State Farm Long Term Care Policy

State Farm Long Term Care Policy: What You Need to Know

What is Long Term Care Insurance?

Long term care insurance is a type of insurance policy that covers the cost of long-term care services for those who are unable to care for themselves due to a chronic or disabling condition. This type of insurance is designed to cover a wide range of care services, such as nursing home care, home health care, assisted living, and adult day care. Long term care insurance can be a great way to protect your finances and ensure that you are able to receive the care you need in the event of a disabling condition.

What Does State Farm Offer?

State Farm offers a long term care insurance policy that can cover a wide range of care services, including home health care, assisted living, adult day care, and nursing home care. The policy can also cover some of the cost of in-home care services such as respite care and chore services. The policy also covers the cost of medical equipment such as wheelchairs, walkers, and hospital beds. In addition, the policy can cover the cost of transportation to and from medical appointments, as well as the cost of medications.

What Are the Benefits of State Farm's Long Term Care Policy?

State Farm's long term care policy offers several benefits to policyholders. For example, the policy offers protection from the high cost of long-term care services, as well as peace of mind knowing that you'll be able to receive the care you need in the event of a disabling condition. The policy also offers flexibility, allowing you to customize the coverage to fit your needs. Finally, the policy is affordable, making it an attractive option for those who are looking for a way to protect their finances.

What Are the Eligibility Requirements?

In order to be eligible for State Farm's long term care policy, you must be at least 18 years old and a resident of the United States. You must also be able to demonstrate that you are able to pay the premium in full. In addition, you must be able to provide proof of your current health status.

How Do I Get Started?

If you're interested in learning more about State Farm's long term care policy, you can contact your local State Farm agent or visit the State Farm website. Your agent will be able to answer any questions you may have and help you find the right policy for your needs. In addition, you can use the State Farm website to get a free quote and compare different policy options.

Conclusion

State Farm's long term care policy can be a great way to protect yourself and your family from the high cost of long-term care services. The policy offers flexibility, affordability, and peace of mind knowing that you'll be able to receive the care you need in the event of a disabling condition. If you're interested in learning more about State Farm's long term care policy, contact your local State Farm agent or visit the State Farm website. With a little research and the help of your State Farm agent, you can find the right policy to fit your needs.

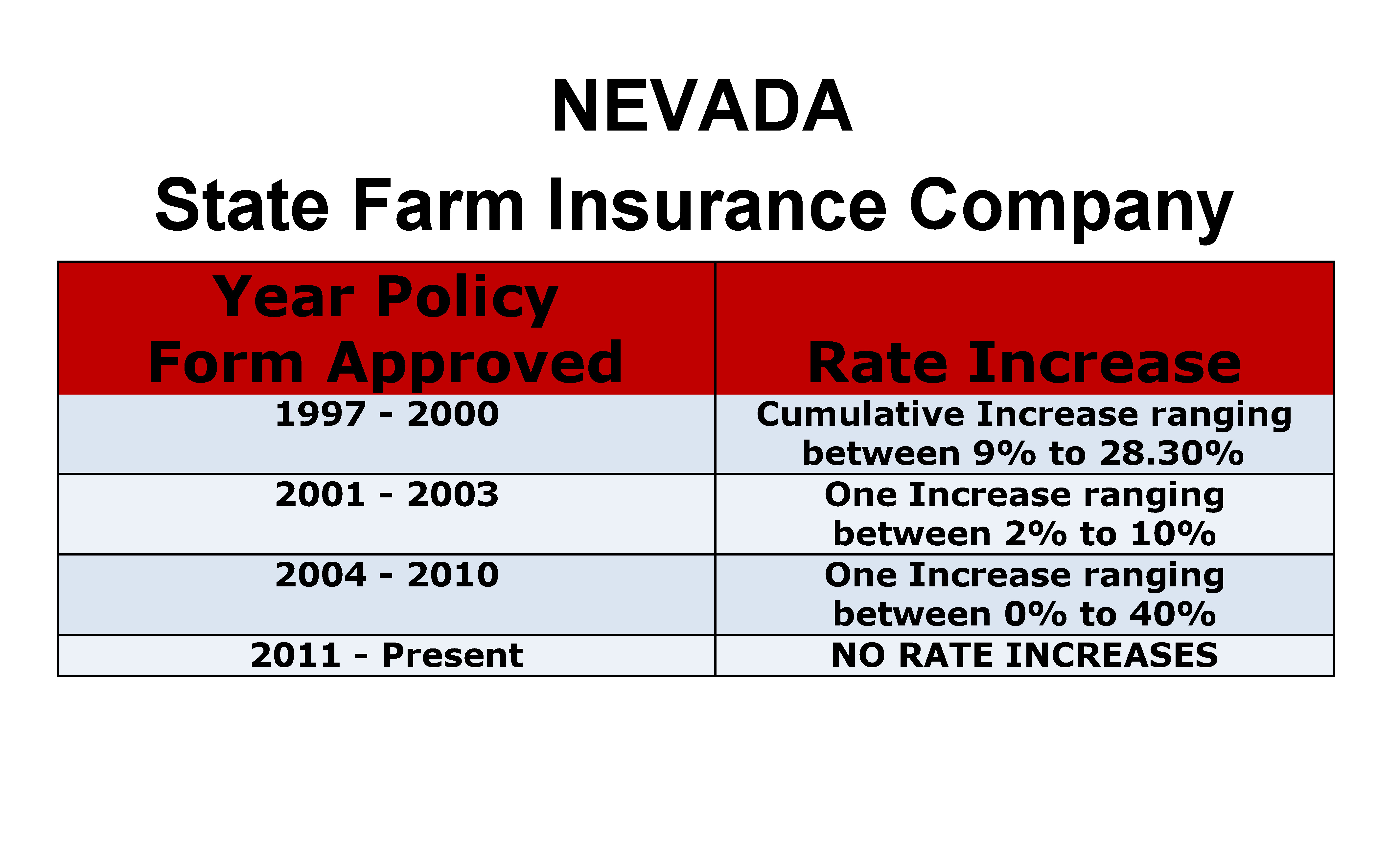

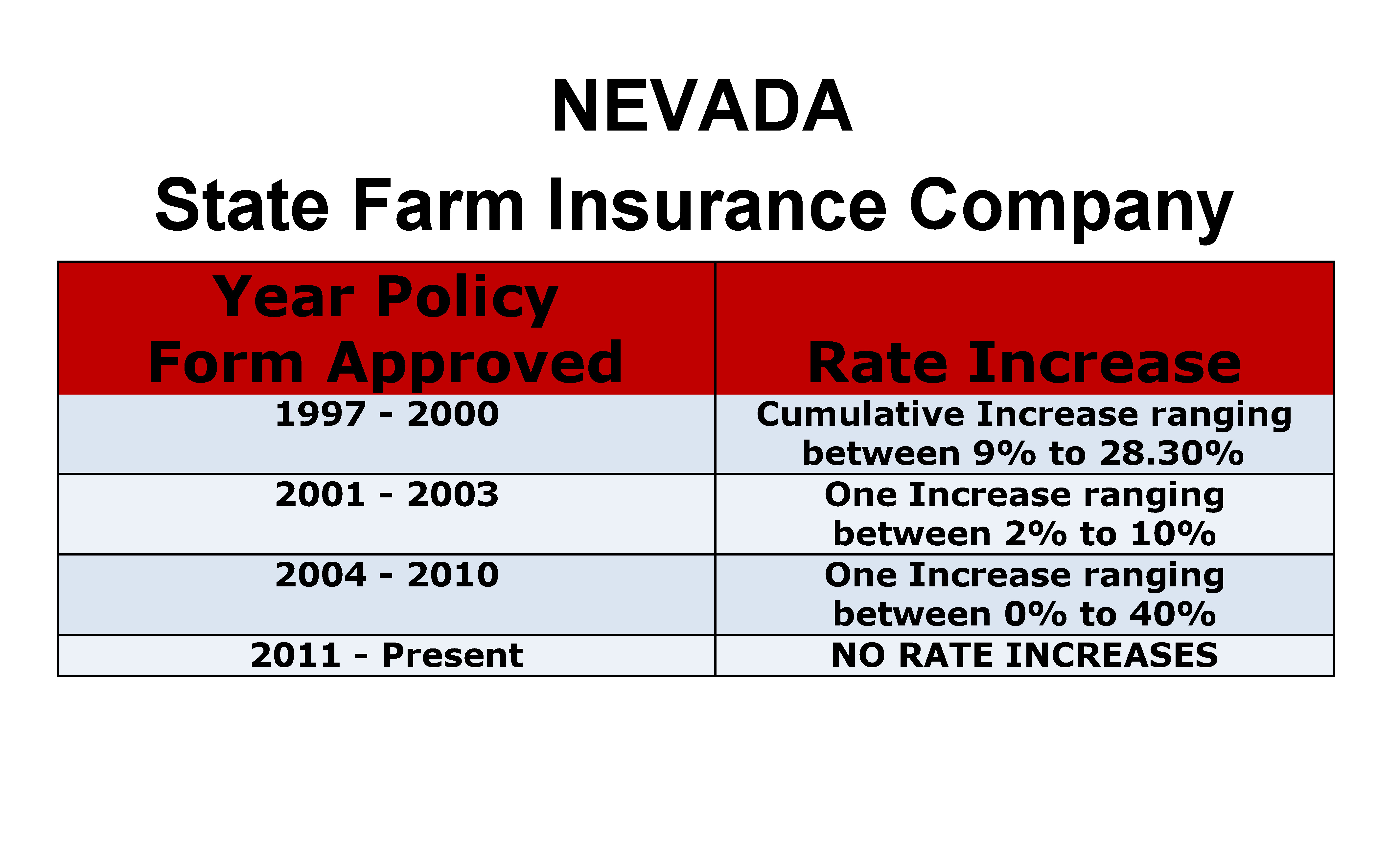

State Farm Long Term Care Insurance Rate Increases Nevada - LTCFacts.org

Long-Term Care Insurance – State Farm® | Long term care insurance

We are State Farm. #statefarm #tomluscombe #likeagoodneighbor | State

State Farm Insurance offers coverage for auto, life, home, health, and

State Farm Declaration Page - Farm Tractors