Buy Gap Insurance For My Car

Gap Insurance for Your Car: What You Need To Know

What is Gap Insurance?

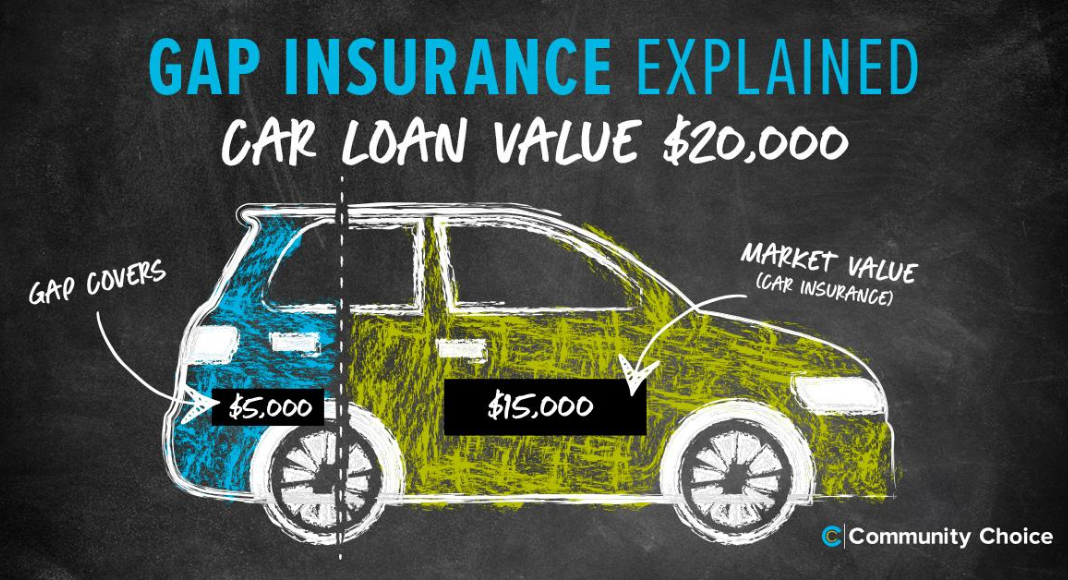

Gap insurance is an optional form of car insurance that covers the difference between what you owe on your car and what it’s worth in the event of a total loss. It’s a great way to protect yourself financially in the event of an accident or other damage to your vehicle. If you’re concerned that you may be at risk of a total loss, gap insurance can help you avoid a major financial loss.

Gap insurance is also sometimes referred to as “loan/lease gap coverage” because it is most often used to cover the difference between the actual cash value of a vehicle and the balance of a loan or lease that the consumer is still paying on it. It is important to note that gap insurance is an optional coverage that is not required by law.

Do I Need Gap Insurance?

Whether or not you need gap insurance depends on your individual circumstances. If you’ve recently bought a new car, you may want to consider gap insurance if you still owe money on it. Gap insurance can help protect you in the event of a total loss, so if you’re at risk of a total loss, it may be worth considering.

In addition, if you’ve recently leased a car, gap insurance may be a good idea. Leased vehicles are typically less valuable than their purchase price, so gap insurance can help cover the difference in the event of a total loss. It’s important to note that gap insurance is not always required when leasing a vehicle, but it can be a good idea to consider it if you’re at risk of a total loss.

How Much Does Gap Insurance Cost?

The cost of gap insurance can vary depending on your individual circumstances. Generally speaking, gap insurance costs a few hundred dollars per year. However, the cost can vary depending on the coverage you choose and the amount of coverage you need. Gap insurance is typically sold as a one-time payment, but you may be able to find a policy that allows you to pay monthly if you prefer.

It’s important to shop around and compare policies to find the best rate for the coverage you need. Your insurance company may be able to offer you a discounted rate if you bundle gap insurance with your other car insurance policies.

How Does Gap Insurance Work?

Gap insurance can help protect you in the event of a total loss. If your vehicle is deemed a total loss due to an accident or other damage, gap insurance will cover the difference between the actual cash value of the vehicle and the amount you still owe on it. This can help protect you from a major financial loss in the event of a total loss.

Gap insurance is typically sold as a one-time payment, but you may be able to find a policy that allows you to pay monthly if you prefer. It’s important to read the fine print of any policy you’re considering to make sure you understand the coverage and how it works.

Conclusion

Gap insurance can be a great way to protect yourself financially in the event of an accident or other damage to your vehicle. It’s an optional form of car insurance that covers the difference between what you owe on your car and what it’s worth in the event of a total loss. It’s important to shop around and compare policies to find the best rate for the coverage you need.

What Is Gap Auto Insurance? Is It Worth It? and Should You Finance It

Gap Insurance For Cars Is It Worth It - Is Car GAP Insurance Worth It

What is GAP Insurance and do I need it when buying a car? | Auto Trader UK

Is GAP Insurance Worth It? | Exotic Car Hacks

What to Consider When You Buy a Car from Community Choice