Car Insurance In New York City

Car Insurance in New York City

The Basics of Car Insurance in New York City

Car insurance in New York City is an important part of driving in the city. It is required by law for all drivers, and the state of New York has specific regulations for coverage and policies. All drivers in the city are required to have liability insurance, which pays for damages to another person or property caused by the driver. Additionally, drivers may also purchase optional coverage, such as collision and comprehensive coverage, to protect their own vehicles from damage.

The minimum liability coverage for drivers in New York City is $25,000 for bodily injury coverage per person, $50,000 for bodily injury coverage per accident, and $10,000 for property damage coverage per accident. Drivers can purchase additional coverage in higher amounts, and they may also purchase optional coverage such as collision and comprehensive coverage to protect their own vehicles from damage.

How to Get Car Insurance in New York City

The best way to get car insurance in New York City is to compare rates from different insurers. There are several ways to do this, including using an online insurance comparison site or speaking to an insurance agent.

When comparing rates, it’s important to consider factors such as the type of coverage, the amount of coverage, the deductible, and any discounts that may be available. It is also important to make sure the insurer is licensed and reputable.

Things to Consider When Buying Car Insurance in New York City

When buying car insurance in New York City, there are several factors to consider. These include coverage type, coverage amount, deductible, and discounts available. Additionally, drivers should consider any additional riders or endorsements that may be available, such as rental car coverage or roadside assistance.

It is important to remember that the cheapest policy may not always be the best policy. Drivers should consider the coverage and their own needs when selecting a policy. Additionally, it is important to read the policy carefully and make sure that it covers what the driver needs it to cover.

Additional Tips for Buying Car Insurance in New York City

When buying car insurance in New York City, there are several tips to keep in mind. First, drivers should shop around and compare rates from different insurers. Second, drivers should read the policy carefully and make sure that it covers what they need it to cover. Third, they should take advantage of any discounts that are available. Finally, they should consider any additional riders or endorsements that may be available.

By taking the time to shop around and compare rates, drivers can get the best deal on car insurance in New York City. Additionally, they can make sure that their policy covers all of their needs and provides them with the protection they need.

Create a news blog article about Car Insurance In New York City, in relaxed English. The article consists of at least 6 paragraphs. Every paragraphs must have a minimum 200 words. Create in html file form without html and body tag. first title using tag. sub title using and tags. Paragraphs must use

tags. Paragraphs must use

tags.

Car Insurance in New York City

The Basics of Car Insurance in New York City

Car insurance in New York City is an essential part of driving in the city. It is mandated by the law for all drivers, and the state of New York has specific regulations for coverage and policies. All drivers must have liability insurance, which pays for damages to another person or property caused by the driver. Additionally, drivers may also purchase optional coverage, such as collision and comprehensive coverage, to protect their own vehicles from damage.

The minimum liability coverage for drivers in New York City is $25,000 for bodily injury coverage per person, $50,000 for bodily injury coverage per accident, and $10,000 for property damage coverage per accident. Drivers can buy additional coverage in higher amounts, and they may also purchase optional coverage such as collision and comprehensive coverage to protect their own vehicles from damage.

How to Get Car Insurance in New York City

The best way to get car insurance in New York City is to compare rates from different insurers. There are several ways to do this, including using an online insurance comparison site or speaking to an insurance agent.

When comparing rates, it’s important to consider factors such as the type of coverage, the amount of coverage, the deductible, and any discounts that may be available. It is also important to make sure the insurer is licensed and reputable.

Things to Consider When Buying Car Insurance in New York City

When buying car insurance in New York City, there are several factors to consider. These include coverage type, coverage amount, deductible, and discounts available. Additionally, drivers should consider any additional riders or endorsements that may be available, such as rental car coverage or roadside assistance.

It is important to remember that the cheapest policy may not always be the best policy. Drivers should consider the coverage and their own needs when selecting a policy. Additionally, it is important to read the policy carefully and make sure that it covers what the driver needs it to cover.

Additional Tips for Buying Car Insurance in New York City

When buying car insurance in New York City, there are several tips to keep in mind. First, drivers should shop around and compare rates from different insurers. Second, drivers should read the policy carefully and make sure that it covers what they need it to cover. Third, they should take advantage of any discounts that are available. Finally, they should consider any additional riders or endorsements that may be available.

By taking the time to shop around and compare rates, drivers can get the best deal on car insurance in New York City. Additionally, they can make sure that their policy covers all of their needs and provides them with the protection they need.

Finally, drivers should remember that car insurance is an important part of protecting themselves while driving in New York City. While it can be expensive, it is essential to have the right coverage to protect drivers and their vehicles. By taking the time to compare rates and find the right policy, drivers can get the best deal on car insurance in New York City.

North Atlantic Car Insurance in New York City - YouTube

North Atlantic Car Insurance New York City NY - North Atlantic Car

Cheapest Car Insurance in New York in 2020 | Car insurance, Getting car

Download New Insurance Images Pictures

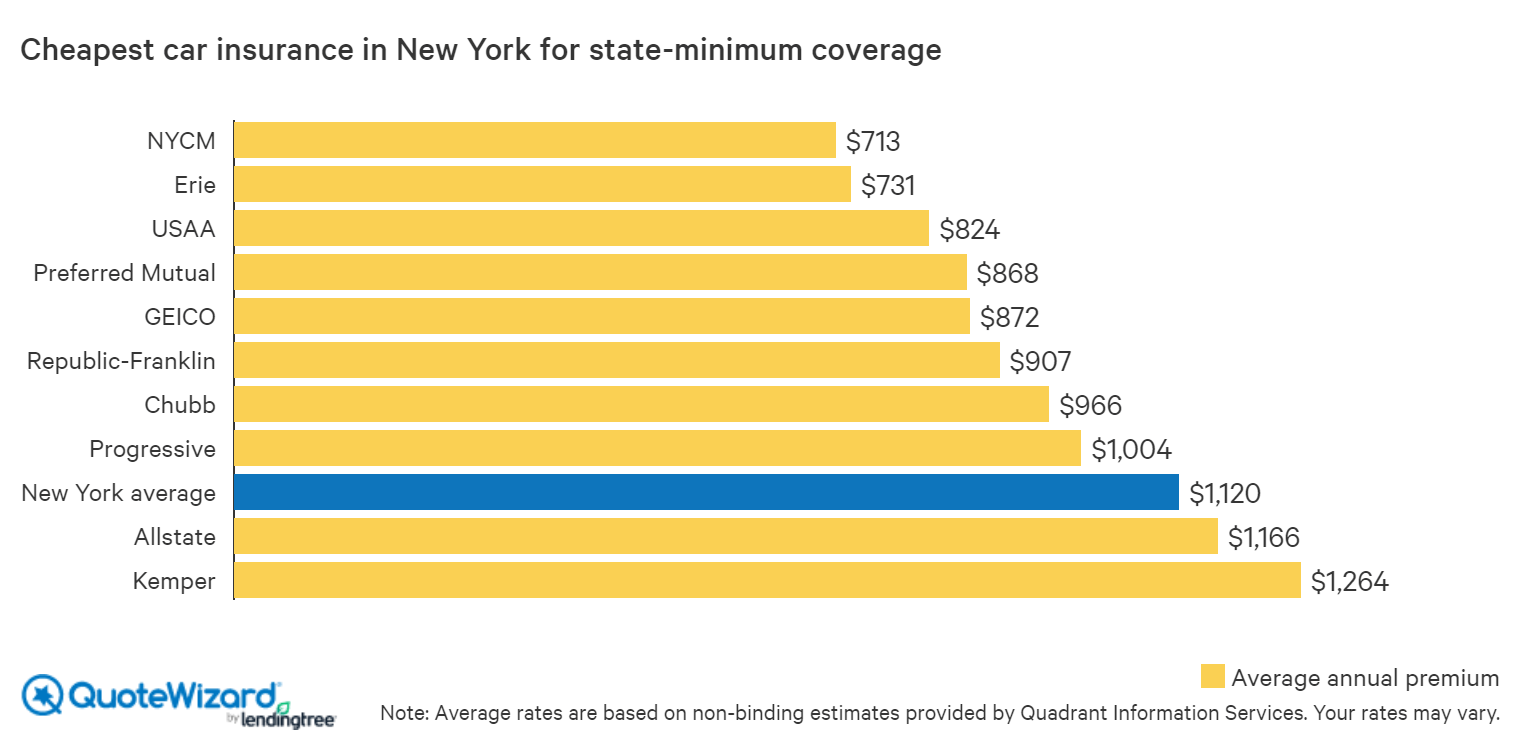

New York Car Insurance Rates for 2021 - Cost + Cheapest to Insure