How Much Is Gap Insurance On A Used Car

How Much Is Gap Insurance On A Used Car?

If you have recently purchased a used car, you may be wondering how much is gap insurance on a used car. Gap insurance is a valuable asset for anyone who owns a car, especially if you have taken out a loan to purchase it. This insurance protects you against the possibility of a major financial loss if your car is stolen or damaged beyond repair.

What Is Gap Insurance?

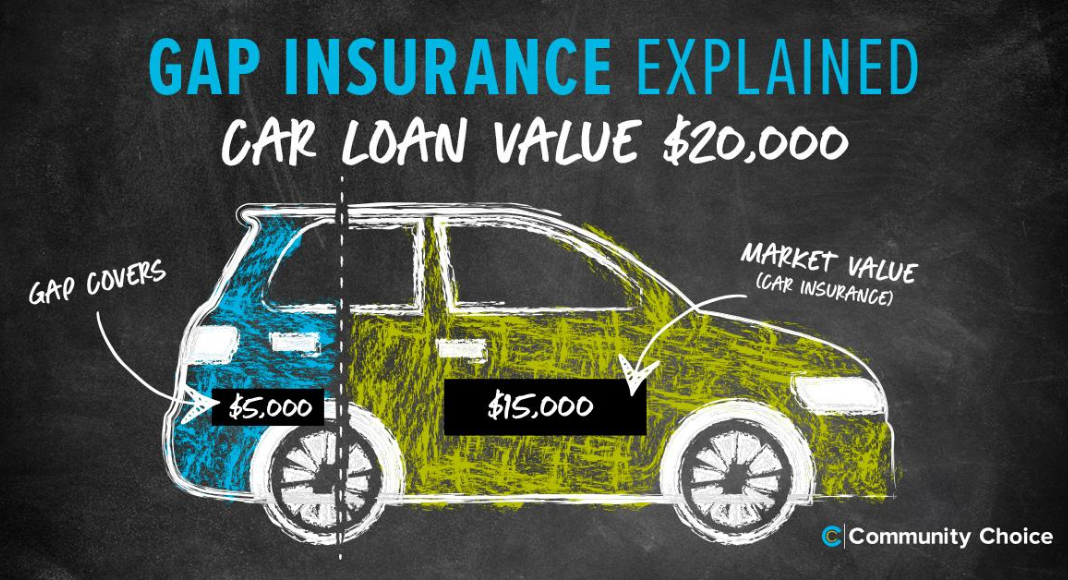

Gap insurance is a type of auto insurance that pays the difference between the actual cash value of a vehicle and the balance owed on the loan. It is also known as “loan-lease gap coverage” or “guaranteed asset protection.” This type of insurance is especially important for those who are financing a used car, since the loan balance may be much higher than the actual cash value of the car.

How Much Does Gap Insurance Cost?

The cost of gap insurance can vary depending on the type of coverage and the amount of coverage you purchase. Generally, gap insurance premiums are usually a percentage of the car’s loan amount, usually between 5 and 7 percent. So, if you have a loan of $20,000, you can expect to pay between $1,000 and $1,400 in premiums.

How Do You Get Gap Insurance?

Gap insurance is usually offered through your car loan lender, but you can also purchase it from an insurance company or other provider. It’s important to compare quotes from multiple providers to ensure you’re getting the best rate. Additionally, you should read the fine print and make sure you understand the coverage you’re getting and the costs associated with it.

What Are the Benefits of Gap Insurance?

Gap insurance can provide you with peace of mind. It can help you avoid a large financial loss if your car is stolen or damaged beyond repair. Additionally, if you owe more on the loan than the car is worth, gap insurance can help you pay off the loan balance. This can be especially helpful if you’re in a situation where you need to sell the car and don’t have the money to pay off the loan.

What Are the Drawbacks of Gap Insurance?

The biggest drawback of gap insurance is that it can be expensive. Additionally, if you’re able to pay off your loan before the end of the loan term, the insurance won’t be of any value. Additionally, if the car is worth more than the loan amount, gap insurance won’t be necessary. Finally, if you don’t have collision or comprehensive coverage, gap insurance won’t provide any additional protection.

Overall, gap insurance can provide you with peace of mind if you’ve recently purchased a used car. It can protect you against large financial losses if your car is stolen or damaged beyond repair. However, it’s important to weigh the cost of the insurance against the benefit it provides and make sure it’s the right decision for your situation.

How Does Gap Insurance Work? | RamseySolutions.com

Gap Insurance For Cars Is It Worth It - Is Car GAP Insurance Worth It

Understanding Auto Insurance “Gap Coverage“

What to Consider When You Buy a Car from Community Choice

What Is Gap Insurance? - Lexington Law