Average Monthly Car Insurance Bill

What is the Average Monthly Car Insurance Bill?

Car insurance is a necessity for most drivers, but it can be expensive. Knowing the average monthly car insurance bill helps you budget for the future. It's important to understand the various factors that influence the cost of your car insurance so that you can make an informed decision when buying a policy. This article will provide an overview of the average monthly car insurance bill and how to lower the cost.

Factors that Influence the Cost of Car Insurance

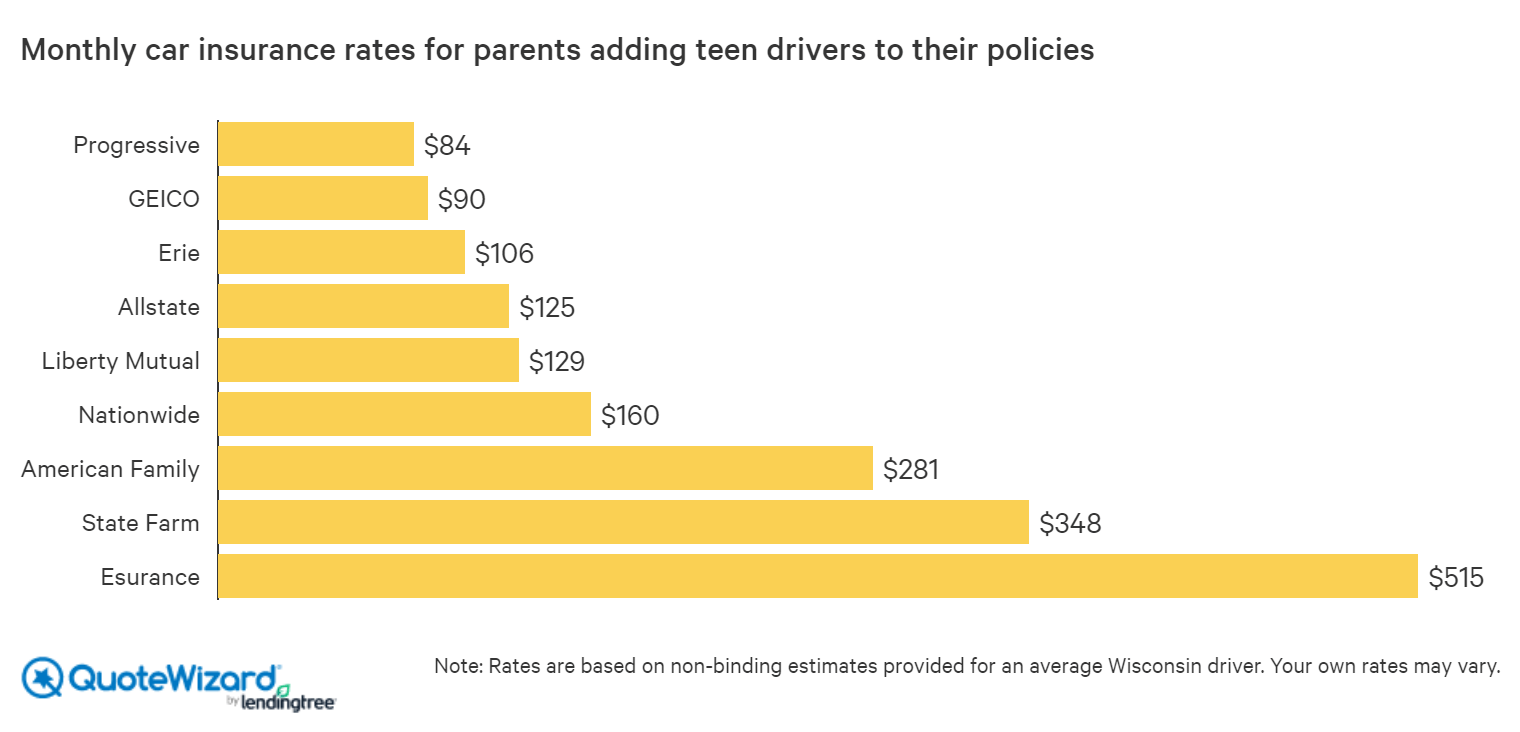

There are many factors that can influence the cost of car insurance, including: your age, driving record, type of car, and where you live. Your age plays a big role in the cost of your policy. Generally, younger drivers are more expensive to insure than older drivers since they are more likely to be involved in an accident. Your driving record is also taken into consideration. If you have had multiple tickets or accidents in the past, your rates will be higher. The type of car you drive can also affect the cost of your insurance. Certain types of cars, such as sports cars or luxury cars, can be more expensive to insure because they are more expensive to repair in the event of an accident. Lastly, where you live can influence the cost of your policy. Living in a densely populated area can drive up the cost of your insurance since there is a greater risk of an accident.

Average Monthly Car Insurance Bill

The average monthly car insurance bill can range from $50 to $250, depending on the factors mentioned above. Generally, people who are older, have a good driving record, and drive an average car will pay closer to $50 per month. People who are younger, have a poor driving record, or drive a more expensive car will pay closer to $250 per month. Of course, these are just estimates and your actual car insurance bill could be more or less depending on your individual circumstances.

How to Lower Your Monthly Car Insurance Bill

If you are looking to lower your monthly car insurance bill, there are a few steps you can take. The first is to shop around and compare quotes from different insurance companies. Comparing quotes will help you find the best rate for the coverage you need. You can also consider raising your deductible, which is the amount you pay out of pocket before your car insurance kicks in. Raising your deductible will reduce your monthly premium, but make sure you can afford the higher deductible in the event of an accident. Lastly, you can consider taking a defensive driving course, which can often result in a discount on your car insurance.

Conclusion

The average monthly car insurance bill can vary greatly depending on the factors mentioned above. Knowing the average can help you budget for the future and make an informed decision when choosing a policy. If you are looking to lower your monthly premiums, there are a few steps you can take, such as shopping around and comparing quotes, raising your deductible, or taking a defensive driving course. By taking these steps, you can ensure that you are getting the best rate on your car insurance.

Quick Answer: What Is The Average Car Insurance Rate?? - AutoacService

Average Monthly Car Insurance Payment / Texas Car Insurance

Average Monthly Car Insurance Maryland - blog.pricespin.net

Average Monthly Car Insurance Cost - What Is The Average Monthly Cost

The average cost of car insurance in the US, from coast to coast