Cheats To Make Insurence Cheaper For Teen

Wednesday, April 5, 2023

Edit

Cheats To Make Insurence Cheaper For Teen

Why Teenagers Need Insurance?

Insurence is a necessary expense for all age groups, but teenagers have special needs that require additional coverage. As a teen, you don't just need to insure yourself and your car, but you need to insure your parents too. It's important to understand the basics of insurance and how it can help you save money and protect you in the event of an accident.

Teenagers are a high risk group when it comes to insurance. They are inexperienced drivers and may not have the best driving record. Many teens also lack the financial resources to pay for high-end insurance plans. As a result, they may need to look for ways to make their insurance cheaper. Here are some tips to help them do just that.

Getting Good Grades

One of the easiest and most cost effective ways to lower your insurance premiums is to get good grades. Most insurance companies offer discounts for good students. This is because insurers believe that students with high grades are more likely to be responsible drivers. To qualify for the discount, you will need to maintain a certain grade point average (GPA). Contact your insurance company for specific details.

Take a Defensive Driving Course

Another way to lower your insurance premiums is to take a defensive driving course. These courses are designed to teach drivers how to be safe and responsible on the road. They cover topics such as safe driving techniques, traffic laws, and accident avoidance. Many insurance companies offer discounts for those who successfully complete a defensive driving course. Check with your insurance company to see if they offer this type of discount.

Raise Your Deductible

Raising your deductible is another way to lower your insurance premiums. A deductible is the amount you must pay before your insurance company will pay for a claim. By raising your deductible, you are taking on more of the risk and the insurance company will offer you a lower premium. Keep in mind that if you do have an accident, you will be responsible for paying the higher deductible.

Shop Around and Compare

The best way to get the cheapest insurance is to shop around and compare different insurance companies. Get quotes from several different companies and compare their coverage, deductibles, and premiums. This will help you find the best deal for your specific needs. Be sure to read the fine print and ask questions if you don't understand something.

Stay on Your Parent's Policy

If you are under 25 and living with your parents, you may be able to stay on their policy. This can save you a lot of money as insurers often offer discounts for young drivers who stay on their parents' policy. Just be sure to ask your parents if they can add you to their policy and what the cost would be.

Conclusion

Insurance premiums for teens can be high, but there are ways to reduce them. By following the tips outlined above, you can lower your insurance premiums and be better protected in the event of an accident. Don't forget to shop around and compare different insurance companies to get the best deal possible. Good luck!

4 Ways to Get Cheaper Insurance for Your Teen | Coaching New Drivers

Pin on How to Start Saving Money

Pin on products I love

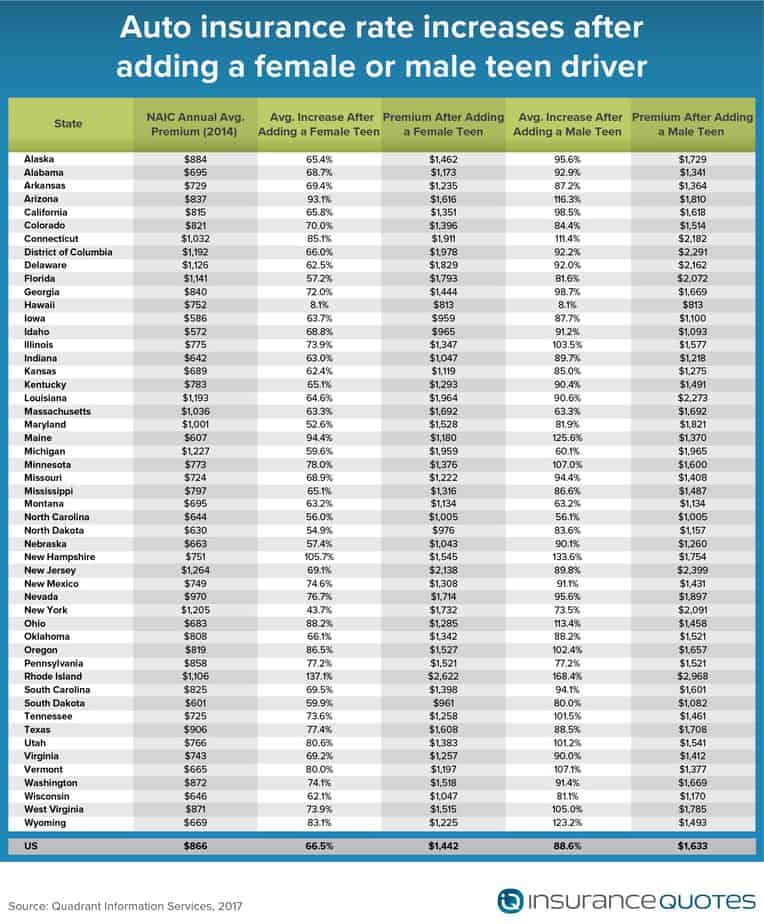

Teen Driver Insurance Gets Cheaper As Family Rates Rise | InsuranceQuotes

North Carolina Teen Drivers See Fewer Fatalities But Teen Driver