Car Insurance For Over 50 Year Olds

Car Insurance for Over 50 Year Olds

What Does Car Insurance for Over 50 Year Olds Entail?

Car insurance for over 50 year olds is an important consideration for those who are approaching retirement age and may be looking to save money on their car insurance. It is important to know that, as you age, you may be eligible for discounts on your car insurance premiums. This is because many insurance companies recognize that older drivers are generally more cautious on the road and are less likely to be involved in a serious accident.

In addition, many insurance companies offer special discounts for drivers over the age of 50. These discounts can vary from company to company, so it is important to shop around to find the best deal. Some of the discounts available to older drivers include lower premiums for those who are retired or semi-retired, discounts for those who have a clean driving record, and discounts for those who are members of certain organizations.

The Benefits of Car Insurance for Over 50 Year Olds

Car insurance for over 50 year olds can offer many advantages. Firstly, these drivers are generally more experienced in driving than those who are younger. This means that they are less likely to be involved in an accident and will be able to maintain a safe driving record.

In addition, older drivers tend to drive less frequently and at slower speeds. This means that they are less likely to get into a serious accident and will be less expensive to insure. This is one of the main reasons why car insurance for over 50 year olds can often be cheaper than those for younger drivers.

How to Save Money on Car Insurance for Over 50 Year Olds

There are several ways to save money on car insurance for over 50 year olds. One of the most effective ways is to shop around. By comparing quotes from different insurance companies, you can find the best deal for your situation. It is also important to make sure that you are getting the best coverage for the amount of money that you are paying.

In addition, it is important to consider the type of coverage that you need. For example, some policies may offer higher coverage limits for older drivers, while others may offer lower premiums for those who are retired or semi-retired. It is also important to consider any special discounts or incentives that may be available to you.

Tips for Choosing Car Insurance for Over 50 Year Olds

When choosing car insurance for over 50 year olds, it is important to consider several factors. Firstly, it is important to make sure that the coverage limits are adequate for your needs. It is also important to make sure that you are getting the best rate for the coverage you require.

In addition, it is important to look at the different discounts and incentives that are available. Many insurance companies offer discounts for drivers who have a clean driving record, are members of certain organizations, or are retired or semi-retired. Finally, it is important to make sure that you are getting the best coverage for the amount of money that you are paying.

Conclusion

Car insurance for over 50 year olds is an important consideration for those approaching retirement age. As you age, you may be eligible for discounts on your car insurance premiums, and there are many ways to save money on car insurance for over 50 year olds. It is important to shop around to find the best deal and to make sure that you are getting the best coverage for the amount of money that you are paying.

Car Insurance Costs for 50-Year-Olds (and Those Over 50) - ValuePenguin

Cheap Car Insurance Over 50S Uk - Car Insurance Get A Quote From 195

Guaranteed Life Insurance Over 50

Car Insurance for Over 50s | The Best Providers | Compare UK Quotes

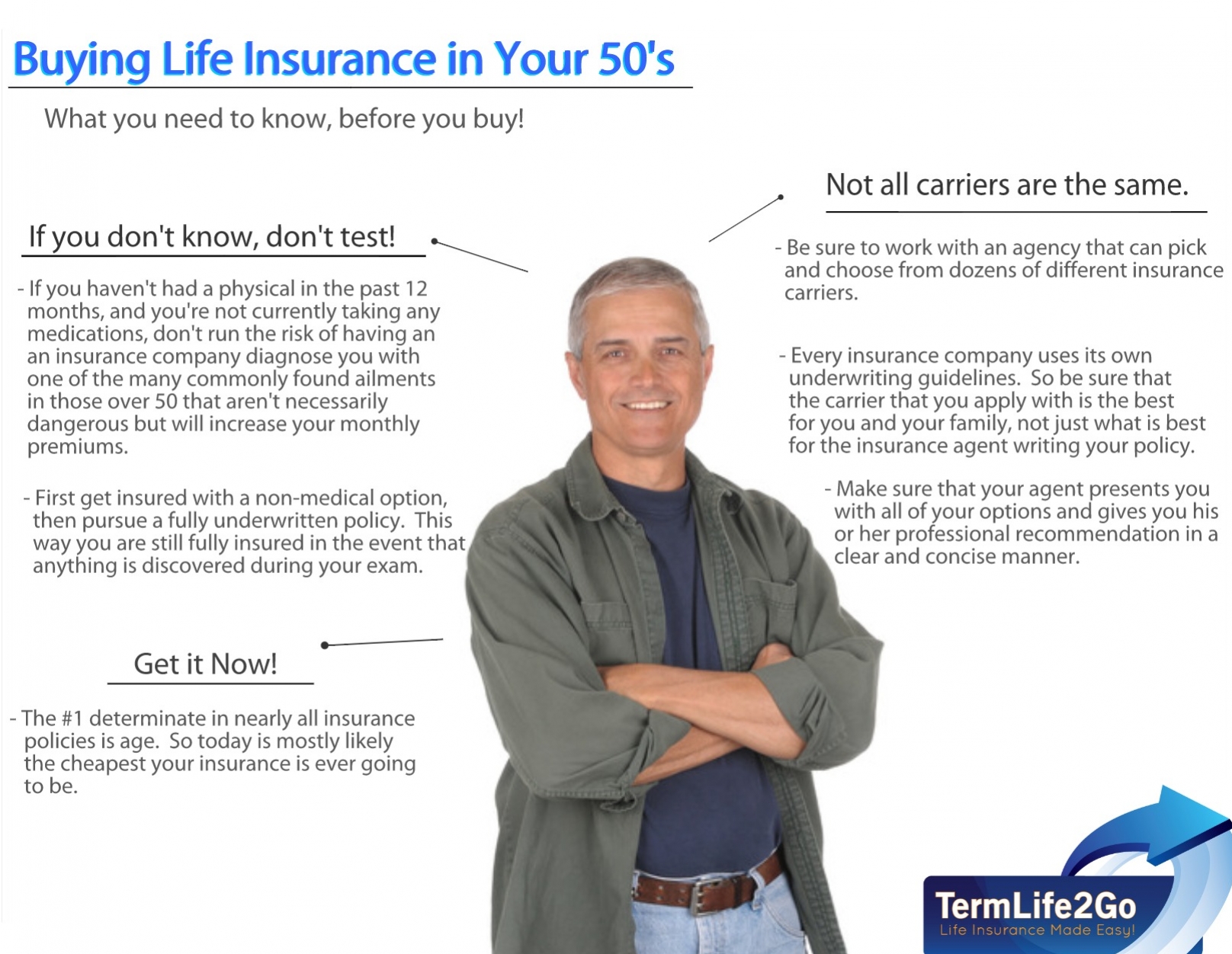

4 things to Know Before Buying Life Insurance at Age 50