Non Owner Car Insurance Policy

What Is Non Owner Car Insurance Policy?

A non owner car insurance policy is a type of insurance coverage for individuals who do not own a vehicle, but may need to rent or borrow one occasionally. This type of insurance policy is designed to provide financial protection against property damage and bodily injury that may occur while operating a motor vehicle. It can also provide coverage for medical expenses and other costs incurred as a result of an accident. The coverage provided by a non owner car insurance policy can vary, depending on the insurance provider and the specific policy purchased.

Who Needs Non Owner Car Insurance Policy?

People who do not own a vehicle but may need to rent or borrow one occasionally can benefit from a non owner car insurance policy. This type of policy is designed for those who do not own vehicles, but may occasionally need to rent or borrow one. This can include people who use ride-sharing services such as Uber or Lyft, or those who frequently borrow cars from family or friends. Non owner car insurance policies can also be useful for those who drive their employer’s vehicles for business purposes.

What Does Non Owner Car Insurance Policy Cover?

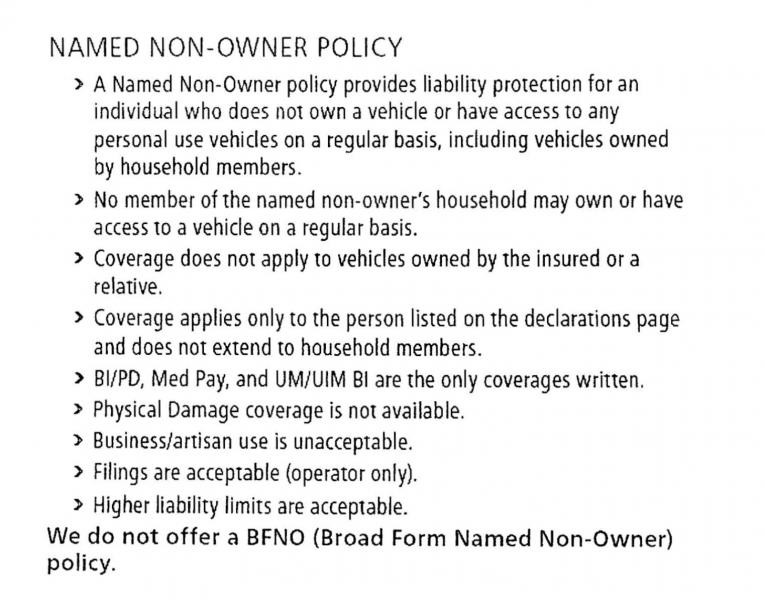

The coverage provided by a non owner car insurance policy will vary depending on the insurance provider. Generally, these policies will provide financial protection against property damage and bodily injury that may occur while operating a motor vehicle. Additionally, non owner car insurance policies may provide coverage for medical expenses and other costs incurred as a result of an accident. Some policies may also provide coverage for uninsured or underinsured motorist protection, which can help cover the costs of medical expenses and other costs resulting from an accident caused by a driver who does not have sufficient insurance coverage.

How Much Does Non Owner Car Insurance Cost?

The cost of a non owner car insurance policy will vary depending on the insurance provider and the coverage limits selected. Some factors that can affect the cost of a non owner car insurance policy include the driver’s age and driving history, the type of vehicle that is being insured, and the coverage limits selected. Generally speaking, non owner car insurance policies tend to be more affordable than traditional car insurance policies due to the fact that they do not provide coverage for a vehicle that the driver owns.

Where Can I Buy Non Owner Car Insurance Policy?

Non owner car insurance policies can be purchased from most major auto insurance providers. Many insurance companies offer online applications for non owner car insurance policies, making it easy and convenient to purchase coverage. Additionally, many insurance providers offer discounts or other incentives when purchasing non owner car insurance policies. It is important to compare quotes from different insurers to ensure that you are getting the best rate possible.

Conclusion

Non owner car insurance policies are a great option for people who do not own a vehicle, but may need to rent or borrow one occasionally. These policies can provide financial protection against property damage and bodily injury that may occur while operating a motor vehicle, as well as coverage for medical expenses and other costs incurred as a result of an accident. Non owner car insurance policies are typically more affordable than traditional car insurance policies and can be purchased from most major auto insurance providers. It is important to compare quotes from different insurers and select the coverage limits that best meet your needs.

Non Owner Auto Insurance | Compare quotes wih Good to Go

Non Owners Car Insurance Policy

Non-Owner Car Insurance Explained

Non-Owner Car Insurance: Best Coverage Available | Car insurance

Non-Owner Car Insurance - United Policyholders