Cheap Auto Insurance In Illinois

Friday, April 14, 2023

Edit

Cheap Auto Insurance In Illinois: Everything You Need To Know

Why Do You Need Auto Insurance?

When it comes to owning and operating a vehicle, it’s important to understand the need for auto insurance. Auto insurance helps to protect you, your vehicle, and other drivers on the road in the case of an accident. It can help pay for any damages or medical bills that may arise in the event of an accident, which is why it’s important to have the right coverage.

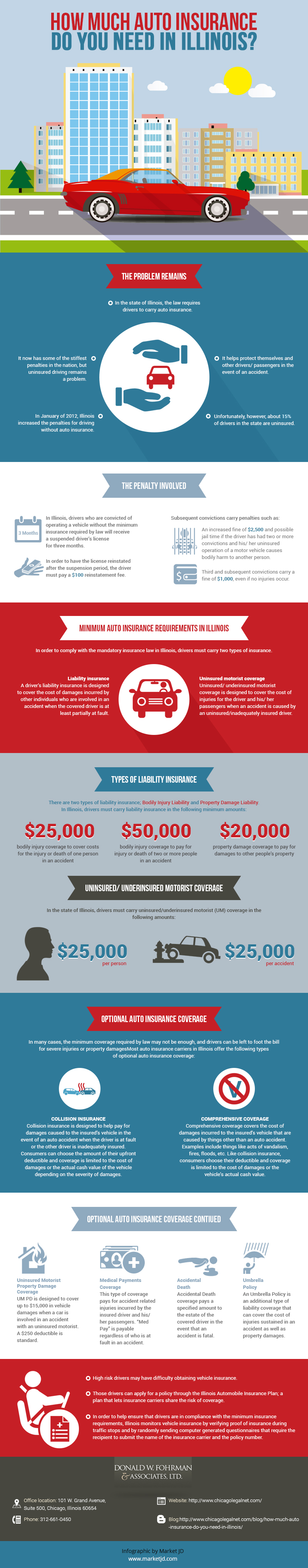

In Illinois, it’s mandatory for all drivers to have auto insurance. Without it, you are at risk of facing fines and other penalties. Furthermore, if you are found to be at-fault in an accident, you will be responsible for any damages you cause. This is why it’s important to make sure you have the right insurance coverage for your vehicle.

How To Find Cheap Auto Insurance In Illinois

If you’re looking for cheap auto insurance in Illinois, there are a few things you can do. First, shop around and compare rates from different providers. This will help you to get the best deal on your coverage. Additionally, you may be able to take advantage of discounts or incentives, such as a good driver discount, that can help to lower your premiums.

Another way to save money on auto insurance is to consider raising your deductible. This is the amount you will have to pay out of pocket in the event of an accident before your insurance kicks in. Raising your deductible can help to lower your premiums, but make sure you are comfortable with the amount you choose, as you will have to pay it before your insurance covers any costs.

What Type Of Coverage Do You Need?

When it comes to auto insurance, there are several different types of coverage you can choose from. The most basic coverage is liability insurance, which is required by law. This type of coverage helps to pay for any property damage or injuries you cause in an accident.

In addition to liability insurance, you may want to consider adding other types of coverage, such as collision or comprehensive coverage. These types of coverage will help to cover any damages to your vehicle if it is involved in an accident or if it is damaged by something other than an accident, such as a storm or theft.

What Is The Minimum Coverage Requirement In Illinois?

In Illinois, the minimum auto insurance coverage requirement is as follows:

- $25,000 for bodily injury or death of one person in an accident

- $50,000 for bodily injury or death of two or more people in an accident

- $20,000 for property damage in an accident

This coverage is often referred to as 25/50/20 coverage. It’s important to make sure that your auto insurance policy meets these minimum requirements in order to be in compliance with the law.

Where To Get Auto Insurance In Illinois?

When it comes to getting auto insurance in Illinois, there are a variety of providers to choose from. Most major insurance companies offer auto insurance policies in the state. Additionally, there are a number of independent agents and brokers who can help you to find the right coverage for your needs.

It’s important to shop around and compare rates from different providers in order to get the best deal on your auto insurance. Additionally, make sure you understand what type of coverage you need and what the minimum requirements are in order to be in compliance with state laws.

Conclusion

Auto insurance is an important part of owning and operating a vehicle in Illinois. It’s important to make sure you have the right coverage for your needs, as well as the minimum coverage required by law. Shopping around and comparing rates from different providers can help you to find the best deal on your auto insurance.

Who Has the Cheapest Car Insurance Quotes in Chicago, IL? - ValuePenguin

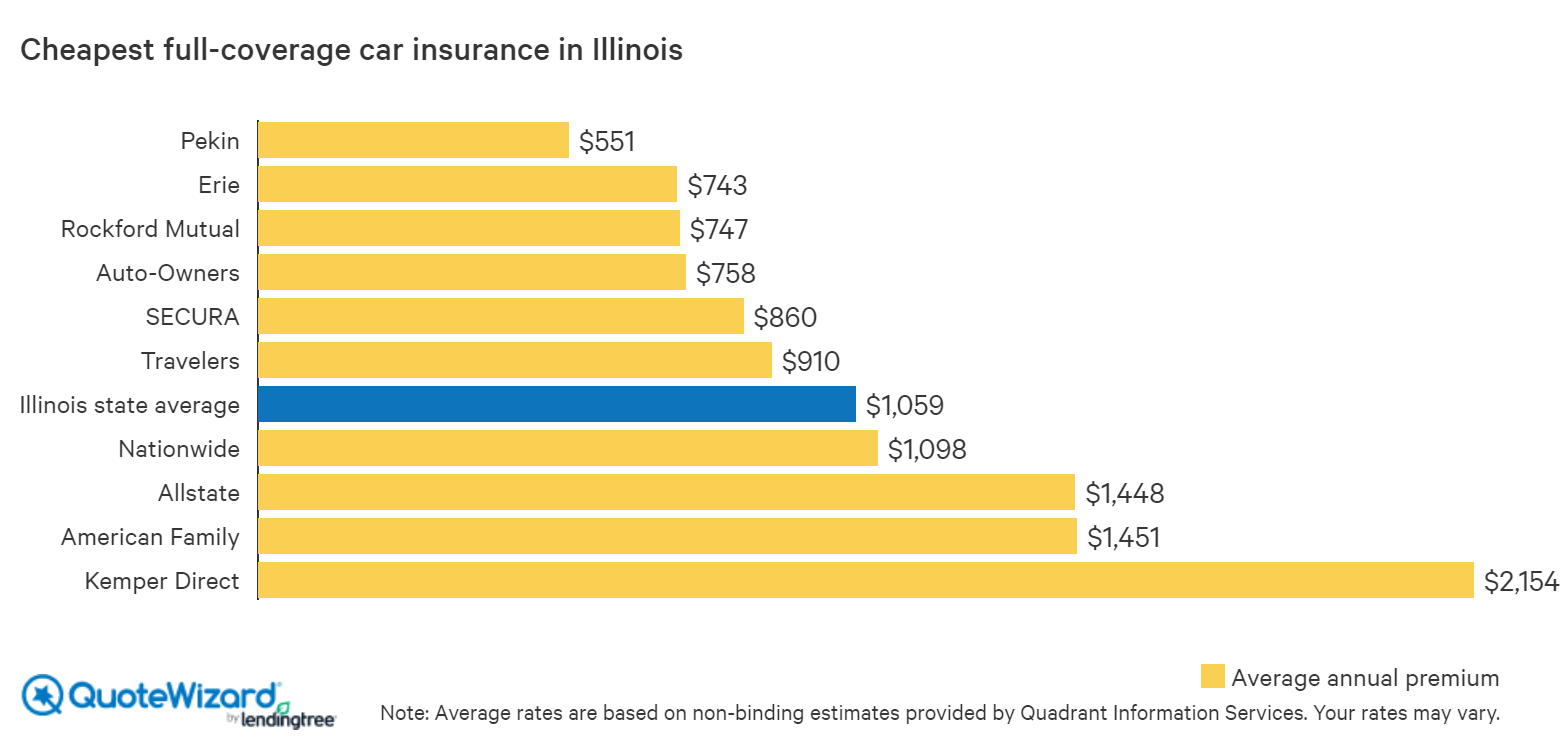

Cheap Auto Insurance Companies In Illinois With Full Coverage

Find Cheap Car Insurance in Illinois | QuoteWizard

Auto Insurance Illinois | Personal Injury Lawyers

Cheap Car Insurance In West Palm Beach Fl | Auto Insurance BLOG