Cheap And Affordable Car Insurance State Minimum

Cheap And Affordable Car Insurance State Minimum

What Is State Minimum Car Insurance?

State minimum car insurance is a type of insurance required by state law to help cover liability costs in the event of a car accident. Each state has different requirements for how much coverage a driver must carry, and different states can also have different rules on what type of coverage is required. In some states, drivers must carry liability coverage, personal injury protection, and uninsured/underinsured motorist coverage. In other states, drivers may only be required to carry liability coverage. It’s important to check with your state’s insurance department to find out what coverage is required in your state.

Why Is State Minimum Car Insurance Better Than No Insurance?

Having state minimum car insurance provides some financial protection in the event of an accident. Without insurance, drivers will be responsible for any damages and medical bills associated with an accident. Even if the accident was not your fault, you could still end up paying thousands of dollars out of pocket for repairs and medical bills. State minimum car insurance provides some protection in the event of an accident, and you will not be responsible for paying the entire bill.

What Are The Benefits Of State Minimum Car Insurance?

State minimum car insurance is often the most affordable type of insurance available. It is usually much less expensive than comprehensive coverage, and it can still provide some financial protection in the event of an accident. State minimum car insurance can also be a good choice for drivers who are looking for a low-cost way to get the coverage they need. It can provide some financial protection in the event of an accident, and it is usually much less expensive than comprehensive coverage.

What Are The Drawbacks Of State Minimum Car Insurance?

The biggest drawback of state minimum car insurance is that it does not provide much financial protection in the event of an accident. It is only designed to cover the cost of liability costs, and it does not provide any other coverage. This means that it will not cover the cost of repairs or medical bills, which can add up quickly in the event of an accident. Additionally, state minimum car insurance may not meet the requirements of a lender if you are financing a car.

How To Find Cheap And Affordable State Minimum Car Insurance

There are several ways to find cheap and affordable state minimum car insurance. You can start by comparing quotes from different insurance companies. Make sure to compare the same coverage levels to get an accurate comparison of the cost. You can also ask your friends and family members for recommendations on insurance companies. Additionally, you can use online comparison tools to quickly compare quotes from different companies. Lastly, you can contact your state’s insurance department for more information about state minimum car insurance.

Conclusion

State minimum car insurance is a type of insurance required by state law to help cover liability costs in the event of a car accident. It is often the most affordable type of insurance available, but it does not provide much financial protection in the event of an accident. There are several ways to find cheap and affordable state minimum car insurance, including comparing quotes from different insurance companies, asking friends and family for recommendations, and using online comparison tools. Lastly, you can contact your state’s insurance department for more information about state minimum car insurance.

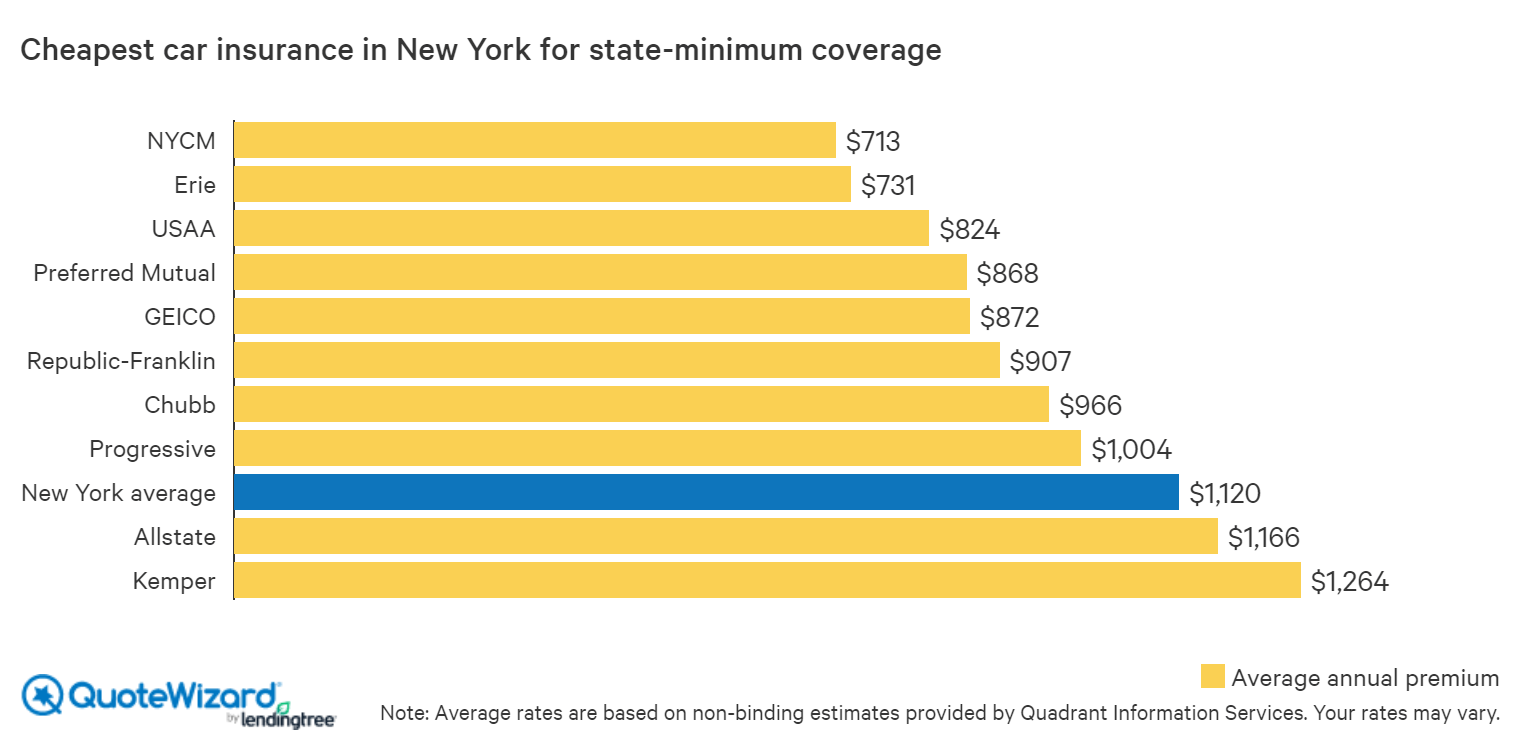

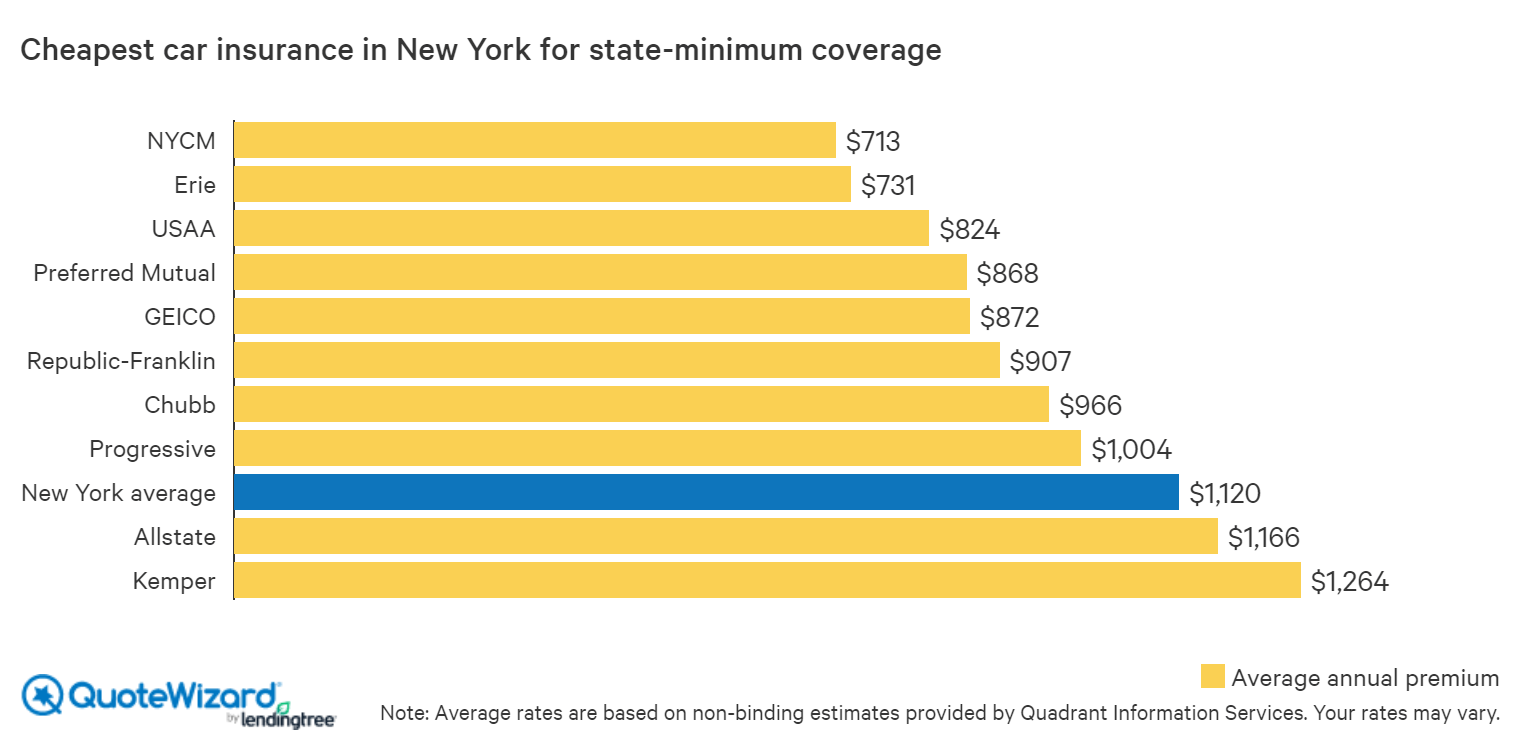

The Cheapest Car Insurance in New York | QuoteWizard

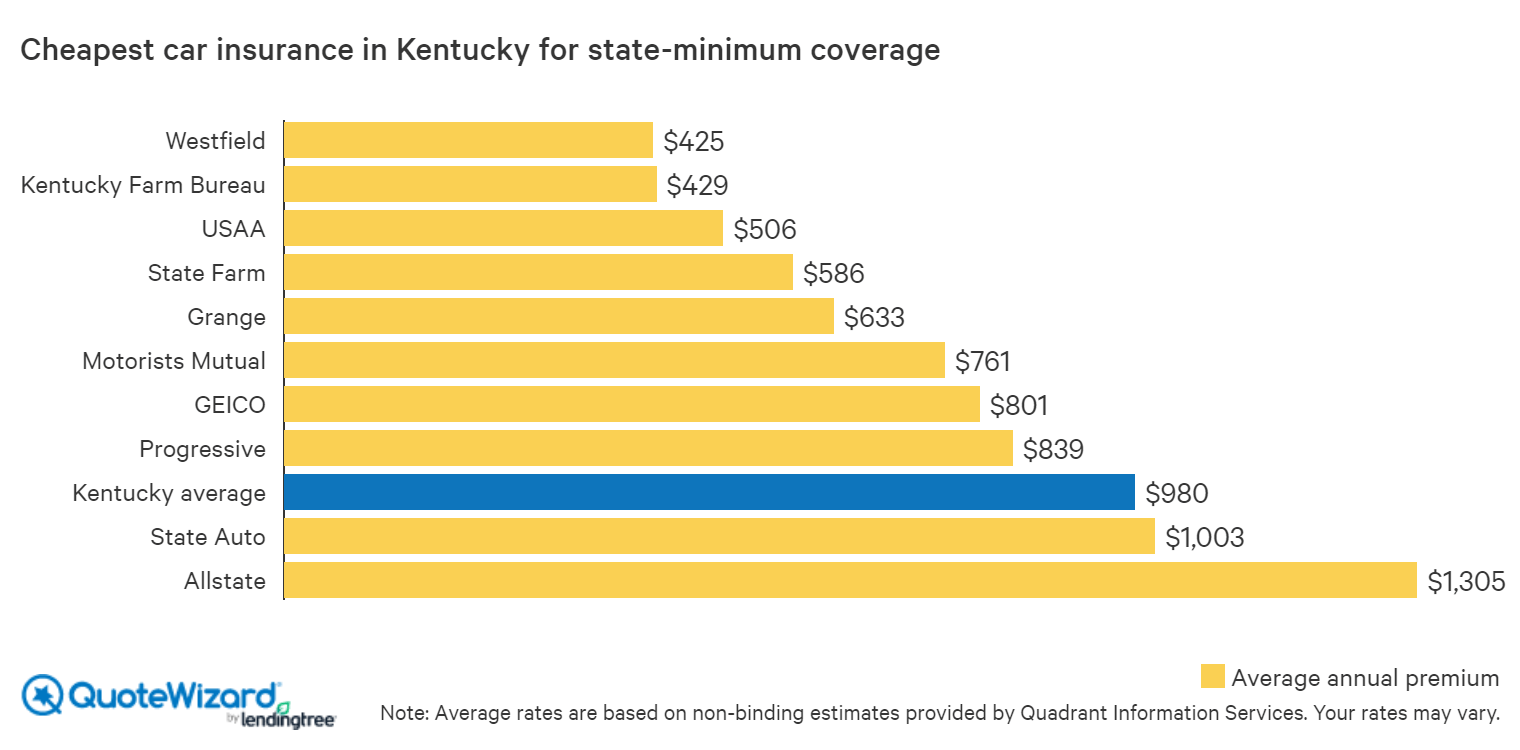

Find Cheap Car Insurance in Kentucky | QuoteWizard

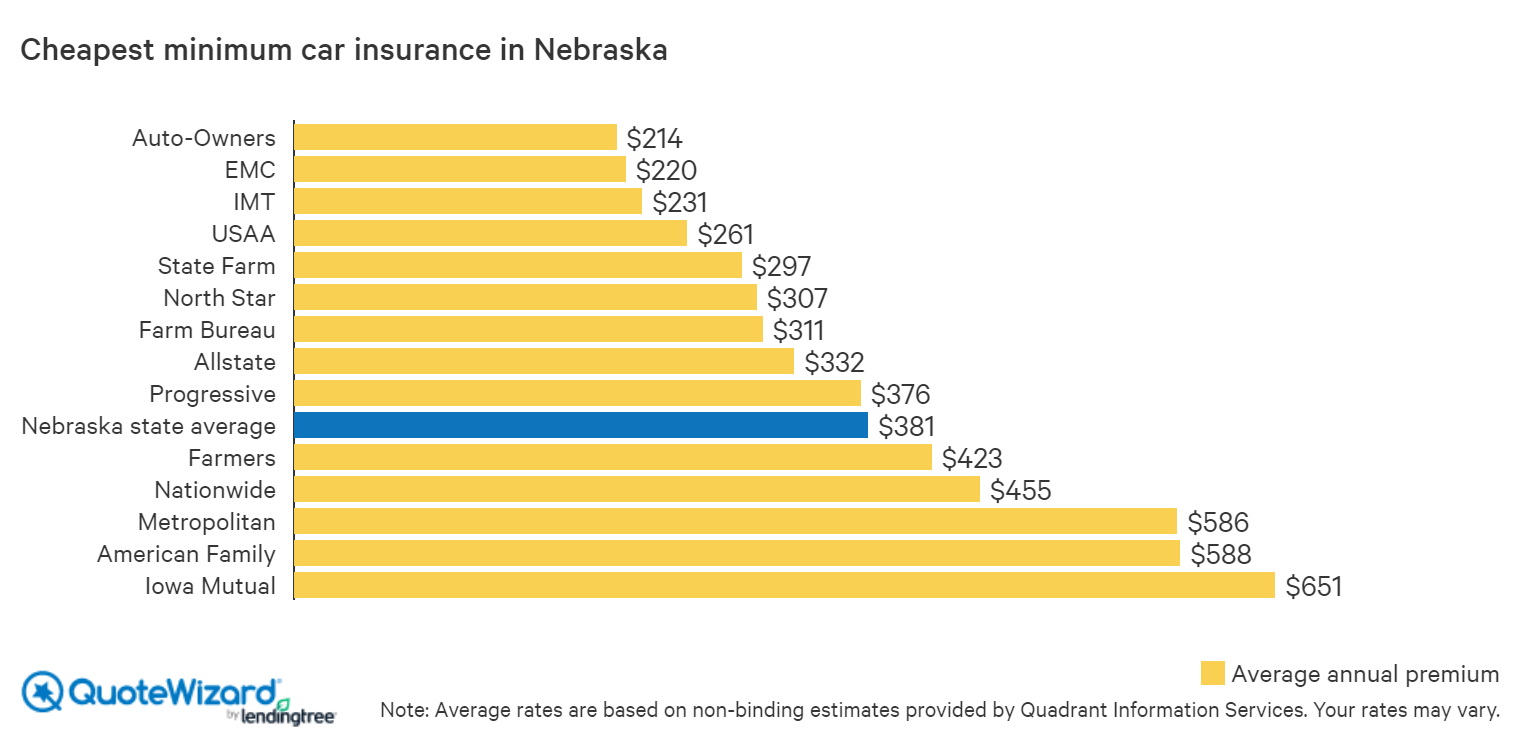

How to Get Cheap Car Insurance in Nebraska | QuoteWizard

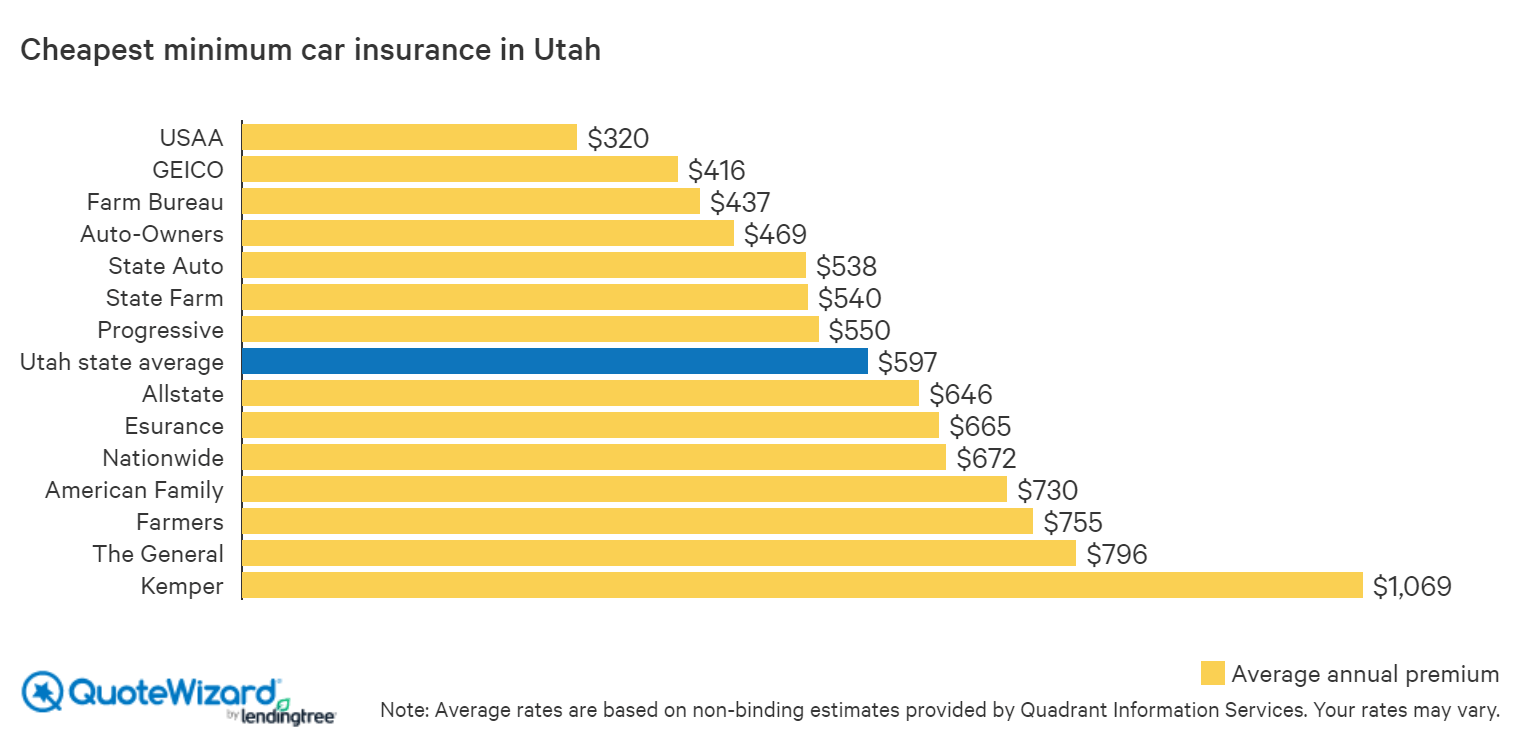

Where to Find Cheap Car Insurance in Utah | QuoteWizard

A Guide to the BEST 9 Car Insurance Hacks No One Talks About | Cheap