How Much More Is 4x4 Insurance

What Is 4x4 Insurance?

4x4 insurance is an insurance policy specifically designed to cover the cost of repairing and replacing vehicles that have been designed and built with four-wheel-drive capabilities. This type of insurance covers the costs associated with accidents, theft, fire, and other natural disasters that could result in costly damage to the vehicle. 4x4 insurance is typically more expensive than regular auto insurance due to the increased risk associated with driving a four-wheel-drive vehicle. However, with the right policy, you can save money on your insurance premiums while still receiving the benefits of being covered in the event of an accident or other damage.

What Does 4x4 Insurance Cover?

4x4 insurance typically covers a wide range of potential damages that could occur to your vehicle. This includes items such as theft, fire, hail damage, flood damage, and other natural disasters. Additionally, it often covers accidental damage caused by other drivers, as well as any damage caused by off-road driving. It may also cover damage caused by vandalism and other malicious acts. Depending on the policy, it may also include coverage for rental cars in the event of a breakdown or other emergency.

How Much More Is 4x4 Insurance?

The cost of 4x4 insurance will vary depending on the type of vehicle you own, the coverage you select, and the amount of risk associated with your vehicle. Generally speaking, 4x4 insurance is more expensive than regular auto insurance due to the increased risk associated with four-wheel-drive vehicles. However, if you shop around and compare quotes, you may be able to find an insurance policy that is more affordable than you might think. Additionally, you may be able to qualify for discounts or other special offers if you have a good driving record or if you have safety features such as airbags and anti-lock brakes installed on your vehicle.

Are There Any Other Costs Associated With 4x4 Insurance?

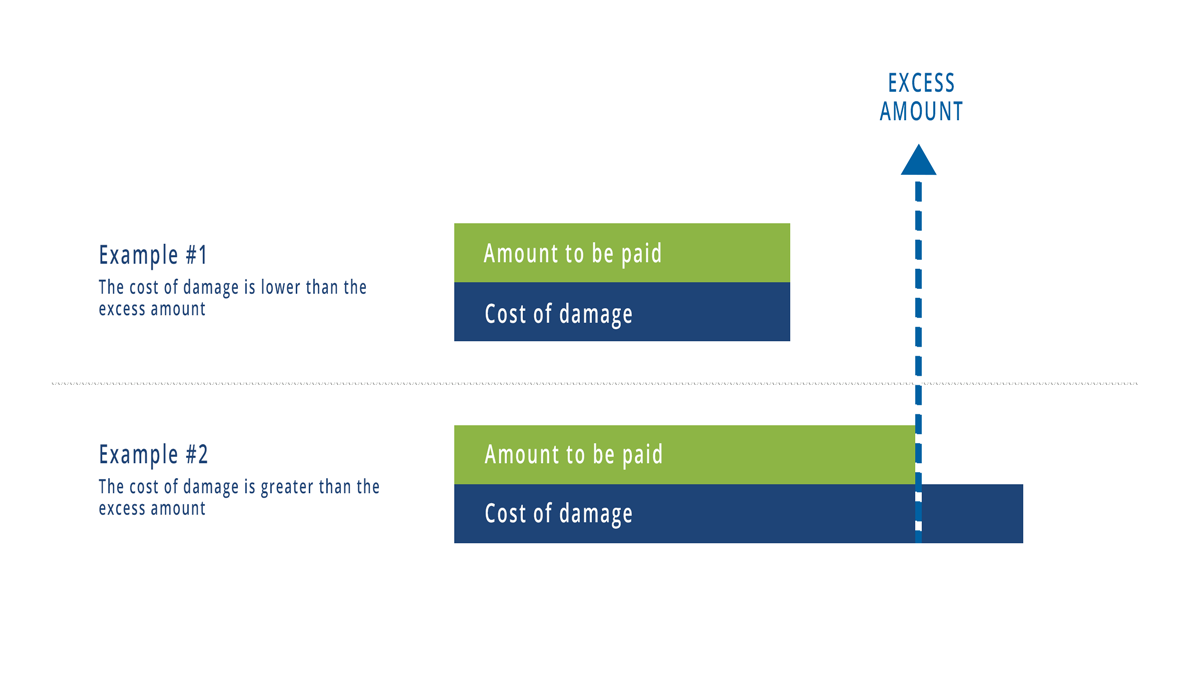

In addition to the premiums you will be required to pay for your 4x4 insurance policy, you may also be responsible for other costs associated with the policy. These include deductibles, which are the amount of money you must pay out-of-pocket before your insurance policy kicks in, and other fees related to the policy. Additionally, you may also be required to pay for additional items such as roadside assistance or rental car coverage. It is important to carefully read your policy and ask questions so you know exactly what is covered and what other costs you may be responsible for.

How Can I Get the Best Rate on 4x4 Insurance?

The best way to get the best rate on 4x4 insurance is to shop around and compare rates from different insurance companies. Additionally, you may be able to qualify for discounts or other special offers if you have a good driving record or if you have safety features such as airbags and anti-lock brakes installed on your vehicle. Finally, it’s important to read through your policy carefully and ask questions so you know exactly what is covered and what other costs you may be responsible for.

Conclusion

4x4 insurance is an important form of coverage for vehicles that have been built with four-wheel-drive capabilities. While it can be more expensive than regular auto insurance, it is possible to save money by shopping around and comparing quotes from different insurance companies. Additionally, you may be able to qualify for discounts or other special offers if you have a good driving record or if you have safety features such as airbags and anti-lock brakes installed on your vehicle. Ultimately, it’s important to read through your policy carefully and ask questions so you know exactly what is covered and what other costs you may be responsible for.

4X4 Insurance - Insure Your Off Road 4WD Vehicle & Caravan with Tough Toys

CLUB 4x4-Insurance for 4x4 Enthusiasts

DOES YOUR 4X4 INSURANCE REALLY COVER YOU IN THE BUSH? - Unsealed 4X4

4x4 insurance and excess for your self-drive safaris - Tawana Self Drive

4x4 Car Insurance | This optional cover is a necessity for anyone who