Affordable Full Coverage Car Insurance

The Benefits of Affordable Full Coverage Car Insurance

What is Full Coverage Car Insurance?

Full coverage car insurance is a type of insurance policy that provides protection for all areas of your vehicle. It includes liability coverage, which is required by law in most states, and comprehensive and collision insurance, which are optional. Liability coverage pays for the damage you cause to another person or their property in an accident. Comprehensive and collision coverage pays for repairs to your own vehicle if it is damaged in an accident, due to theft, vandalism, or other type of covered incident.

Why Choose Affordable Full Coverage Car Insurance?

When it comes to car insurance, it's important to get the right coverage to protect yourself and your vehicle. Full coverage car insurance is the best way to ensure that you have the protection you need. It provides you with the peace of mind of knowing that you are covered in case of an accident or other type of incident. But it can also be expensive. That's why it's important to find an affordable full coverage car insurance policy.

Shop Around

When looking for affordable full coverage car insurance, it's important to shop around. Compare prices from different insurance companies to find the best deal. Make sure to get quotes from at least three different companies to get the best rates. Don't forget to compare coverage levels and deductibles to make sure you're getting the right coverage for your needs.

Look for Discounts

Most insurance companies offer a variety of discounts that can help you save on your car insurance. Look for discounts such as good driver discounts, multi-policy discounts, and low-mileage discounts. You may also qualify for discounts if you have a safe driving record, have taken a defensive driving course, or have certain safety features on your vehicle.

Consider a Higher Deductible

Raising your deductible is a great way to lower your premium. By increasing your deductible, you are agreeing to pay a larger portion of the repair costs if you are in an accident. It's important to make sure you can afford the higher deductible in case of an accident. But if you can, it's a great way to save on your car insurance.

Choose the Right Coverage

It's important to make sure you're getting the right coverage for your needs. Make sure you understand the different types of coverage and what they cover. Don't be tempted to skimp on coverage to save a few dollars. Remember, you get what you pay for and inadequate coverage can leave you vulnerable if you are in an accident.

Get Started with Affordable Full Coverage Car Insurance

Full coverage car insurance is an important investment in protecting yourself, your vehicle, and your finances. It's important to find an affordable policy that provides the coverage you need. Shop around for the best rates, look for discounts, and consider raising your deductible. With the right coverage and the right price, you can enjoy the peace of mind that comes with knowing your car is fully protected.

How to Get Cheap Full Coverage Auto Insurance Plan by Helvin Hills - Issuu

PPT - Cheap Full Coverage Car Insurance For All People PowerPoint

Who Has The Cheapest Full Coverage Car Insurance - Quotes quotebody.com

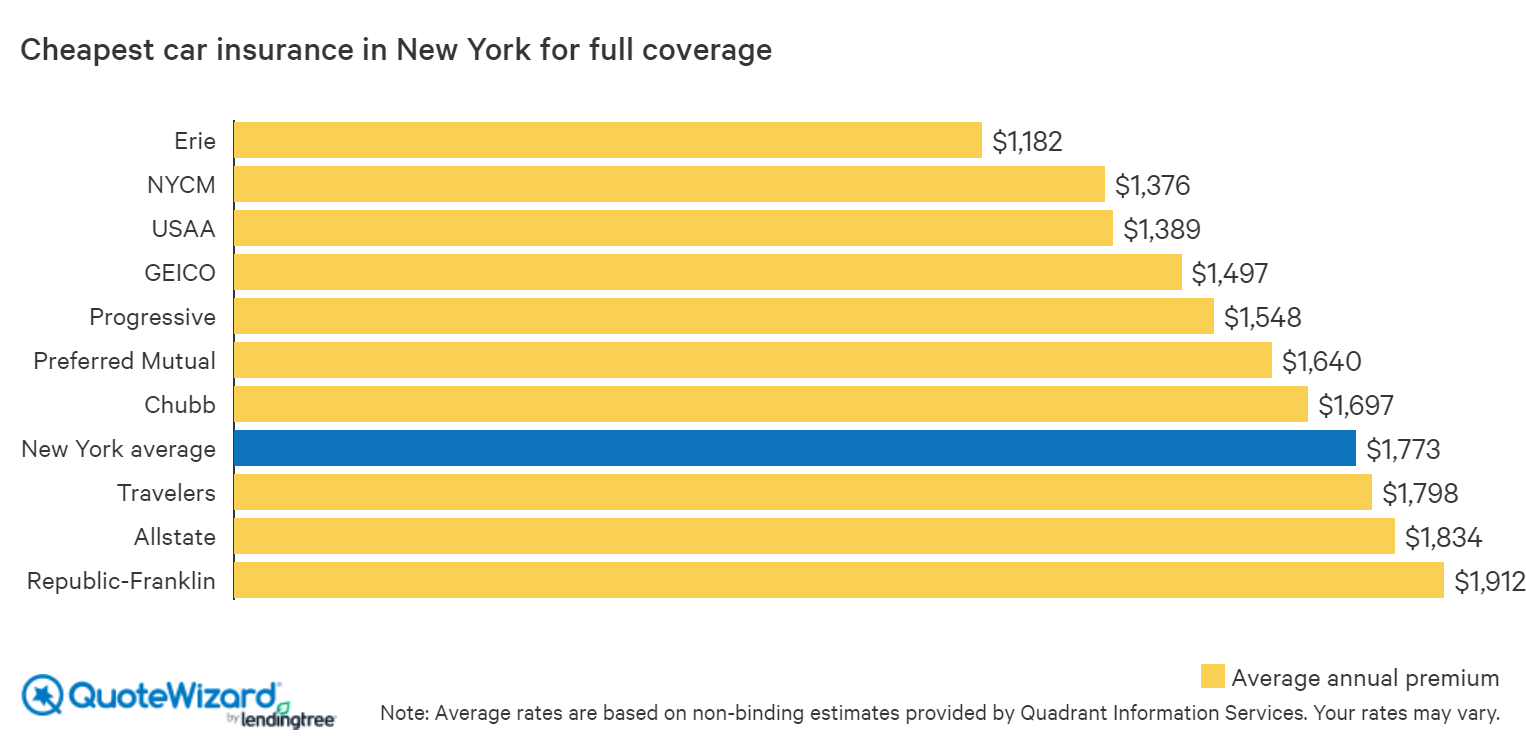

The Cheapest Car Insurance in New York | QuoteWizard

How To Get Cheap Full Coverage Auto Insurance Quotes - Best Insurance