Auto Repair Shop Loaner Car Insurance

Auto Repair Shop Loaner Car Insurance: What You Need To Know

When you take your vehicle in for repair, you may be offered the use of a loaner car. This can be a great convenience, but you need to make sure you have adequate coverage for any damages that may occur during your time of use. Loaner car insurance is an extra coverage that you can add to your existing auto policy to protect you from any financial loss that could arise from an accident or other incident involving the loaner car.

What is Loaner Car Insurance?

Loaner car insurance is a type of auto insurance specifically designed to cover a vehicle that you are temporarily using. It typically provides liability coverage as well as comprehensive and collision coverage, depending on the policy. This coverage usually extends to any damage or liability caused by an accident while you are using the vehicle, but it may also include theft, fire, and vandalism.

How Does Loaner Car Insurance Work?

When you take out a loaner car insurance policy, you will typically be required to provide proof of your existing auto insurance coverage. The insurer will then look at the details of your current policy and determine how much additional coverage you need for the loaner car. They will also review any existing coverage on the loaner car and determine if there are any gaps in protection. Once the policy is in place, you will be able to use the loaner car with the assurance that you are covered for any damages or liabilities that may result from an accident.

What Does Loaner Car Insurance Cover?

Loaner car insurance typically covers damages you may cause while using the loaner car, as well as any liabilities that may arise from an accident. It also covers the cost of repairs to the loaner car, as well as any rental car costs if the loaner car needs to be replaced while it is being repaired. The coverage may also include medical expenses for any passengers in the loaner car at the time of the accident. In some cases, loaner car insurance may also cover towing and other expenses related to the accident.

How Much Does Loaner Car Insurance Cost?

The cost of loaner car insurance will vary depending on the type and amount of coverage you choose. Generally, the more coverage you purchase, the more expensive the policy will be. In most cases, the cost of the coverage is usually significantly lower than the cost of renting a car, so it can be a cost-effective way to make sure you are protected while using a loaner car.

Is Loaner Car Insurance Worth It?

Loaner car insurance can be a great way to protect yourself financially while using a loaner car. It can provide you with peace of mind knowing that you are covered if an accident or other incident occurs while using the loaner car. Additionally, the cost of loaner car insurance is usually significantly less than the cost of renting a car, so it can be a cost-effective way to ensure you are adequately covered.

auto repair shop loaner car insurance - merissa-lynch

Reserve a Loaner Vehicle Today! | Auto body repair, Auto body repair

maximo-peagler

auto repair shop loaner car insurance - merissa-lynch

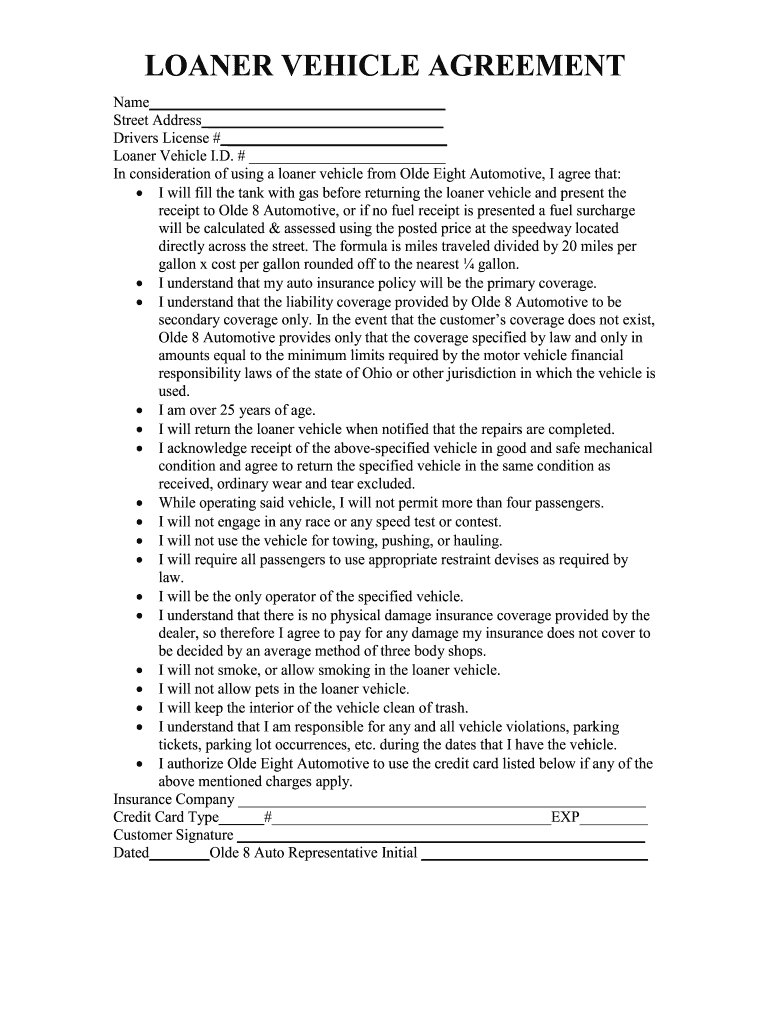

Loaner Vehicle Agreement - Fill Online, Printable, Fillable, Blank