When To Use Ctpl Insurance Philippines

When To Use CTPL Insurance Philippines

What is CTPL Insurance?

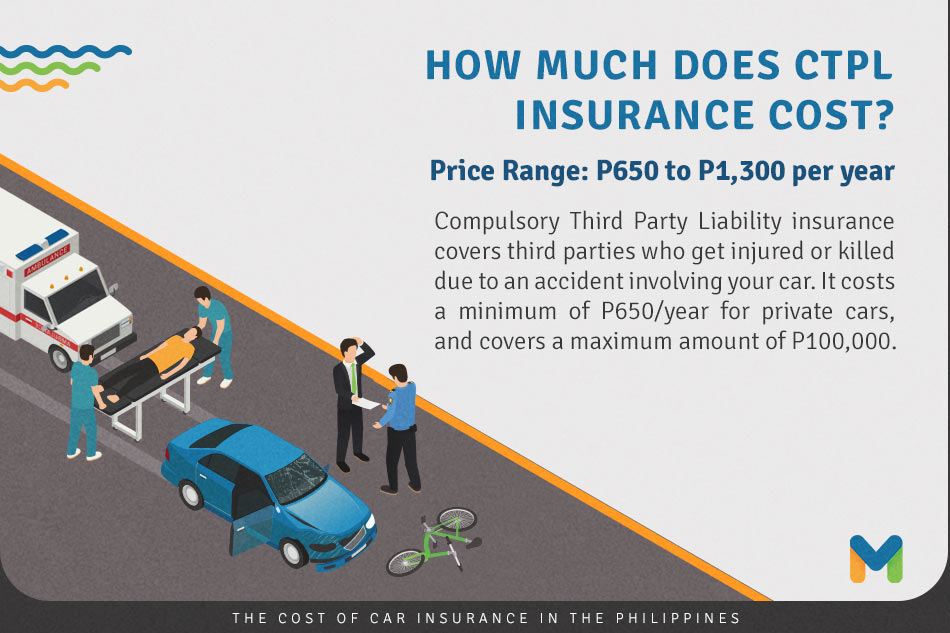

CTPL or Compulsory Third Party Liability Insurance is a type of vehicle insurance in the Philippines that is mandated by the government. It is a form of liability insurance, which provides coverage for any third party bodily injury or property damage caused by a vehicle, regardless of fault. The coverage for CTPL insurance is limited to a maximum of ₱100,000 for property damage, and a maximum of ₱100,000 for bodily injury and death claims. This type of insurance does not cover damage to the vehicle itself, nor does it cover damage caused by a driver to their own vehicle.

When Do You Need CTPL Insurance?

CTPL insurance is required for all vehicles registered in the Philippines. This includes cars, motorcycles, and even boats. The insurance must be purchased from a licensed insurance company and the policy must be renewed annually. Failure to do so can result in the suspension of the vehicle's registration. CTPL insurance is also mandatory for all drivers, regardless of whether they own the vehicle or not.

Why Is CTPL Insurance Important?

CTPL insurance is important because it provides financial protection in the event of an accident. In the event of an accident, the insurance company will pay for any damages that you or your vehicle may have caused to another person or property. Without CTPL insurance, you would be responsible for any damages that you have caused, which could result in hefty fines or even jail time. That is why it is important to make sure that you always have the right amount of CTPL insurance coverage.

What Are The Benefits Of CTPL Insurance?

CTPL insurance provides financial protection in the event of an accident. It also provides peace of mind knowing that if you do get into an accident, you will be financially protected. CTPL insurance also helps to reduce the number of uninsured drivers on the road, which helps to reduce the number of accidents and fatalities.

Where Can I Get CTPL Insurance?

CTPL insurance can be purchased from any licensed insurance company in the Philippines. There are many different companies that offer CTPL insurance, so it is important to compare the different policies and prices to find the best coverage for you. Most insurance companies also offer payment plans so that you can pay for the insurance in installments.

Conclusion

CTPL insurance is an important form of insurance that is required by law in the Philippines. It provides financial protection in the event of an accident and helps to reduce the number of uninsured drivers on the road. CTPL insurance can be purchased from any licensed insurance company in the Philippines, and it is important to compare policies and prices to find the best coverage for you.

Getting CTPLs Fast and Easy from Cebuana Lhuillier | Ketchup the Latest

6 FAQs about Compulsory third-party liability (CTPL) insurance in the

July 9, 2018 – Rosevida's Ticketing, Bills Payment and Remittance Center

ARTA wants CTPL for LTO registration removed for insured vehicles

The cost of car insurance in the Philippines | ABS-CBN News