Discount Car Insurance For Seniors

Discount Car Insurance For Seniors

Why Do Seniors Need Discount Car Insurance?

As we age, our driving skills and reflexes can begin to decline. The risk of being involved in an accident increases with age. As a result, many insurance companies will increase rates for seniors. This can make it difficult for them to afford the insurance they need to stay on the road. That’s why it’s important for seniors to look for discounts that can help them save money. Discount car insurance for seniors can provide much-needed relief from high insurance rates.

How Can Seniors Find Discount Car Insurance?

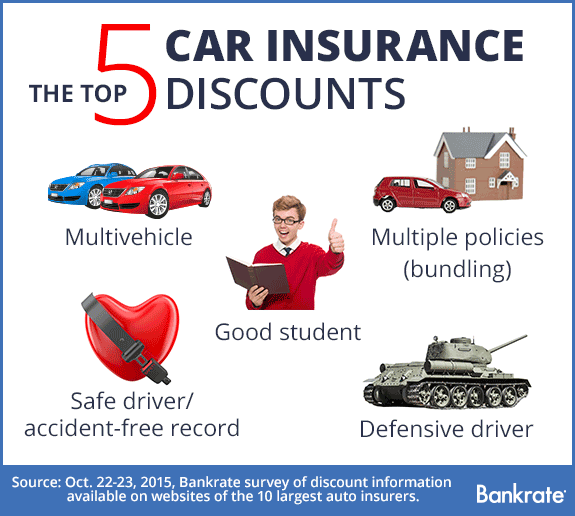

The first way for seniors to find discounts is to shop around. Different insurance companies offer different discounts. It pays to compare rates from multiple companies to see which one offers the best deal. It’s also important to ask about any additional discounts that may be available. For instance, some companies offer discounts for taking a defensive driving course or for belonging to certain organizations. Seniors should also ask about discounts for having a clean driving record or for being a long-time customer.

What Other Types of Discounts Are Available?

In addition to discounts for seniors, there are also discounts for other types of drivers. For instance, young drivers are often eligible for discounts if they maintain a good grade point average or if they complete a driver’s education class. Drivers who drive less than a certain number of miles per year may also be eligible for discounts. There are also discounts for those who install certain safety features in their vehicles, such as anti-lock brakes or airbags.

How Can Seniors Make Sure They Are Getting the Best Possible Deals?

The best way for seniors to make sure they are getting the best deal on car insurance is to shop around. Compare rates from multiple companies to see which one is offering the best deal. It’s also important to ask about any additional discounts that may be available. For instance, some companies offer discounts for taking a defensive driving course or for belonging to certain organizations. Seniors should also ask about discounts for having a clean driving record or for being a long-time customer.

Conclusion

Discount car insurance for seniors can be a great way to help seniors save money on insurance. Shopping around and asking about discounts can help seniors find the best deal. Additionally, there are discounts available for other types of drivers, such as young drivers and those who drive less than a certain number of miles per year. By taking the time to compare rates and ask about discounts, seniors can make sure they are getting the best possible deal on their car insurance.

Discount Car Insurance For Seniors / 19 Discounts Seniors Did Not Know

Buying Car Insurance For Seniors - Full Guide - YouTube

5 Golden Senior Car Insurance Discounts – Easy Seniors Life

Low Car Insurance For Seniors - Insurance Reference

Who Offers the Most Car Insurance Discounts? | Bankrate.com