Auto Insurance Discounts To Ask For

Auto Insurance Discounts To Ask For

What is Auto Insurance

Auto insurance is a policy that provides financial protection for you, your passengers, and your vehicle. It’s a contract between you and the insurance company that helps cover losses if you’re in an accident or if your vehicle is stolen. Depending on your policy, auto insurance will also cover repairs, medical expenses, and legal fees if you’re involved in an accident. It’s important to have the right coverage on your vehicle, so you don’t have to pay out of pocket for repairs or medical bills.

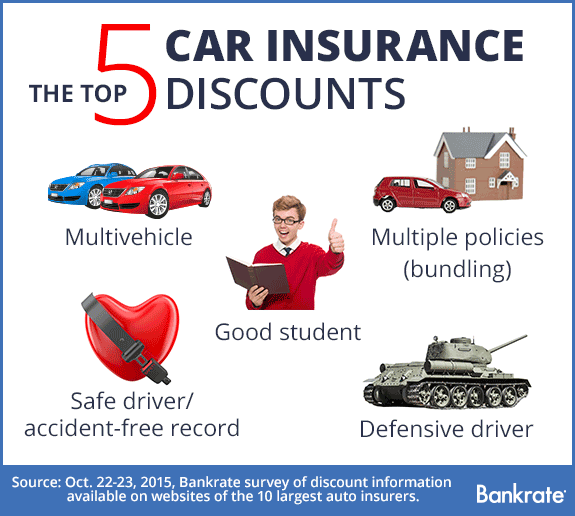

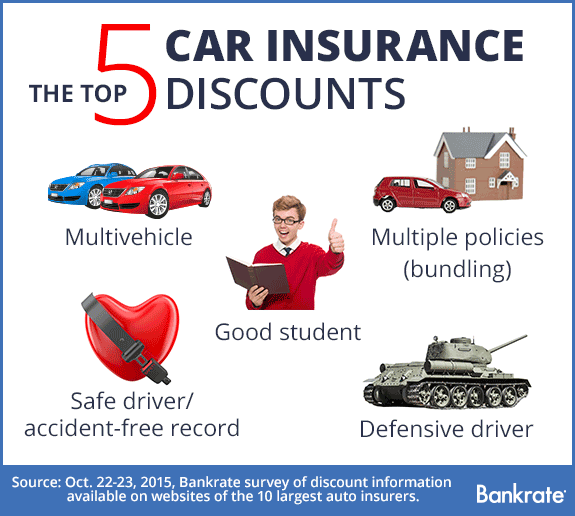

Types of Auto Insurance Discounts

When shopping for auto insurance, it’s important to know what discounts are available. Insurance companies offer discounts on auto insurance for a variety of reasons, including safe driving, good credit, and safe vehicle features. Knowing what discounts you’re eligible for can save you money on your policy. Here are some of the most common auto insurance discounts to ask for.

Good Driver Discounts

If you’re a safe driver with a clean driving record, you may be eligible for a good driver discount. This discount is usually based on the number of years you’ve been driving without any tickets or accidents. The longer you’ve been driving without any issues, the more you may be able to save.

Multi-Car Discount

If you have multiple cars in your household, you may be eligible for a multi-car discount. This discount is offered by some insurance companies to reward customers who insure multiple vehicles. The discount can vary depending on the number of vehicles you insure and the policy you choose.

Safety Features Discount

Many insurance companies offer discounts for vehicles with safety features, such as airbags and anti-lock brakes. If your vehicle has certain safety features, you may be eligible for a discount on your premiums. The amount of the discount will vary depending on the safety features your vehicle has and the insurance company you choose.

Good Credit Discount

Some insurance companies may offer a good credit discount if you have a good credit score. A good credit score can indicate that you’re a responsible borrower and can help you save money on your insurance premiums. The amount of the discount will vary depending on your credit score and the insurance company you choose.

Conclusion

Auto insurance can be expensive, but there are discounts available for drivers who qualify. Knowing what discounts are available can help you save money on your auto insurance premiums. Good driver discounts, multi-car discounts, safety feature discounts, and good credit discounts are all available to help you save money on your auto insurance. Be sure to ask your insurance company about the discounts you may be eligible for.

Who Offers the Most Car Insurance Discounts? | Bankrate.com

Car Insurance Discounts | OTIP Insurance

Complete Guide to Auto Insurance Discounts | Insurance.com | Car

Car insurance discounts for students | CarInsurance.com

Pin on Auto Insurance | Squeeze