Full Cover Insurance For Car

Full Cover Insurance For Car

The Benefits of Full Cover Insurance

Full cover insurance for car provides the most comprehensive coverage of all car insurance policies. It covers financial losses resulting from theft, accidents and natural disasters, as well as the repair or replacement of the car itself. This type of insurance also covers damage to other people and property resulting from an accident. It is important to note that most full cover car insurance policies do not include liability coverage, so it is important to purchase this type of coverage separately.

Full cover insurance for car provides peace of mind for those who own a car. Knowing that the car is fully covered for any conceivable event can provide a great deal of assurance. In addition, having the car fully covered can save a considerable amount of money in the long run, since the financial costs associated with any type of accident, theft or natural disaster can be extremely high.

What Does Full Cover Insurance Cover?

Full cover car insurance provides coverage for a wide range of events, including: theft, accidents, fire, floods and other disasters. It also covers damage resulting from an accident, including repair or replacement of the car itself. In addition, full cover insurance policies often include towing and rental car coverage, as well as legal expenses.

What Is Not Covered by Full Cover Insurance?

Full cover car insurance does not cover any liability claims that may be made against the policyholder. Liability coverage is typically purchased separately, as it covers any medical expenses or property damage that may be caused by the policyholder during an accident. In addition, full cover insurance does not cover damage resulting from normal wear and tear, or damage resulting from mechanical failure.

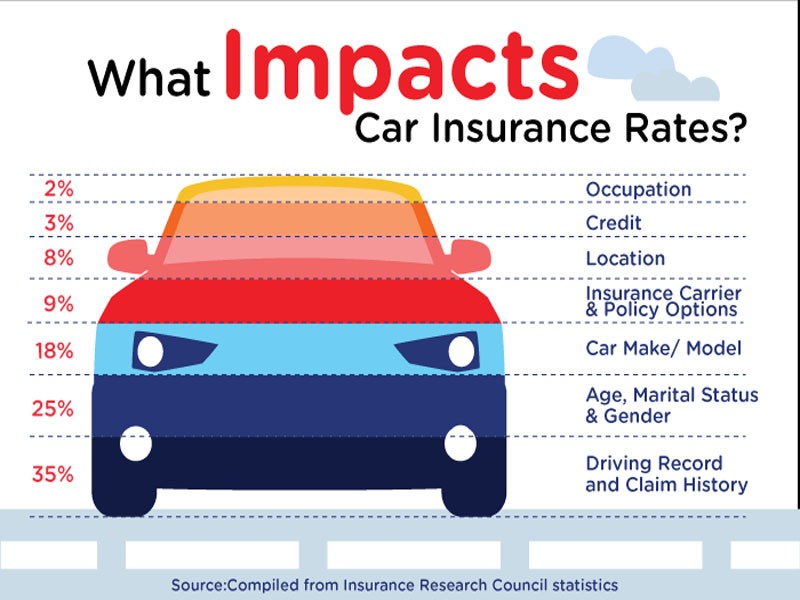

What Are the Costs of Full Cover Insurance?

The cost of full cover car insurance will depend on the type of coverage purchased and the age and condition of the car. Generally, full cover car insurance policies are more expensive than basic policies, but the additional coverage may be worth the cost. It is important to shop around for the best rates, as well as to compare different policies to ensure that the policy purchased is the best fit for the individual.

Conclusion

Full cover insurance for car is a great way to ensure that a vehicle is fully protected in the event of an accident, theft or natural disaster. The additional coverage provided by this type of policy can save a lot of money in the long run, and the peace of mind that comes with knowing that the car is fully covered is invaluable. It is important to shop around for the best rates, and compare different policies to ensure that the right coverage is purchased.

Full coverage car insurance in california by Promax Insurance Agency

What is Full Coverage Car Insurance? - eTrustedAdvisor

“Full Coverage” Car Insurance Explained - YouTube

designflightcollab: Full Cover Insurance

FULL COVERAGE CAR INSURANCE - YouTube