Does General Liability Cover Property Damage

Do General Liability Insurance Cover Property Damage?

What is General Liability Insurance?

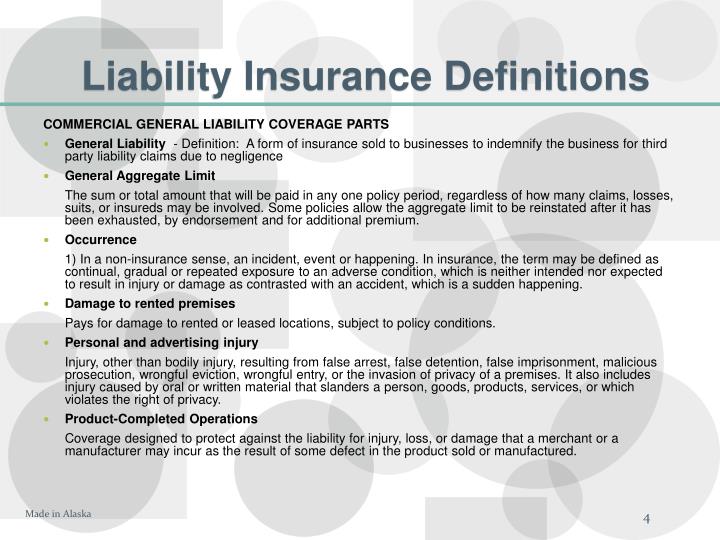

General liability insurance is a type of insurance policy that covers a business from claims of negligence resulting from injuries, property damage, and related lawsuits. It is one of the most important insurance policies that a business can have as it protects the company from losses and damages caused by third parties. With this policy, the business is protected from financial losses due to a variety of circumstances, such as personal injury, property damage, and advertising injury.

What Does General Liability Insurance Cover?

General liability insurance covers a range of potential damages, including medical expenses, attorney fees, and court costs. It also covers damages for property damage caused by the business, including any damage caused by the negligence of employees or contractors. Additionally, it covers advertising injury, which is a type of trademark or copyright infringement.

Does General Liability Insurance Cover Property Damage?

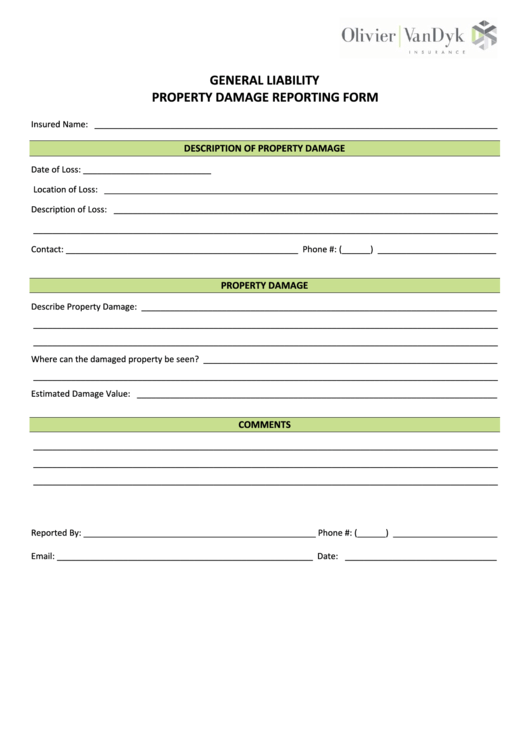

Yes, general liability insurance does cover property damage. The coverage typically includes any damage caused to third-party property as a result of the business’s negligence. This could include physical damage to another person’s property, as well as damage to intangible property like copyrights and trademarks. In some cases, the coverage may also include damage caused by the business’s contractors.

What Is Not Covered By General Liability Insurance?

General liability insurance does not cover damage caused by intentional acts, such as vandalism or theft. It also does not cover damage caused by natural disasters, such as floods, hurricanes, and earthquakes. Additionally, it does not cover damage caused by the business’s own products. To cover these types of damages, the business must have product liability insurance.

What Does General Liability Insurance Cost?

The cost of general liability insurance varies depending on the type and amount of coverage. Generally, the policy will cost more if it covers more potential damages. Additionally, the cost may be impacted by the size of the business and its industry. For businesses in industries with higher risks, such as construction or manufacturing, the cost of coverage may be higher.

Conclusion

General liability insurance is an important type of insurance for businesses as it covers a range of potential damages. It is important to understand what is covered and what is not covered so that the business can make sure it has the right coverage for its needs. General liability insurance does cover property damage, but it does not cover damage caused by natural disasters, intentional acts, or the business’s own products. The cost of the policy will vary depending on the type of coverage and the size and industry of the business.

8+ What Does Commercial General Liability (Cgl) Insurance Cover

Top Property Damage Release Form Templates free to download in PDF format

commercial general liability insurance definition – Kcaweb