Average Cost Of Car Insurance Per Month For 1 Person

Average Cost Of Car Insurance Per Month For 1 Person

Introduction

Car insurance is an essential expense for drivers, and the cost of car insurance for one person can vary greatly depending on a few factors. Your age, driving record, the type of car you drive and the amount of coverage you choose all play a major role in determining how much your car insurance will cost. In this article, we will be taking a look at the average cost of car insurance for one person and how you can reduce your costs.

Factors That Affect Cost

When it comes to the cost of car insurance for one person, there are several different factors that will affect the total cost. Your age is the most important factor because younger drivers are considered a higher risk and therefore have higher premiums. Additionally, your driving record plays a role in the cost of your insurance. If you have any speeding tickets or have been involved in any past accidents, your car insurance premiums will be higher than someone with a clean driving record. The type of car you drive will also affect the cost of your car insurance. Cars that are more expensive to repair or replace will have higher premiums.

Average Cost of Car Insurance For 1 Person

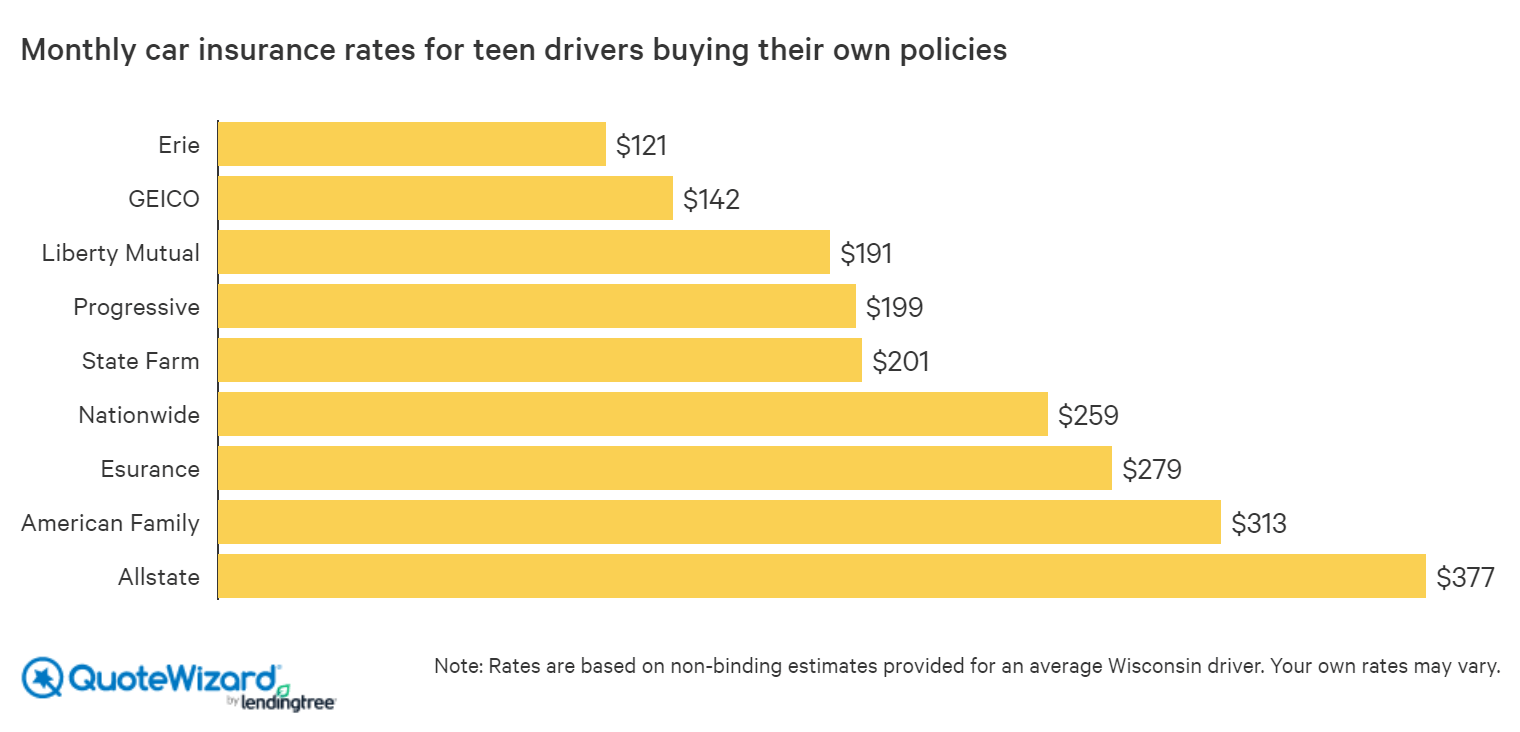

The cost of car insurance varies greatly depending on the factors mentioned above. However, the national average cost of car insurance for one person is approximately $1,500 per year. This works out to about $125 per month for car insurance for one person. Of course, this number can be higher or lower depending on the factors mentioned earlier. It is important to shop around and get quotes from several different companies to find the best rate for your car insurance.

Ways to Lower Your Premiums

If you are looking for ways to lower your car insurance premiums, there are several things you can do. The first is to make sure you have a good driving record. Avoid getting any speeding tickets or other moving violations and make sure your record is clean. Additionally, you can look into discounts for things like good grades, safe driving classes, and bundling multiple policies. You can also look into increasing the amount of your deductibles. This will result in a lower premium, but you will have to pay more out of pocket if you are ever in an accident.

Comparing Quotes

When it comes to getting the best rate for your car insurance, it is important to compare quotes from multiple companies. Each company will have different rates, and you may be able to get a better deal by shopping around. Additionally, you can look into online insurers who may be able to provide lower rates than traditional insurers. It is important to make sure you are getting the right coverage for the best price, so make sure to do your research before buying a policy.

Conclusion

The cost of car insurance for one person can vary greatly depending on a few factors. Your age, driving record, the type of car you drive and the amount of coverage you choose all play a major role in determining how much your car insurance will cost. The national average cost of car insurance for one person is approximately $1,500 per year, or about $125 per month. There are several ways to lower your premiums such as having a clean driving record, looking for discounts, and increasing your deductibles. Additionally, it is important to compare quotes from several different companies to make sure you are getting the best rate for your car insurance.

What's the Average Auto Insurance Cost Per Month? | The Lazy Site

The Best Average Cost Of Car Insurance 2022 - Dakwah Islami

Average Car Insurance in Maryland - NerdWallet

Virginia Auto Insurance Rates - Average Cost Of Car Insurance Per Month

The Basic Principles Of How Much Is Car Insurance Per Month? Average