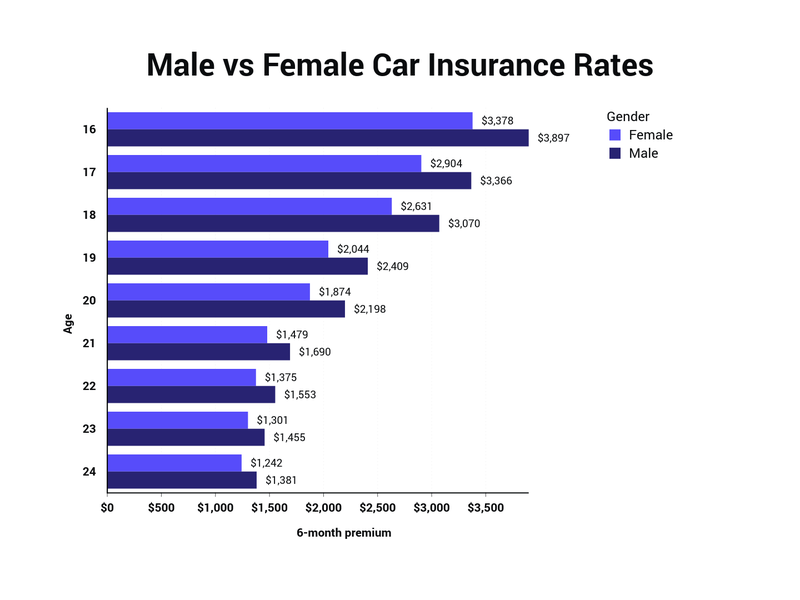

The cost of car insurance will vary depending on a variety of factors, including the type of car you own, your age, your driving record, and the amount of coverage you want. New drivers tend to pay higher car insurance rates than experienced drivers due to their lack of experience and higher risk of having an accident.

Why Do New Drivers Have Higher Insurance Rates?

New drivers are seen as a higher risk to insurance companies because they have not yet had the opportunity to gain experience on the roads. This means that they are more likely to have an accident, and the insurance company will have to pay out a higher amount of money if the accident is their fault.

Insurance companies will also consider other factors such as the type of car a new driver is driving. If the car is a sports car or a luxury vehicle, the insurance company will view it as a higher risk due to its higher potential cost if it is damaged or stolen.

Tips To Lower Insurance Rates For New Drivers

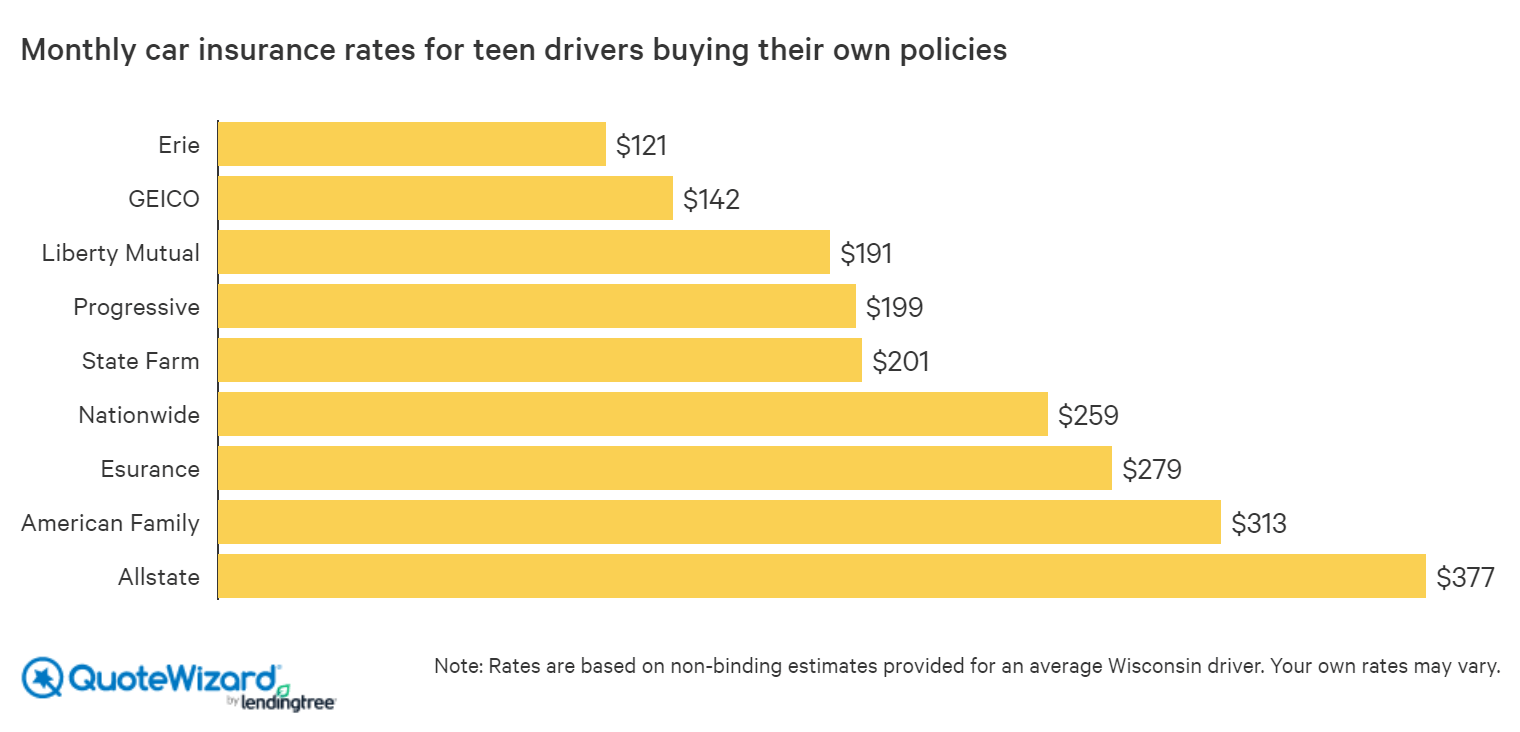

There are a few ways that new drivers can lower their car insurance rates. The most common way is to look for discounts. Many insurance companies offer discounts for students, or for drivers who have taken a defensive driving course. Shopping around and comparing rates can also help new drivers find the best deal.

New drivers can also take steps to reduce their risk on the roads. Taking a defensive driving course can help new drivers gain valuable skills that can help them avoid accidents. Being a careful, attentive driver can also help reduce the risk of an accident.

Conclusion

New drivers will have to pay higher car insurance rates than experienced drivers, but there are ways to reduce the cost. Shopping around and comparing rates can help find the best deal, and taking a defensive driving course can also lower insurance rates. Being a careful, attentive driver on the roads can also help reduce the risk of an accident and lower insurance rates.

2021 Car Insurance Rates by Age and Gender - NerdWallet

Average Cost of Car Insurance for Young Drivers 2020 | NimbleFins

Average Car Insurance Rates by Age and Gender Per Month

Best Car Insurance for Teens | QuoteWizard

Pin by Hurul comiccostum on comiccostum | Compare car insurance, Car