How Much Gap Insurance Costs

How Much Does Gap Insurance Cost?

When purchasing a new car, gap insurance is an important consideration that many people overlook. Gap insurance ensures that if your car is stolen or totaled in an accident, you won’t be stuck with the difference between the remaining loan balance and the actual cash value of the car. It can be a lifesaver for those who are in a tight financial situation, so it’s important to understand what it is and how much it costs.

What Is Gap Insurance?

Gap insurance, also known as guaranteed auto protection, is an insurance policy that covers the difference between the cash value of a car and the amount still owed on the loan. This difference is referred to as the “gap.” This insurance is typically purchased when a car is bought with a loan, so that the owner can be sure that they won’t be stuck with the remaining loan balance if the car is destroyed in an accident or stolen.

How Much Does Gap Insurance Cost?

The cost of gap insurance varies depending on the value of the car being insured, the length of the loan, and the insurance company providing the coverage. Generally speaking, the cost of gap insurance is included in the monthly payment for the loan, and is typically between 3% and 5% of the total loan amount. This means that for a car with a loan of $20,000, the cost of gap insurance may be between $600 and $1000 for the life of the loan.

Are There Other Factors That Influence the Cost of Gap Insurance?

In addition to the value of the car and the length of the loan, other factors can influence the cost of gap insurance. The type of vehicle being purchased, the age of the vehicle, and the insurance company chosen all have an effect on the cost of gap insurance. For instance, older cars may be more expensive to insure, and some insurance companies may charge more for certain types of vehicles. It’s important to shop around to get the best deal on gap insurance.

Is Gap Insurance Worth the Cost?

Gap insurance is an important consideration for anyone taking out a loan to buy a car. It’s a relatively small cost compared to the total cost of the loan, but it can save you a lot of money if your car is destroyed in an accident or stolen. It’s worth the cost for the peace of mind it provides, and it’s better to be safe than sorry when it comes to covering your assets.

Conclusion

Gap insurance is an important consideration when taking out a loan to buy a car. The cost of gap insurance varies depending on the value of the car, the length of the loan, and the insurance company chosen. Other factors, such as the type of vehicle and the age of the vehicle, can also influence the cost of gap insurance. Ultimately, gap insurance is worth the cost for the peace of mind it provides, and it’s better to be safe than sorry when it comes to protecting your assets.

Do Not Get Taken For A Ride When Looking For Auto Insurance — shaketext5

How Much Car Insurance Do You Really Need? | DaveRamsey.com

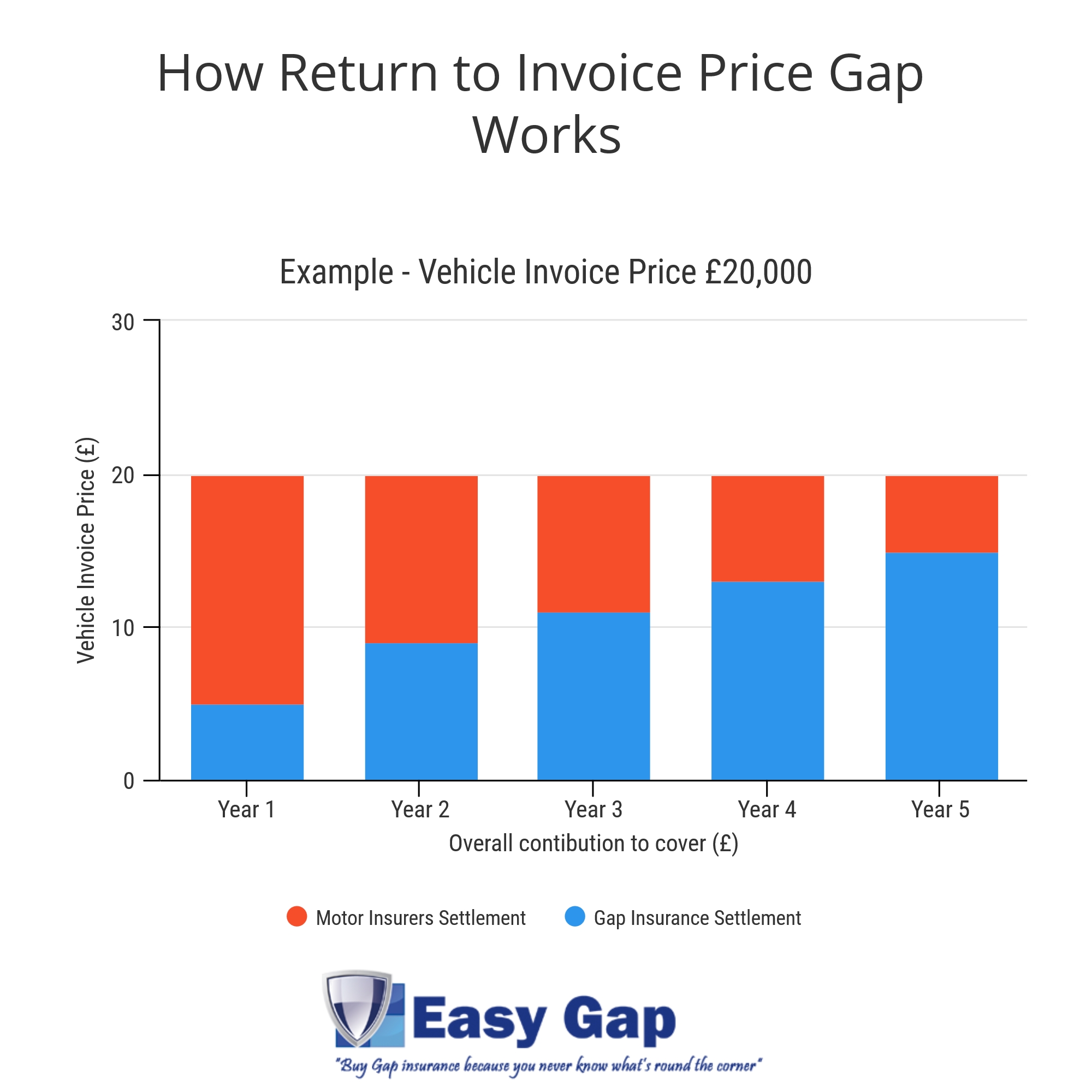

Return To Invoice Gap Insurance * Invoice Template Ideas

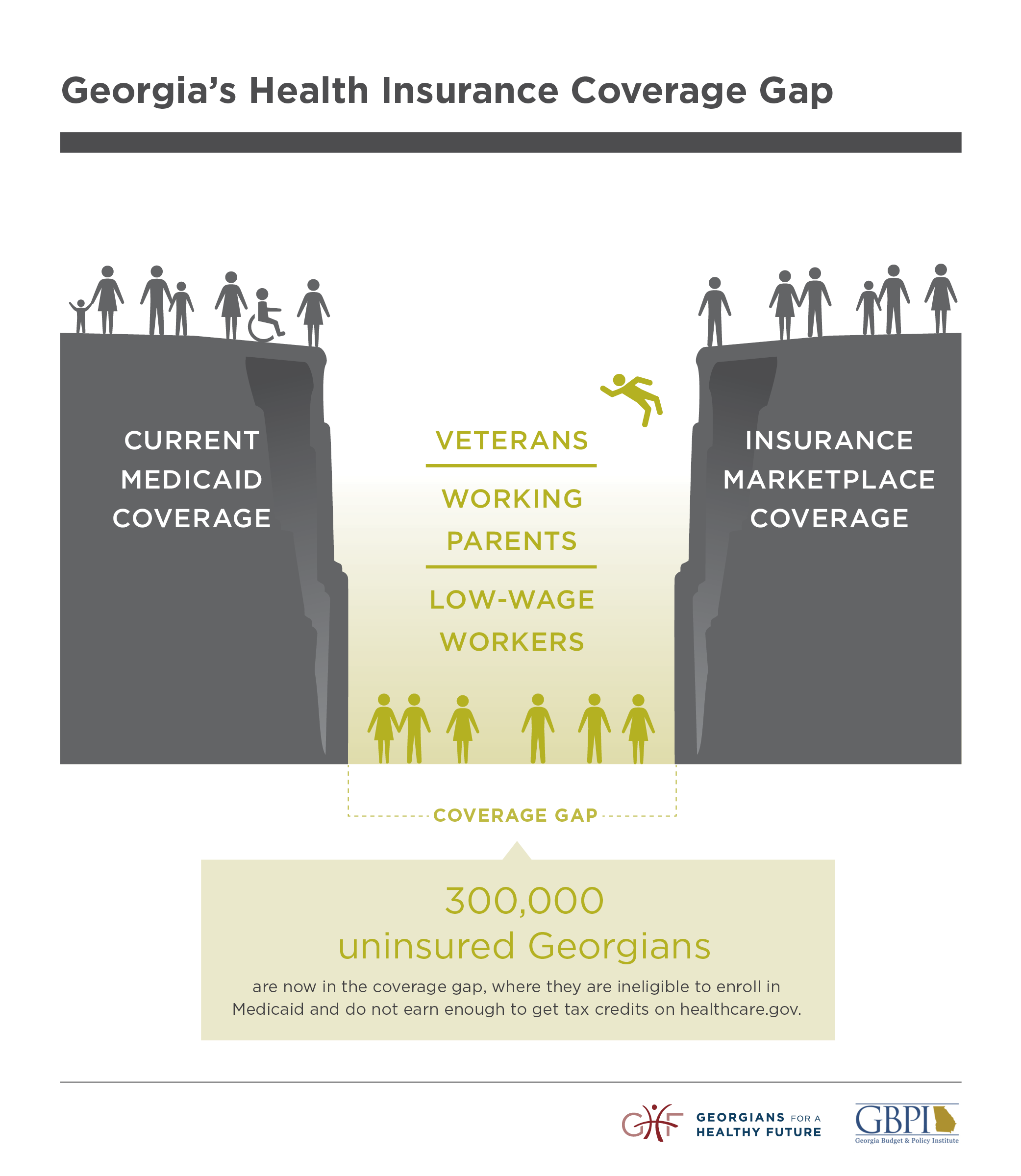

Healthcare Insurance Coverage Gap

What Is Gap Insurance For - What Is Gap Insurance And Why Might You