Hdfc Vehicle Insurance Near Me

Everything You Need to Know About HDFC Vehicle Insurance Near Me

What is HDFC Vehicle Insurance?

HDFC Vehicle Insurance is a comprehensive policy that provides financial protection for your vehicle. It covers you for any damage to your vehicle caused by an accident, natural disasters, theft, or vandalism. It also covers you against liability arising from injury or death of a third party, and/or damage to their property. HDFC Vehicle Insurance provides protection against financial losses arising out of unforeseen events related to your vehicle.

What Are The Benefits Of HDFC Vehicle Insurance?

HDFC Vehicle Insurance offers a wide range of benefits, including: protection against financial losses and liabilities arising out of an accident; coverage for both self and third-party liabilities; coverage for personal accident; coverage for own damage; and coverage for natural disasters. HDFC Vehicle Insurance also provides a host of additional covers, such as road-side assistance, zero depreciation, engine protector, and more. Furthermore, HDFC Vehicle Insurance provides a cashless facility, wherein you can get your repairs done at a networked garage without having to pay any money upfront.

Where Can I Find HDFC Vehicle Insurance Near Me?

HDFC Vehicle Insurance is available all over India. You can buy the policy online or through HDFC’s network of agents and brokers. You can also find HDFC Vehicle Insurance near you, by visiting the HDFC website and typing in your location. You will be presented with a list of HDFC Vehicle Insurance providers near you. You can then contact them and get more information about their plans and benefits.

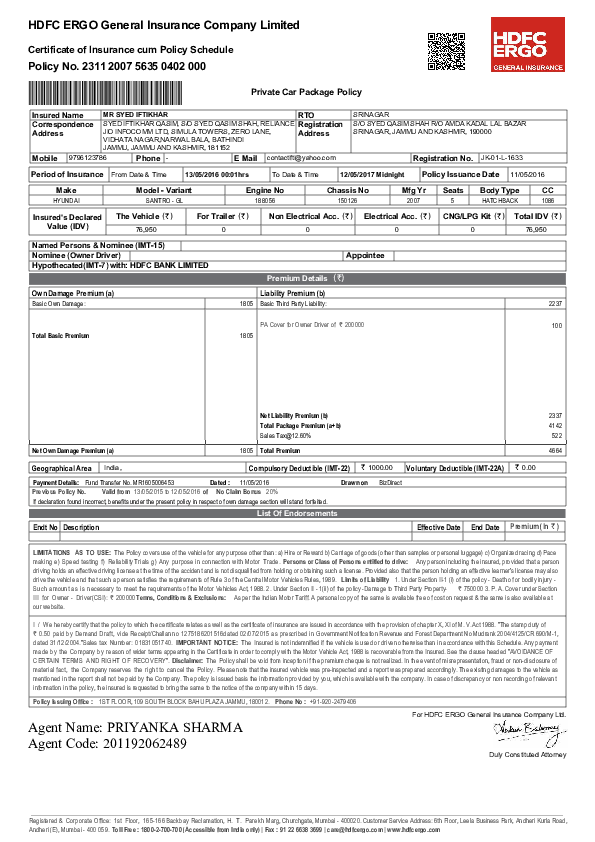

What Are The Documents Required For HDFC Vehicle Insurance?

You will need to submit the following documents when purchasing HDFC Vehicle Insurance: your driving license; your vehicle’s registration certificate; your vehicle’s insurance policy; and proof of address. You may also need to submit additional documents depending on the type of policy you are purchasing. For example, if you are purchasing a third-party insurance policy, you will need to provide the details of the third-party involved in the accident.

How Do I Make A Claim On My HDFC Vehicle Insurance?

You can make a claim on your HDFC Vehicle Insurance by contacting HDFC’s customer service team. They will guide you through the process and help you with the necessary paperwork. You will need to provide the necessary documents, such as your vehicle’s registration certificate and your insurance policy, to support your claim. You will also need to provide details of the accident and any other relevant information. HDFC will then assess the claim and decide whether to approve or reject it.

Conclusion

HDFC Vehicle Insurance is an excellent choice for protecting your vehicle. It provides comprehensive coverage, cashless facility, and a host of other benefits. You can buy the policy online, through agents and brokers, or find HDFC Vehicle Insurance near you. You will need to submit certain documents when purchasing the policy, and you can make a claim by contacting HDFC’s customer service team. HDFC Vehicle Insurance provides financial security and peace of mind.

Hdfc Ergo Car Insurance Policy Download Online - linxydesigns

Hdfc Insurance Claim Form Pdf

Car Insurance Hdfc Ergo

[PDF] HDFC ERGO Motor Car Insurance Form PDF Download in English – InstaPDF

![Hdfc Vehicle Insurance Near Me [PDF] HDFC ERGO Motor Car Insurance Form PDF Download in English – InstaPDF](https://instapdf.in/wp-content/uploads/pdf-thumbnails/hdfc-ergo-motor-car-insurance-form-1361.jpg)

Buy hdfc ergo car insurance