Best Price Car Insurance In Texas

Finding The Best Price Car Insurance In Texas

It is no secret that Texas residents pay some of the highest car insurance rates in the United States. No one likes to pay more than necessary, so if you are looking for the best price car insurance in Texas, you’ve come to the right place. There are a few easy steps that you can take to ensure you are getting the lowest rates possible.

Shop Around For Car Insurance Quotes

The first step to getting the best price car insurance in Texas is to shop around for multiple quotes. Different insurance companies have different rates, and it is important to compare them in order to find the best deal. Talk to multiple insurers, and make sure to ask about any discounts that may be available. Once you have found the best rate, it is time to move on to the next step.

Understand Different Types of Coverage

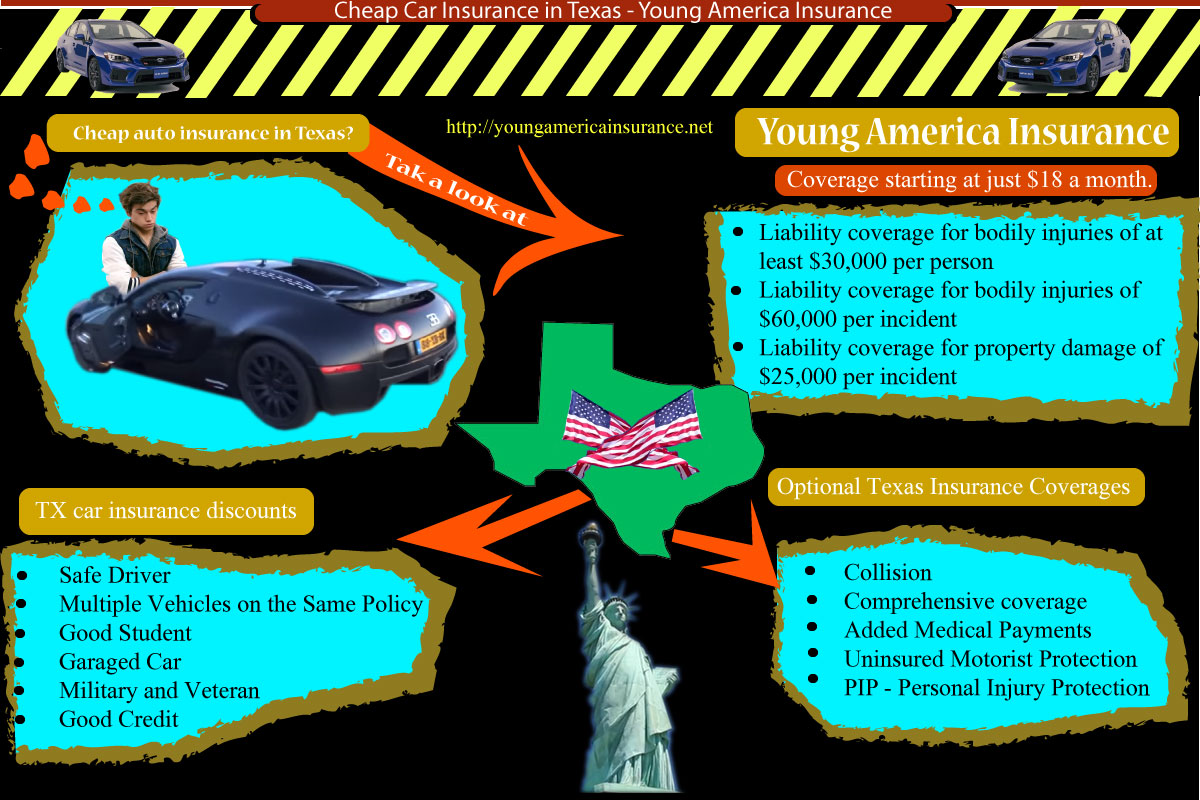

The next step is to understand the different types of coverage available. The most basic type of coverage is liability coverage, which pays for any damages or injuries that you may cause while driving. There is also collision coverage, which pays for damages to your vehicle, and comprehensive coverage, which covers losses caused by weather, theft, or other incidents. You may also want to consider personal injury protection, which can help cover medical expenses if you are injured in an accident.

Raise Your Deductible

Another way to get the best price car insurance in Texas is to raise your deductible. A deductible is the amount you must pay out of pocket before your insurance company will start covering the rest of the costs. By raising your deductible, you can significantly lower your premium, but remember that you will be responsible for paying the full cost of repairs if an accident does occur.

Maintain Good Credit

Your credit score can also have an effect on your car insurance rates. Insurers often use credit scores to determine the likelihood of filing a claim, so maintaining a good credit score can help you get the best price car insurance in Texas. Pay your bills on time and check your credit report regularly to make sure that you are getting the best rates possible.

Ask About Discounts

Finally, don’t forget to ask your insurance company about any available discounts. Many companies offer discounts for things like taking a defensive driving course or having multiple cars insured with the same company. Some insurers also offer discounts if you have a clean driving record or if you have a certain type of vehicle. Ask your insurer about any available discounts and make sure you are taking advantage of them.

Conclusion

Finding the best price car insurance in Texas can be a challenge, but it is not impossible. By shopping around for multiple quotes, understanding different types of coverage, raising your deductible, maintaining a good credit score, and asking about discounts, you can help ensure that you are getting the best rate possible. Keep these tips in mind and you will be well on your way to finding the best car insurance in Texas.

8 Best Car Insurance Companies in Texas | Money

6 Ways Texans Can Lower Their Car Insurance | Baja Auto Insurance

Beautiful Leading Car Insurance Company In Usa Wallpaper - Financelife

Cheap Car Insurance in Texas - YouTube

Cheap Car Insurance in Texas | Young America Only Liability Auto Ins