Managing General Agent Non standard Auto Insurance Hispanic

Managing General Agent Non Standard Auto Insurance Hispanic

What is a Managing General Agent?

Managing General Agent (MGA) is an individual or organization that is appointed by an insurer to transact insurance business on the insurer’s behalf. An MGA has the authority to bind coverage to the insurer, issue policy documents, and manage claims on behalf of the insurer. MGAs are also known as insurance agents and brokers, and are essential for providing insurance solutions for individuals and businesses. MGAs typically specialize in specific types of insurance, such as auto, home, and life insurance.

What is Non Standard Auto Insurance?

Non-standard auto insurance is a type of car insurance that is designed for high-risk drivers. This type of insurance is typically more expensive than standard car insurance but it is often the only option for drivers who are considered to be high-risk due to their driving record or other factors. Non-standard auto insurance is often available to drivers with multiple traffic violations, poor credit, and drivers with limited driving experience.

Why is Non Standard Auto Insurance Important to the Hispanic Community?

Non-standard auto insurance is an important option for the Hispanic community due to the high rate of uninsured drivers in the community. According to a recent report from the Centers for Disease Control and Prevention, nearly one-third of Hispanic drivers are uninsured. This is significantly higher than other demographics and puts the Hispanic community at risk for financial hardship if an accident occurs. Non-standard auto insurance provides an affordable option for the Hispanic community and helps to protect them from financial hardship due to an accident.

What are the Advantages of Using a Managing General Agent for Non Standard Auto Insurance?

Using a managing general agent for non-standard auto insurance can provide a number of advantages to customers. MGAs are typically more knowledgeable about the different types of insurance available and can help customers find the best coverage for their needs. MGAs also have access to multiple insurance companies and can help customers find the most affordable rates. The MGA can also help customers understand the different coverage options and can provide advice on which options are best for their situation.

How Can the Hispanic Community Find an MGA for Non Standard Auto Insurance?

The Hispanic community can find an MGA for non-standard auto insurance by searching online or by asking for recommendations from family and friends. There are a number of MGAs that specialize in providing non-standard auto insurance for the Hispanic community. It is important to research each MGA and compare rates and coverage options before selecting an MGA. The MGA should also have knowledgeable staff that can answer questions and provide advice on the best coverage options for the customer.

Conclusion

Managing General Agents are an important option for the Hispanic community when it comes to non-standard auto insurance. MGAs have access to multiple insurance companies and can help customers find the most affordable rates. They can also provide advice on the different coverage options and help customers understand the different policies that are available. For the Hispanic community, it is important to research MGAs and compare rates before selecting an MGA to ensure the best coverage and most affordable rates.

Hispanic applicants’ discrimination suit against Ford reinstated

Hispanic Lady At An Insurance Agency Counter Foto de stock - Getty Images

Insurance General Agents / Become A General Insurance Agent | Careers

The General Auto Insurance Login www.thegeneral.com

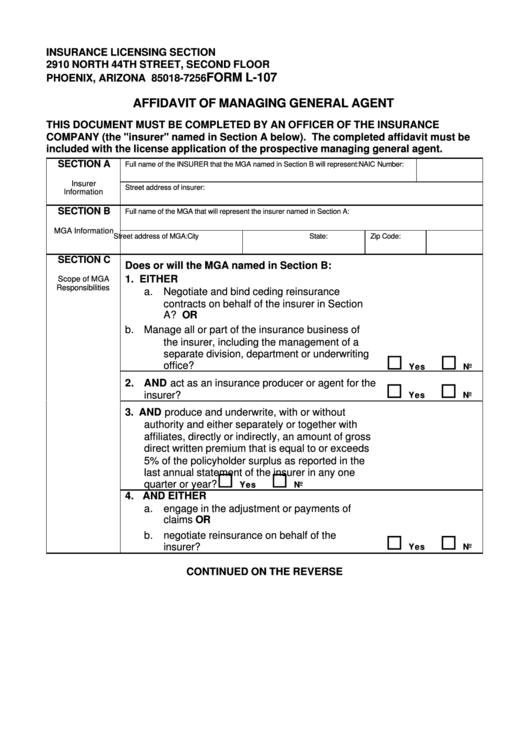

Form L-107 - Affidavit Of Managing General Agent printable pdf download