Cheapest Plpd Insurance In Michigan

Everything You Need To Know About Cheapest PLPD Insurance In Michigan

What Is PLPD Insurance?

PLPD insurance, which stands for Personal Liability and Property Damage, is a type of car insurance coverage that is required in the state of Michigan. This type of coverage includes liability protection for bodily injury and property damage to other people and property. It also includes uninsured and underinsured motorist protection. This type of coverage is usually less expensive than a full coverage policy and provides the same protection.

How Much Does PLPD Insurance Cost?

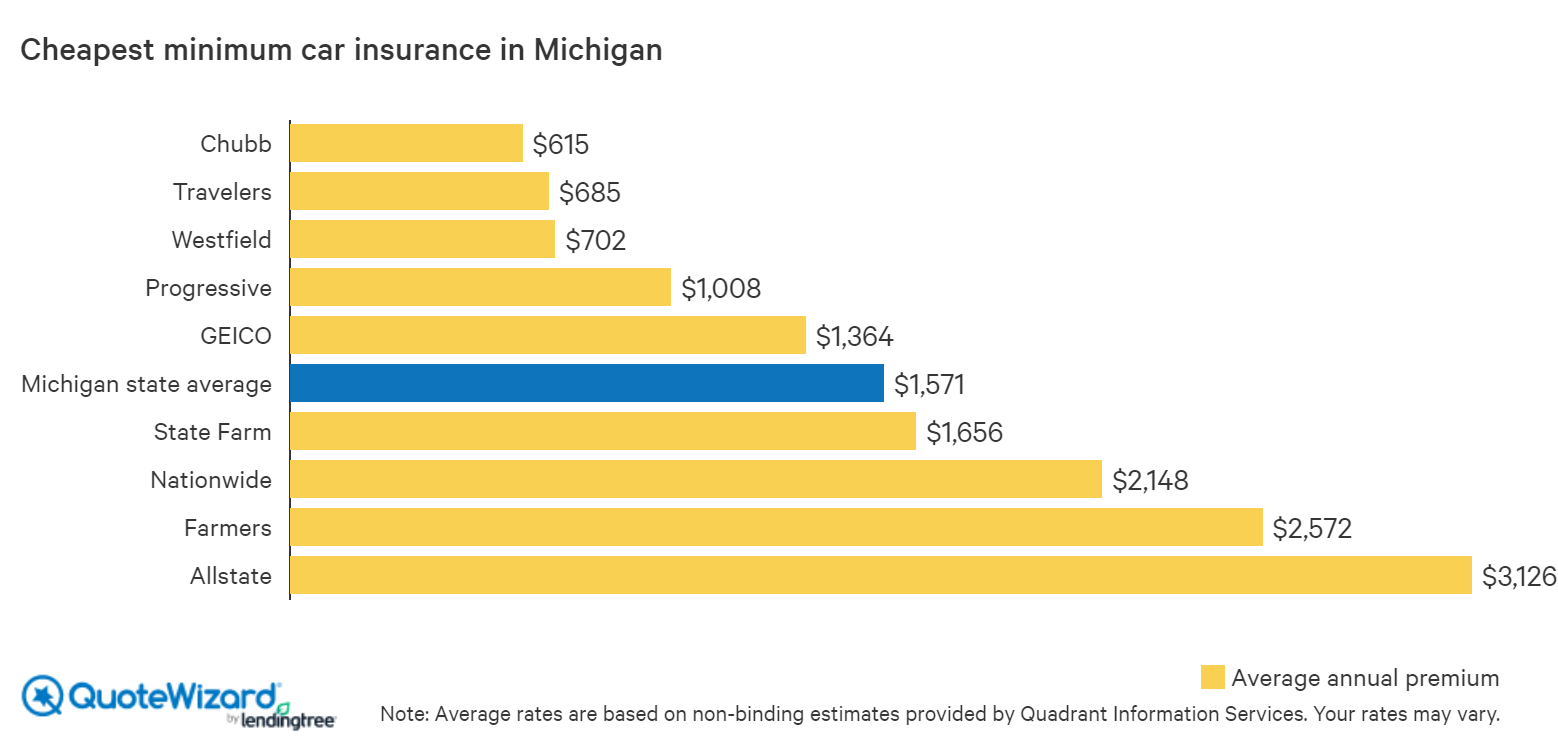

The cost of PLPD insurance in Michigan varies depending on the amount of coverage you choose. The state of Michigan requires a minimum of $20,000 in Bodily Injury Liability coverage, $40,000 in Property Damage Liability coverage, and $10,000 in Uninsured Motorist coverage. The cost for this coverage can range from around $100 to $500 per year, depending on your driving record and other factors.

How To Find Cheapest PLPD Insurance In Michigan?

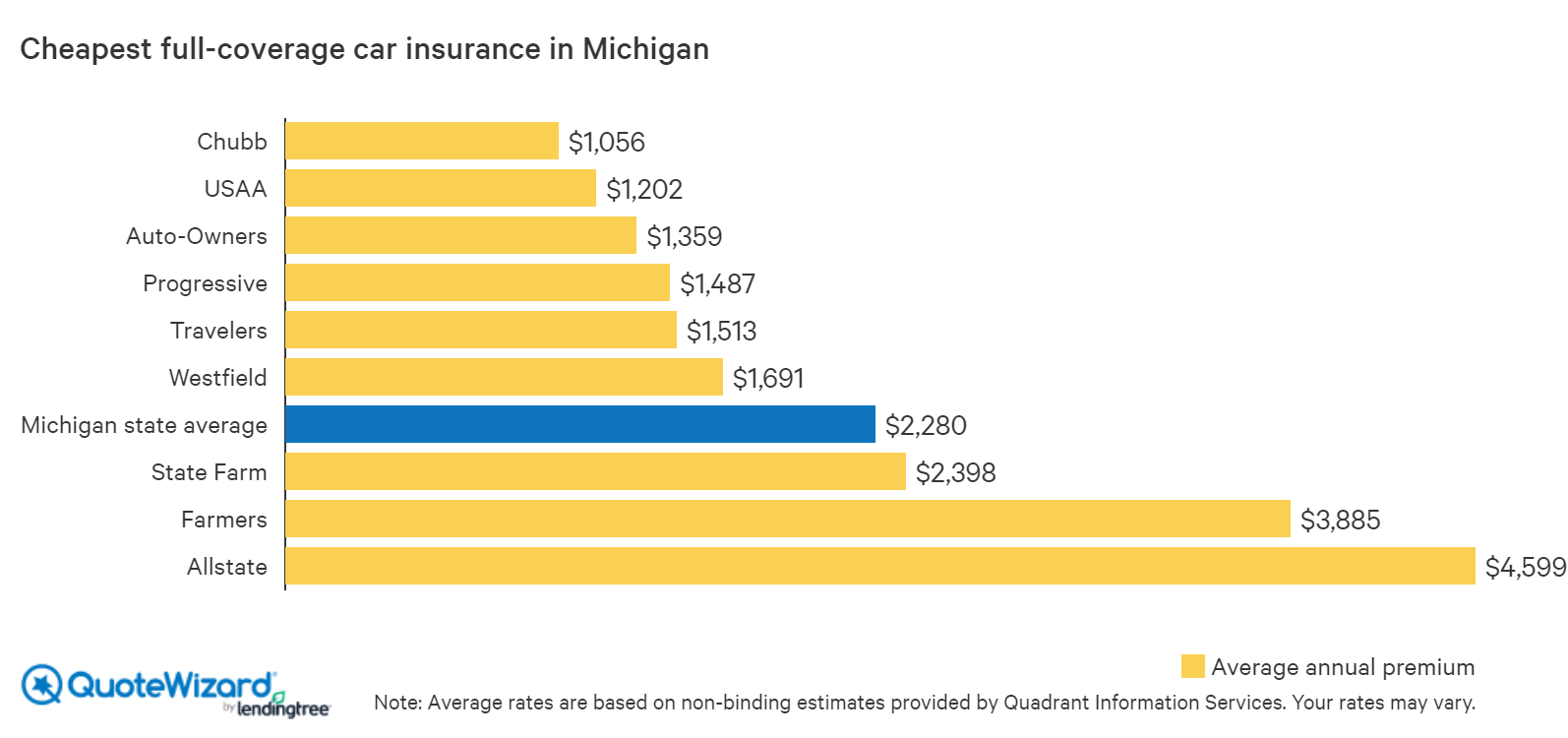

The best way to find the cheapest PLPD insurance in Michigan is to shop around. There are many insurance companies that offer PLPD coverage in the state, and it pays to compare rates. Before you begin shopping, make sure you have an idea of what kind of coverage you need and how much coverage you can afford. You should also consider the coverage options available in each company, such as collision and comprehensive coverage.

What Factors Affect PLPD Insurance Rates?

The cost of PLPD insurance in Michigan is affected by several factors, including your driving record, the type of car you drive, and the amount of coverage you choose. Your driving record will be taken into account when determining your rate, so it’s important to maintain a good driving record. The type of car you drive will also affect your rate, as some cars are more expensive to insure than others. The amount of coverage you choose will also have an impact on your rate, as higher limits will cost more.

What Are The Benefits Of PLPD Insurance?

PLPD insurance is a great way to protect yourself and your property from the costs associated with an accident. It provides coverage for bodily injury and property damage to others, as well as uninsured and underinsured motorist protection. This type of coverage is usually less expensive than a full coverage policy, and it provides the same protection. It also gives you peace of mind knowing that you are covered in the event of an accident.

Where To Find The Cheapest PLPD Insurance In Michigan?

When looking for the cheapest PLPD insurance in Michigan, it is important to compare rates from multiple insurance companies. You can do this by getting quotes from a variety of different providers. Make sure you understand the coverage options and compare the rates between different companies. It is also a good idea to read reviews of the companies to make sure you are getting the best coverage at the best price.

Cheapest Plpd Car Insurance In Michigan - jukkahdesign

Cheapest Car Insurance in Michigan | QuoteWizard

Cheapest Car Insurance in Michigan | QuoteWizard

Who Has the Cheapest Auto Insurance Quotes in Michigan?

What is PLPD Insurance? | Michigan Auto Law