State Farm Gap Insurance Rates

Friday, May 5, 2023

Edit

State Farm Gap Insurance Rates

Understanding Gap Insurance Rate

Gap insurance, also known as Guaranteed Asset Protection, is an insurance policy that covers the “gap” between what is owed on a vehicle loan and the actual value of the vehicle. It provides financial protection in the event that a vehicle is totaled or stolen. The idea is that if an accident or theft occurs, the insurance company will pay the difference between the settlement amount and the amount that is still owed on the loan. Gap insurance can be purchased from a variety of sources, including car dealerships, insurance agents, and online providers. State Farm is one of the leading providers of gap insurance in the United States.

What Does State Farm Gap Insurance Cover?

State Farm gap insurance covers the difference between the actual cash value of the vehicle and the amount of money still owed on the loan. This coverage is sometimes referred to as a “gap waiver.” It is important to note that gap insurance does not cover damage to the vehicle itself, only the difference between the actual value and the amount that is still owed on the loan. Gap insurance is typically only available for new and used vehicles that are less than five years old.

How Much Does State Farm Gap Insurance Cost?

The cost of State Farm gap insurance varies depending on the type of vehicle and the amount of coverage purchased. Generally speaking, the cost of gap insurance is usually around 3% to 4% of the total loan amount. This means that if you have a $20,000 loan, the cost of gap insurance would be $600 to $800. It is important to note that this cost is usually rolled into the loan and paid as part of the monthly payments.

What Other Factors Can Affect Gap Insurance Rates?

In addition to the type of vehicle and the loan amount, there are a few other factors that can affect the cost of gap insurance. The age of the vehicle, the type of loan, and the coverage amount can all have an effect on the overall cost of gap insurance. For example, if you are financing an older vehicle with a longer loan term, the cost of gap insurance will likely be higher. Additionally, if you opt for a higher coverage amount, the cost of gap insurance will likely also be higher.

When Should You Purchase Gap Insurance?

Gap insurance should be considered when you are financing a new or used vehicle. It is important to remember that gap insurance will only cover the difference between the actual cash value of the vehicle and the amount still owed on the loan. Therefore, it is important to purchase gap insurance at the same time that you purchase the vehicle in order to ensure that you are covered in the event of an accident or theft.

Conclusion

State Farm gap insurance is an important form of financial protection for people who are financing a new or used vehicle. The cost of gap insurance varies depending on the type of vehicle, the loan amount, and the coverage amount. It is important to consider gap insurance when financing a vehicle in order to ensure that you are fully protected in the event of an accident or theft.

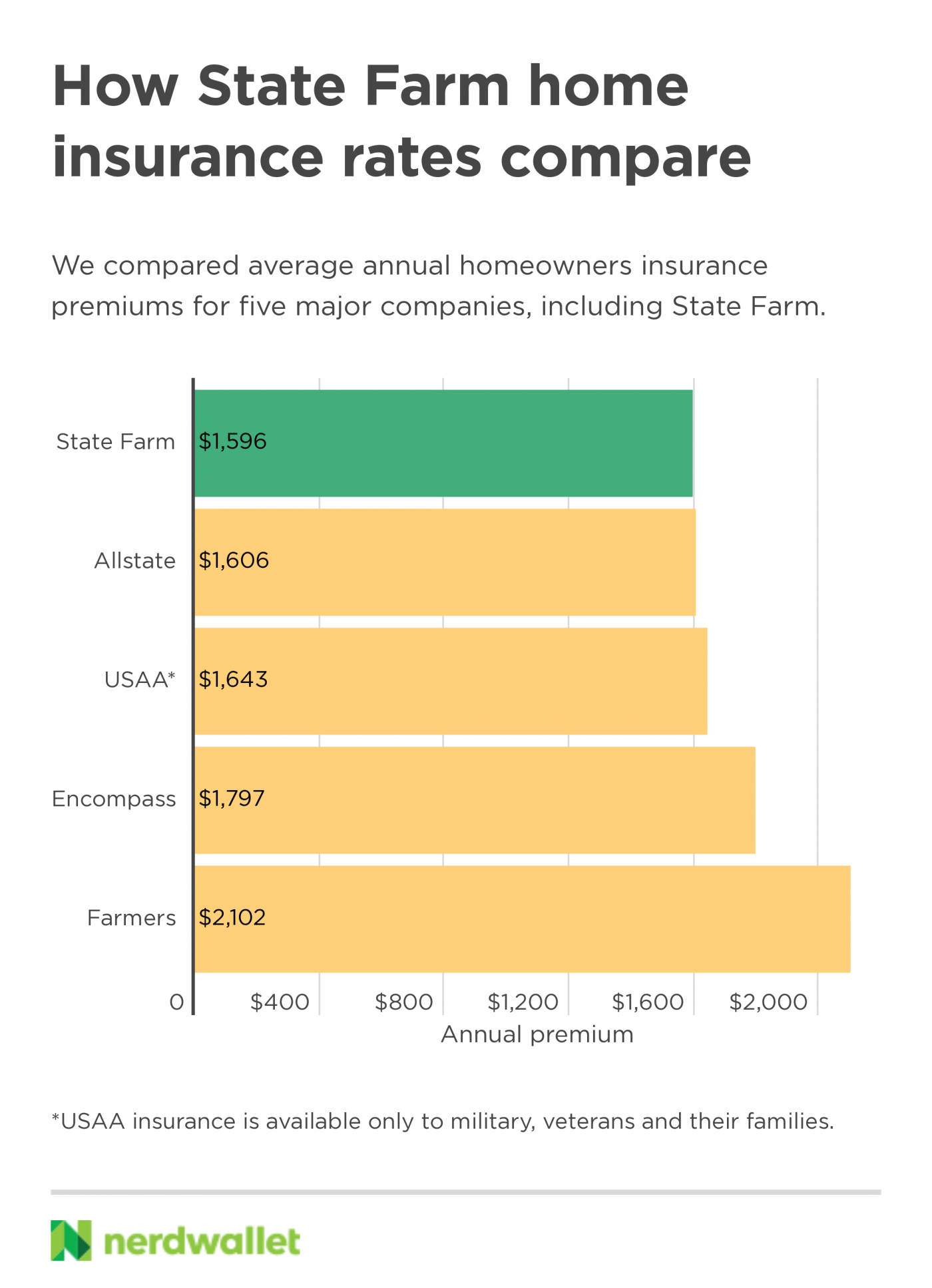

State Farm Home Insurance Review 2021 - NerdWallet

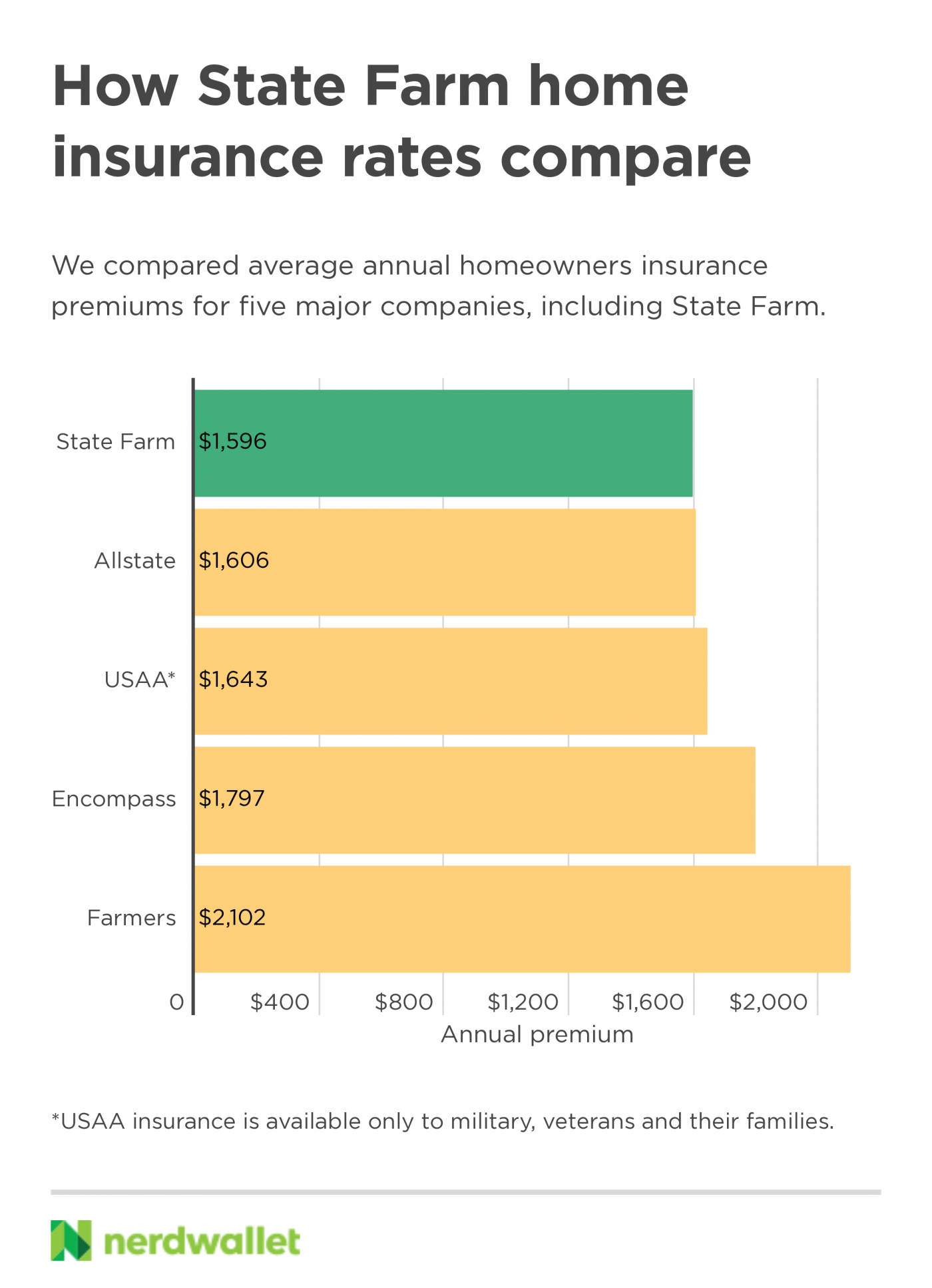

State Farm Long Term Care Insurance Rate Increases Washington

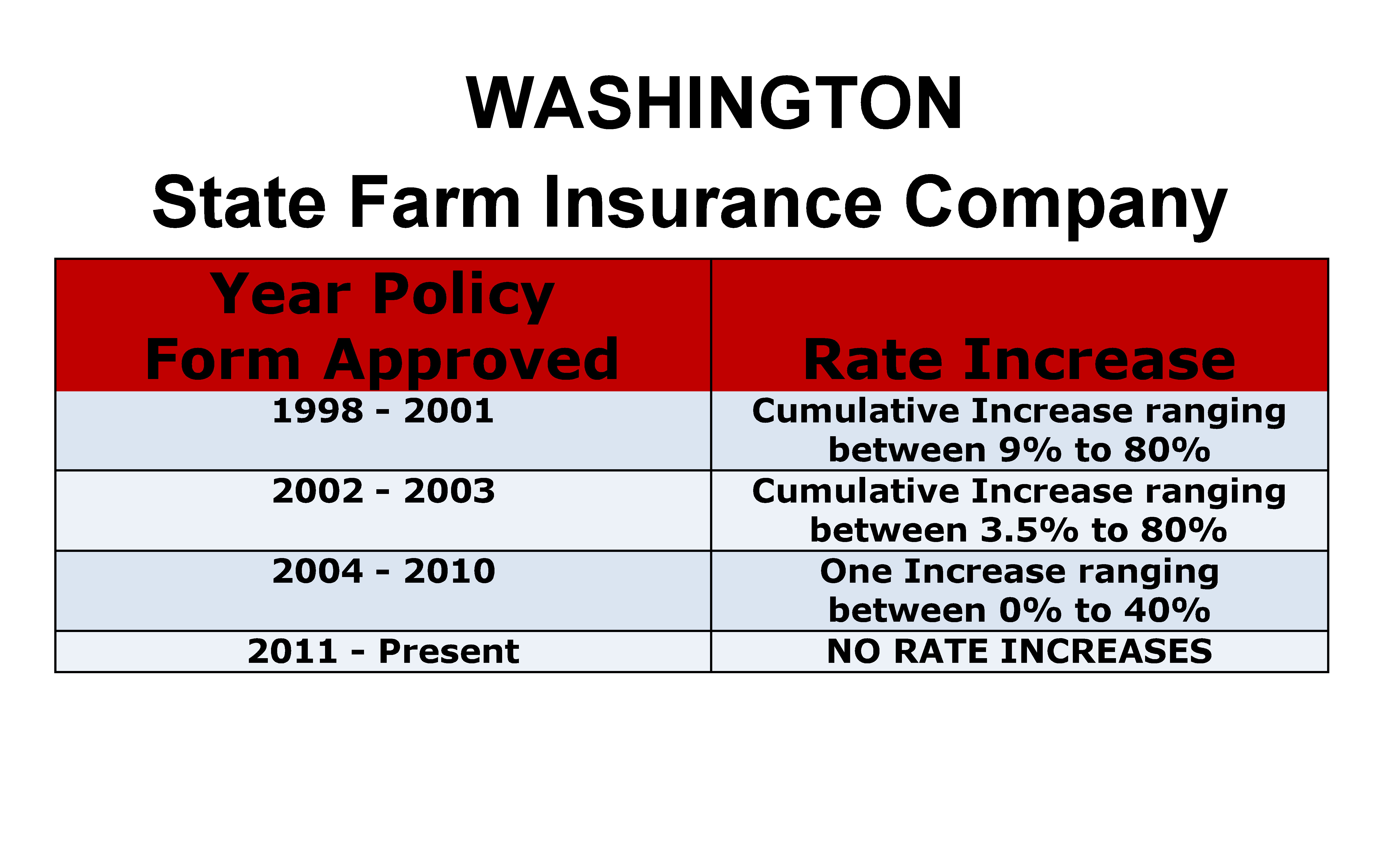

State Farm Auto & Home Insurance Review: Quality Service and Lots of

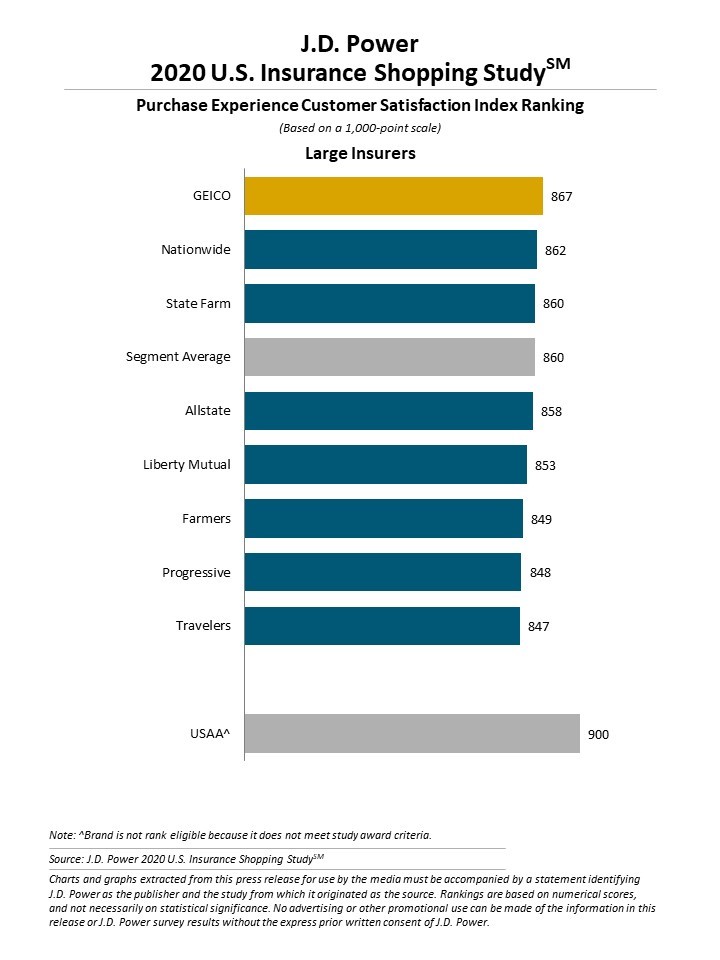

State Farm Gap Insurance Price - Home Collection

Home Insurance Estimate State Farm – Home Sweet Home | Modern Livingroom