Cheap Liability Auto Insurance Texas

Tuesday, April 4, 2023

Edit

Cheap Liability Auto Insurance in Texas

Finding the Cheapest Liability Insurance in Texas

When it comes to finding the cheapest liability insurance in Texas, it is important to shop around and compare different companies and policies. It is important to look at the cost of coverage and the features of the policy to make sure you are getting the best deal. Many people choose to purchase their auto insurance online, as it is often cheaper than purchasing through a local agent or broker. There are also many companies that offer discounts for good drivers, so it is important to make sure you are taking advantage of any discounts available.

The Benefits of Liability Insurance in Texas

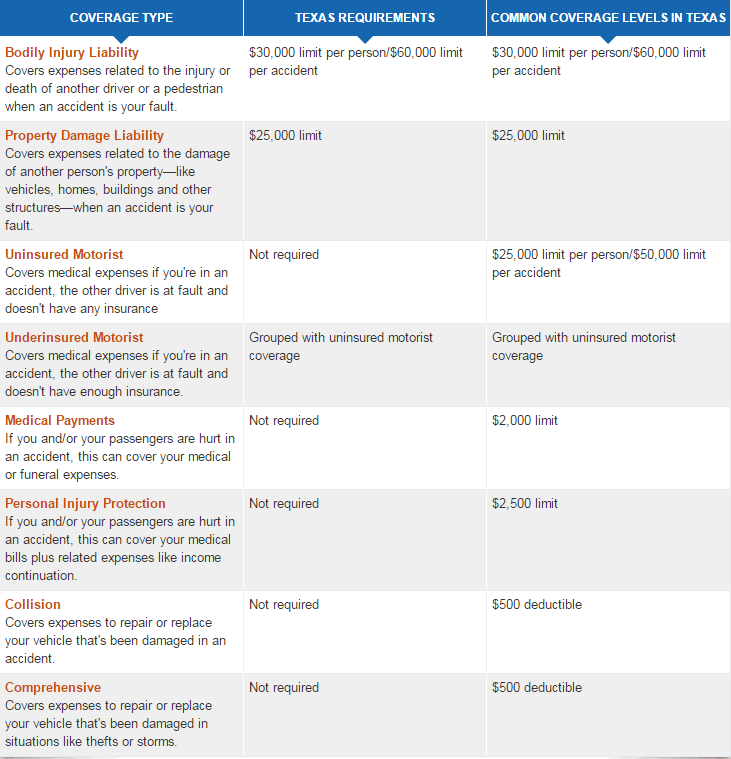

Liability insurance is an important type of coverage for any driver in Texas. It provides protection for the driver and their car in the event of an accident. This type of coverage is especially important for drivers in Texas, as the state has some of the highest rates of uninsured drivers in the country. Liability insurance will help to cover any costs that arise from an accident, such as medical expenses, property damage, and other damages.

Tips for Finding Cheap Liability Auto Insurance in Texas

There are several tips to keep in mind when looking for cheap liability auto insurance in Texas. First, it is important to compare different companies and policies before making a purchase. Many companies offer discounts for good drivers, so it is important to make sure you are taking advantage of any discounts available. In addition, it is important to check the coverage limits of each policy, as this can make a big difference in the cost of the policy.

Other Types of Auto Insurance in Texas

In addition to liability insurance, there are also other types of auto insurance that drivers in Texas may need. Comprehensive coverage is a type of insurance that helps to cover the cost of repairs if a vehicle is damaged due to an accident, theft, or other types of damage. Collision coverage is another type of coverage that pays for repairs to a vehicle if it is damaged in an accident. Finally, uninsured motorist coverage is a type of coverage that can help to cover medical expenses in the event that an accident occurs with an uninsured driver.

Discounts on Auto Insurance in Texas

There are also many discounts available for drivers in Texas when it comes to auto insurance. Many companies offer discounts for good drivers, as well as discounts for drivers who take a defensive driving course. In addition, some companies offer discounts for drivers who are members of certain organizations, such as the military or AARP. Finally, many companies offer discounts for drivers who have multiple vehicles insured with the same company.

Conclusion

Finding cheap liability auto insurance in Texas is possible, but it is important to shop around and compare different companies and policies. It is important to look at the cost of coverage and the features of the policy to make sure you are getting the best deal. Additionally, there are many discounts available for drivers in Texas, so it is important to take advantage of any discounts available. With the right research and comparison, drivers can find an affordable policy that provides the right amount of coverage.

PPT - Cheapest Liability Car Insurance Texas PowerPoint Presentation

PPT - Cheapest Liability Car Insurance Texas PowerPoint Presentation

texas car insurance

PPT - Texas Cheapest Car Insurance PowerPoint Presentation, free

Liability Insurance Texas – Haibae Insurance Class