Does Ohio Requires All Drivers To Carry Vehicle Insurance

Does Ohio Require Drivers To Carry Vehicle Insurance?

What Is Vehicle Insurance?

Vehicle insurance is a type of insurance purchased for cars, trucks, and other vehicles. It is an agreement between the insurer and the insured that if the insured vehicle is damaged, the insurer will pay for the cost of repair or replacement. Vehicle insurance is required by law in most states, including Ohio, and is designed to protect the driver, passengers, and other motorists from the financial burden of an accident or injury.

Does Ohio Require Vehicle Insurance?

Yes, Ohio does require all drivers to carry vehicle insurance. Ohio's Financial Responsibility Law states that all drivers must carry Bodily Injury Liability (BIL) coverage for at least $25,000 per person, $50,000 per accident, and Property Damage Liability (PDL) coverage for at least $25,000 per accident. Drivers may also choose to purchase additional coverage such as Uninsured/Underinsured Motorist (UM/UIM) coverage, Medical Payments (MedPay) coverage, and Collision coverage.

What Is The Penalty For Not Having Vehicle Insurance?

Drivers who do not have the required insurance may face a variety of penalties. These penalties can include suspension of driving privileges, fines, and/or jail time. In addition, drivers who are caught driving without insurance may have their vehicle impounded and be required to pay a fee to have it released. Non-compliance with Ohio's Financial Responsibility Law can also lead to a civil penalty of $150 to $600, depending on the number of offenses.

What Documents Must I Have To Prove I Have Vehicle Insurance?

In Ohio, drivers must have proof of insurance when registering a vehicle, renewing a vehicle registration, or when requested by law enforcement. Proof of insurance can be provided in the form of an insurance ID card, a policy, or a binder. The insurance ID card must include the policyholder's name, the name of the insurance company, the policy number, and the effective and expiration dates of the policy.

What Should I Do If My Vehicle Insurance Lapses?

If your vehicle insurance lapses, you should contact your insurance company immediately to reinstate your policy. You will also need to contact the Ohio Bureau of Motor Vehicles (BMV) to provide proof of insurance. If your policy is not reinstated, the BMV may suspend your license and registration until you can provide proof of insurance.

Conclusion

Ohio does require all drivers to carry vehicle insurance. Drivers who do not have the required insurance may face serious penalties, including a suspension of driving privileges, fines, and/or jail time. It is important to always have proof of insurance, such as an insurance ID card, a policy, or a binder, when requested by law enforcement or when registering or renewing a vehicle registration. If your vehicle insurance lapses, you should contact your insurance company and the Ohio Bureau of Motor Vehicles immediately.

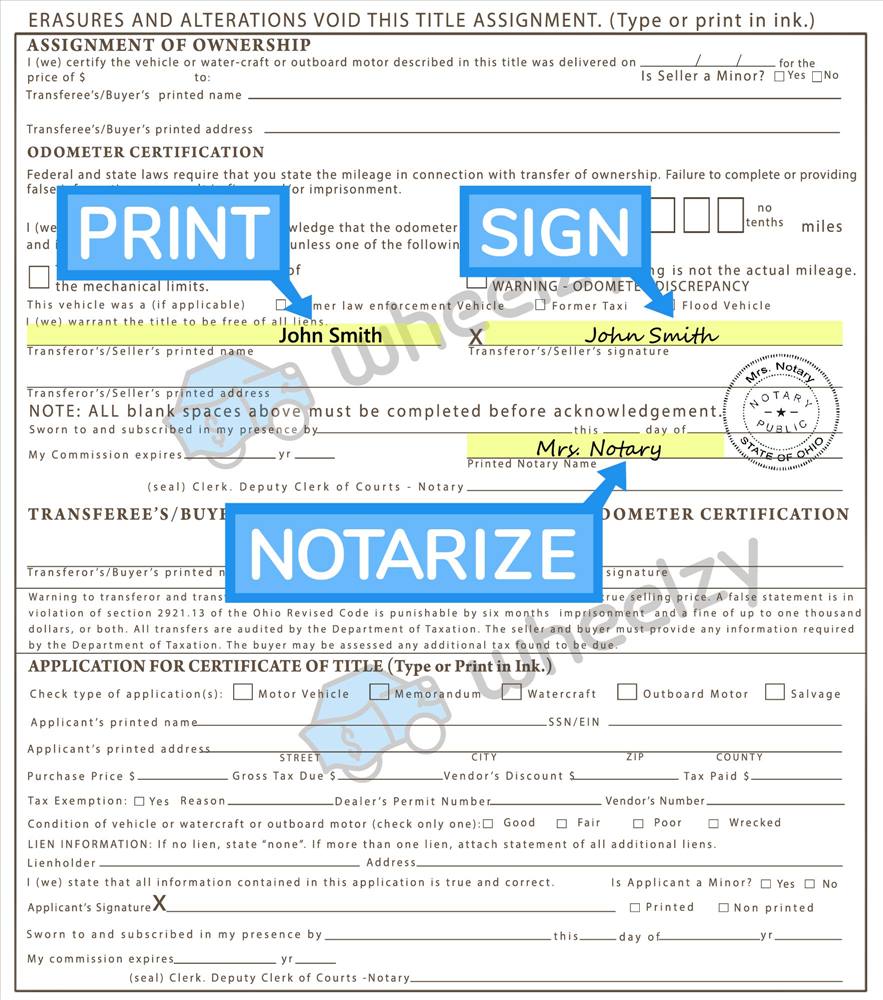

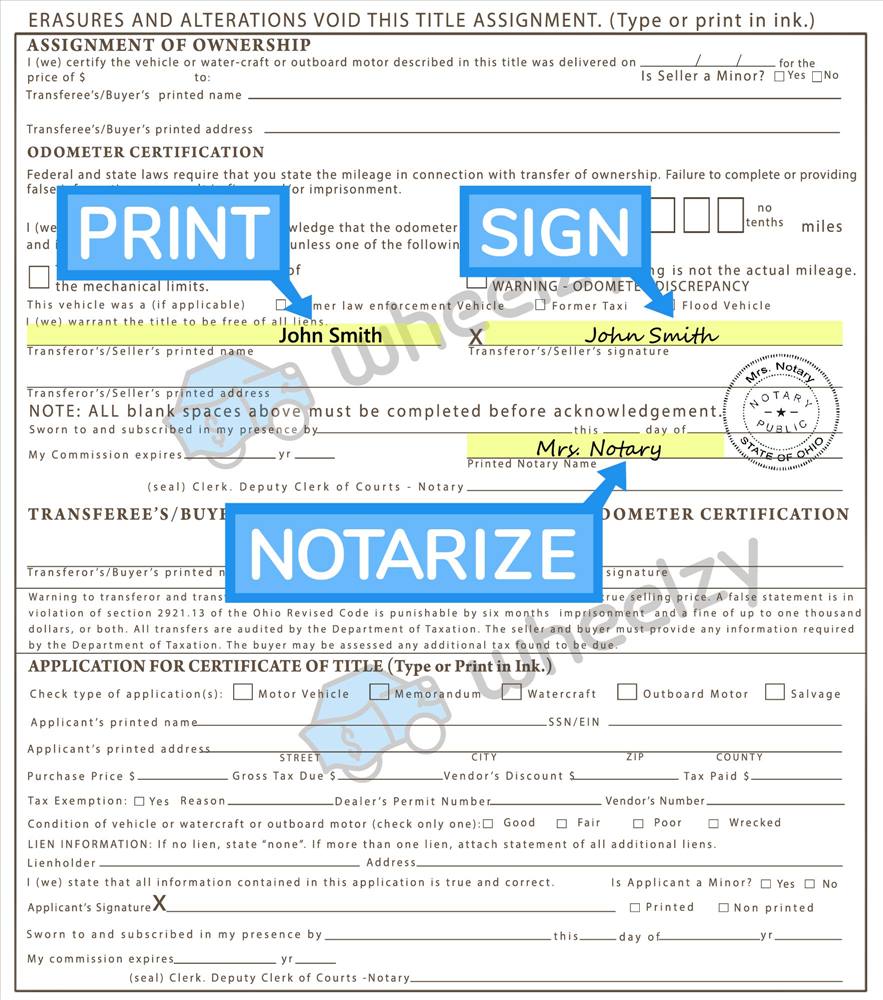

Ohio Car Title Example / This Is How You Can Get Your Vehicle S

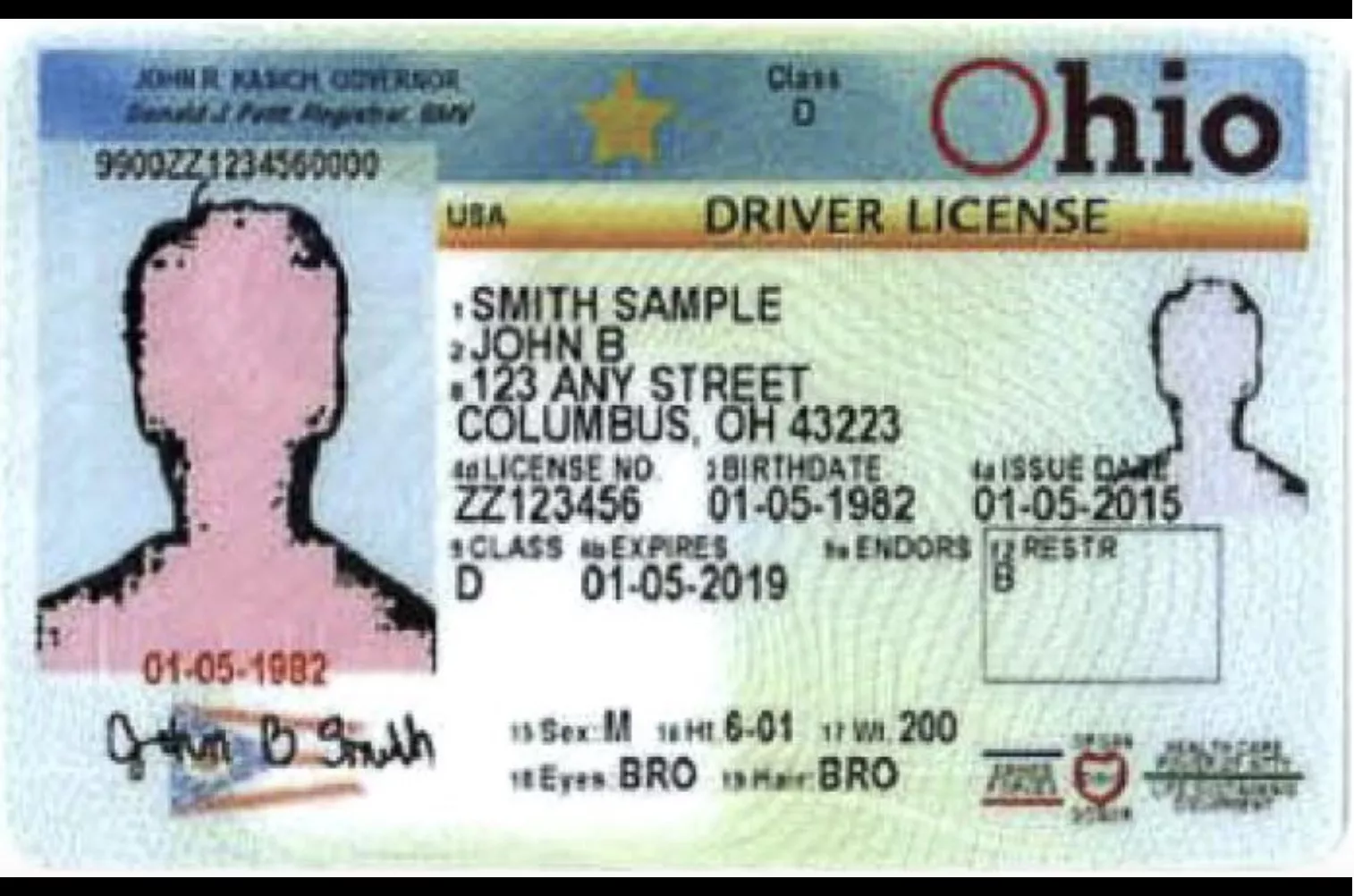

Driver's Ed Soon Required for Ohio Adults Who Don't Pass License Test

Ohio BMV might send you an email and it is not a scam

/cloudfront-us-east-1.images.arcpublishing.com/gray/S7IVMZUFNRCLZBWMVUT2GLKDAE.png)

Online renewal of driver's licenses, IDs coming to Ohio | WTTE

I-Team: Ohio keeps personal information for enhanced driver's license

/cloudfront-us-east-1.images.arcpublishing.com/gray/T7GONMIW2VOTLP545D32BZ7E7Y.png)