Best Insurance Policy For Car

Saturday, May 13, 2023

Edit

Best Insurance Policy For Car

Why You Need Car Insurance?

Car insurance is something that we all need to invest in, but many of us don’t realize how important it is until it’s too late. In the event of an accident, car insurance can help you cover the costs of medical bills, repair bills, and even any legal fees that may arise from the accident. Not having car insurance can be a huge financial burden and can put you in a difficult situation. Because of this, it’s important to understand the types of car insurance policies available and to find the one that best fits your needs.

Types of Car Insurance

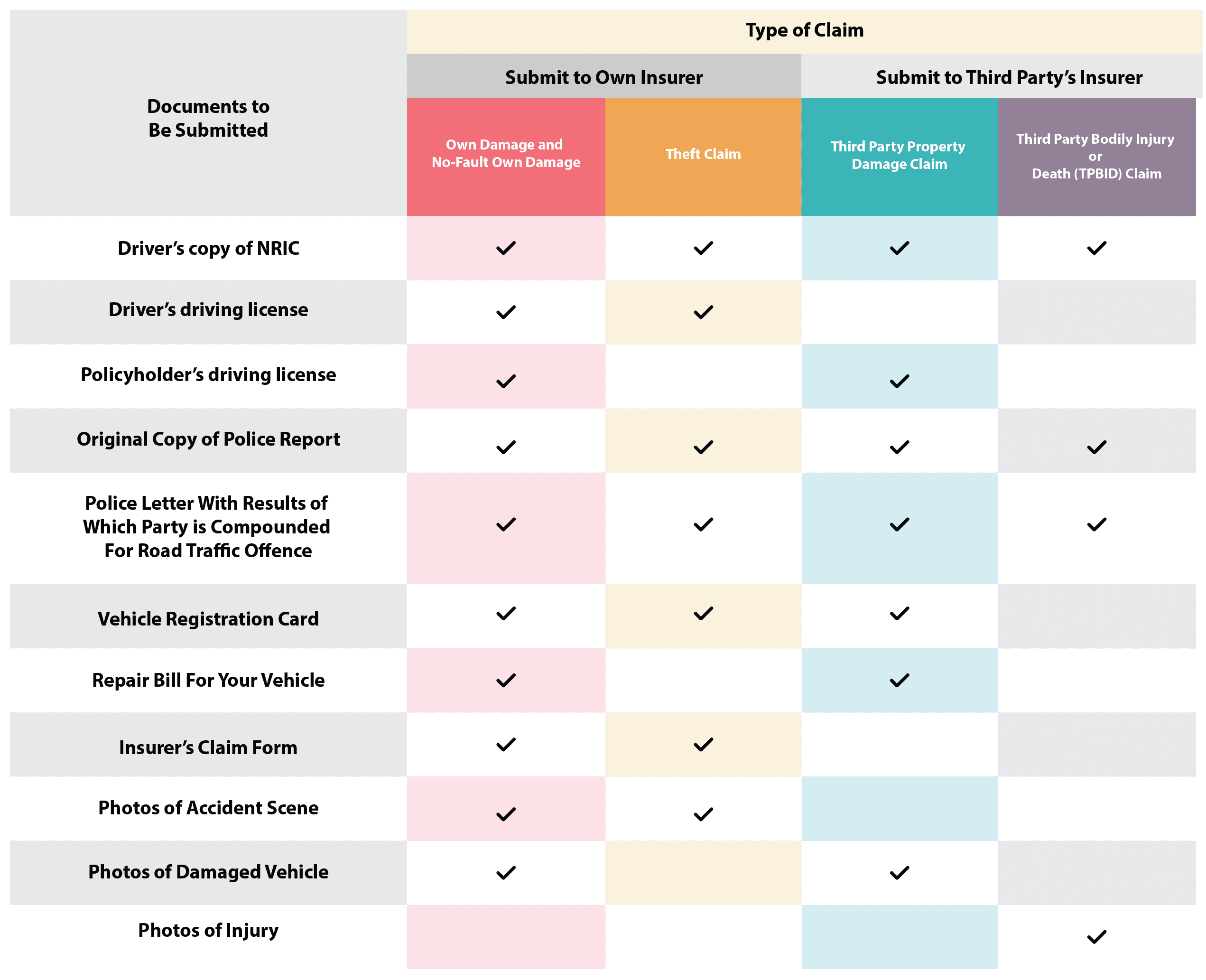

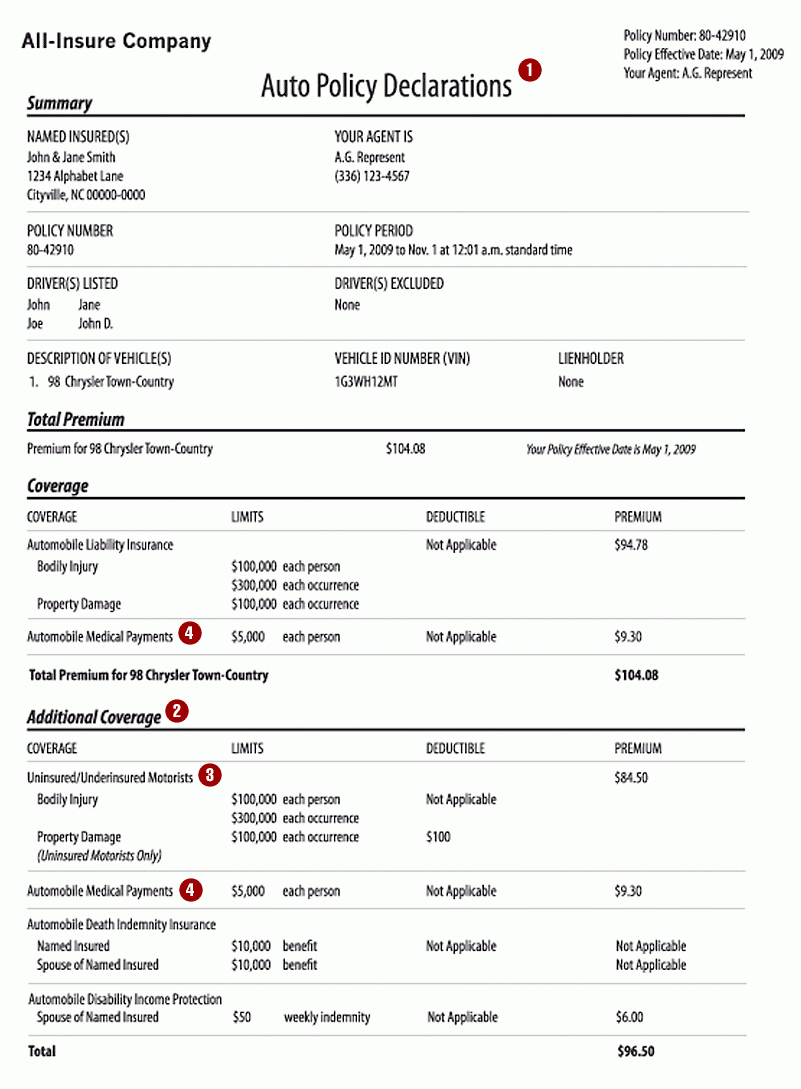

There are several different types of car insurance policies available, and each one offers a different level of coverage. The most common types of car insurance are liability, collision, comprehensive, and uninsured motorist. Liability car insurance covers the costs of damages to other people or property in the event of an accident. Collision insurance covers the costs of damages to your car if you are involved in an accident. Comprehensive coverages cover damages to your car caused by something other than an accident, such as theft, vandalism, or a natural disaster. Uninsured motorist coverage protects you in the event that you are hit by an uninsured driver.

Choosing the Best Policy for You

When choosing the best policy for you, it’s important to consider your individual needs and budget. The type of car you drive, the frequency of your driving, and the area you live in are all factors that can influence the type of policy you should choose. For example, if you live in an area with a high rate of auto theft, you may want to invest in comprehensive coverage. Additionally, if you drive frequently, you may want to invest in a policy with a higher deductible, which can lower your monthly payments.

Getting the Best Price

When shopping for car insurance, it’s important to shop around and compare rates. Different companies offer different rates, so it’s important to compare policies and find the one that best fits your needs and budget. Additionally, many insurers offer discounts for things like safe driving and no-claims history, so it’s important to ask about any potential discounts you may qualify for.

Finding the Right Insurance Agent

The right insurance agent can make a huge difference in getting the best policy for you. It’s important to find an agent who is knowledgeable and experienced in the industry and who can help you find the right policy for your needs. Additionally, it’s important to find an agent who is willing to take the time to answer your questions and who is willing to work with you to find the best policy for you.

Conclusion

Car insurance is an important investment, and it’s important to understand the types of policies available and to find the one that best fits your needs and budget. It’s also important to shop around and compare rates and to ask about any potential discounts you might qualify for. Finally, it’s important to find an insurance agent who is knowledgeable and experienced in the industry and who can help you find the right policy for you.

List of the Best Car Insurance

Best Insurance Policy Words Coverage Health Care Protection Stock

Best car insurance comparison websites – Silversurfers

Motor Insurance Policy – Buy Now Pertaining To Auto Insurance Id Card

Best Car Insurance in Malaysia 2022 - Compare and Buy Online