Low Cost California Car Insurance

Getting Low Cost California Car Insurance

The Basics of California Car Insurance

California car insurance is a necessary expense for anyone who drives a vehicle in the state. Drivers are required to have a minimum amount of liability insurance, which covers damage to other people’s property and medical expenses if you are at fault in an accident. In California, the minimum amount of coverage is $15,000 for damage to another person’s property, $30,000 per accident, and $5,000 for medical expenses.

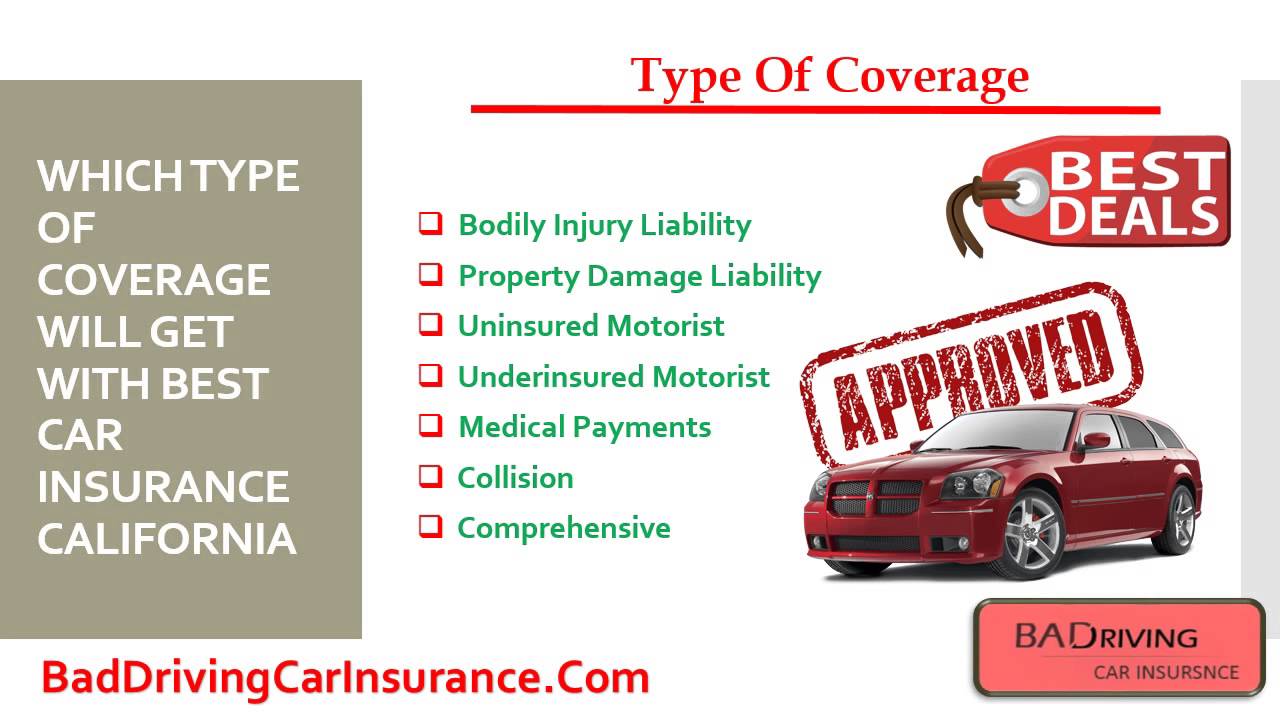

In addition to liability insurance, drivers may also choose to purchase collision and comprehensive coverage. Collision insurance covers damage to your own car in the event of an accident, while comprehensive coverage covers damage from incidents such as theft, vandalism, and natural disasters. These forms of insurance are optional, but they can be very beneficial if you are involved in an accident.

Getting Low Cost California Car Insurance

The good news is that there are a few ways to get low cost California car insurance. The first way is to compare rates from different insurance companies. Shopping around is a great way to find the best deal, as each company offers different rates and discounts. You should also consider the type of coverage you need and make sure to get the best coverage for your budget.

Another way to get low cost California car insurance is to take advantage of discounts. Many insurance companies offer discounts to customers who have a good driving record, as well as those who have taken defensive driving courses. Additionally, some companies offer discounts for having multiple vehicles on the same policy or for bundling your insurance with other policies. Be sure to ask your insurance company about any discounts they may offer.

Finally, you can save money on your California car insurance by increasing your deductible. A higher deductible means you will pay more out of pocket in the event of an accident, but it can also reduce your monthly premium significantly. Be sure to shop around and compare quotes from different insurance companies to find the best rate.

Conclusion

Getting low cost California car insurance is possible if you know how to shop around and take advantage of discounts. Comparing rates from different companies and increasing your deductible are two great ways to save money. Be sure to contact your insurance company and ask about any discounts they may offer, as this can help you get the lowest possible rate.

California Low Cost Auto Insurance - Wallrich Creative Communications

California Low Cost Auto Insurance Program Flyer - Yelp

Low cost auto insurance in California - YouTube

California Car Insurance Companies - Get Free Auto Quotes With Low

Find Cheap California Car Insurance - Instantly Compare Lowest Rates