Can I Get Gap Insurance On A Used Car

Gap Insurance On A Used Car - What You Need To Know

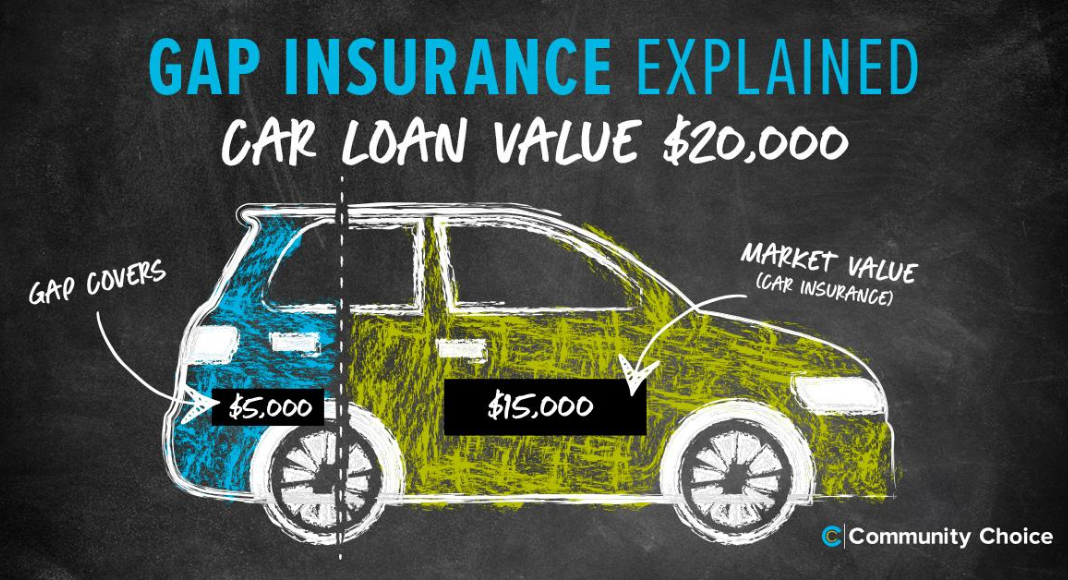

Gap insurance, also known as guaranteed asset protection, is a type of insurance that covers the difference between the actual cash value of a vehicle and the amount that the owner owes on the loan. It is a particularly useful policy for those who buy used cars, as the loan amount is often higher than the actual cash value of the vehicle.

What Is Gap Insurance?

Gap insurance is designed to protect the owner from having to pay out of pocket for any difference between the actual cash value of the vehicle and what is owed on the loan. In the event that the vehicle is stolen or totaled, the insurance will cover the difference. This can be especially helpful if the owner has a loan for a used car that is worth less than what is owed on the loan. Without gap insurance, the owner would be responsible for paying the difference out of pocket.

What Is Covered Under Gap Insurance?

Gap insurance covers the difference between the actual cash value of a vehicle and the loan amount. This includes any taxes and fees that may be associated with the purchase of the vehicle. It also covers the cost of any repairs or replacements that may be needed due to an accident or other incident. Gap insurance does not cover any damage that occurs as a result of normal wear and tear or lack of maintenance.

Do I Need Gap Insurance On A Used Car?

Gap insurance can be a good idea for those who purchase used cars. It is important to remember that used cars can quickly lose value, so the loan amount can often be higher than the actual cash value of the car. Gap insurance can help protect the owner from having to pay out of pocket for any difference between the loan amount and the actual cash value of the vehicle.

How Much Does Gap Insurance Cost?

The cost of gap insurance will vary depending on the type of coverage and the age and condition of the vehicle. Generally, gap insurance will cost between 5% and 10% of the loan amount. It is important to shop around and compare rates to ensure that you get the best deal. Additionally, some lenders may offer gap insurance as part of the loan, so it is important to check with the lender to see if this is an option.

Where Can I Get Gap Insurance?

Gap insurance can usually be purchased from the dealership where the vehicle was purchased, or from a third-party insurer. It is important to compare rates to ensure that you get the best deal. Additionally, some lenders may offer gap insurance as part of the loan, so it is important to check with the lender to see if this is an option.

In conclusion

Gap insurance can be a great way to protect yourself financially in the event that your vehicle is stolen or totaled. It is important to remember that gap insurance will only cover the difference between the actual cash value of the vehicle and the loan amount. The cost of gap insurance will vary depending on the type of coverage and the age and condition of the vehicle. Gap insurance can usually be purchased from the dealership where the vehicle was purchased, or from a third-party insurer. It is important to compare rates to ensure that you get the best deal.

Understanding Auto Insurance "Gap Coverage"

Gap Insurance For Cars Is It Worth It - Is Car GAP Insurance Worth It

What to Consider When You Buy a Car from Community Choice

Is GAP Insurance Worth It? | Exotic Car Hacks

Car Insurance With Gap Coverage | Auto Insurance Near Me