Low Cost Car Insurance Illinois

Low Cost Car Insurance Illinois

Find the Best Rates for Illinois Car Insurance

Illinois residents are always on the lookout for low cost car insurance. With the cost of living on the rise, it’s more important than ever to find the best rates for car insurance in the state. Fortunately, there are a few ways you can go about finding the most affordable car insurance in Illinois. Here are some tips to help you get the most bang for your buck.

Shop Around

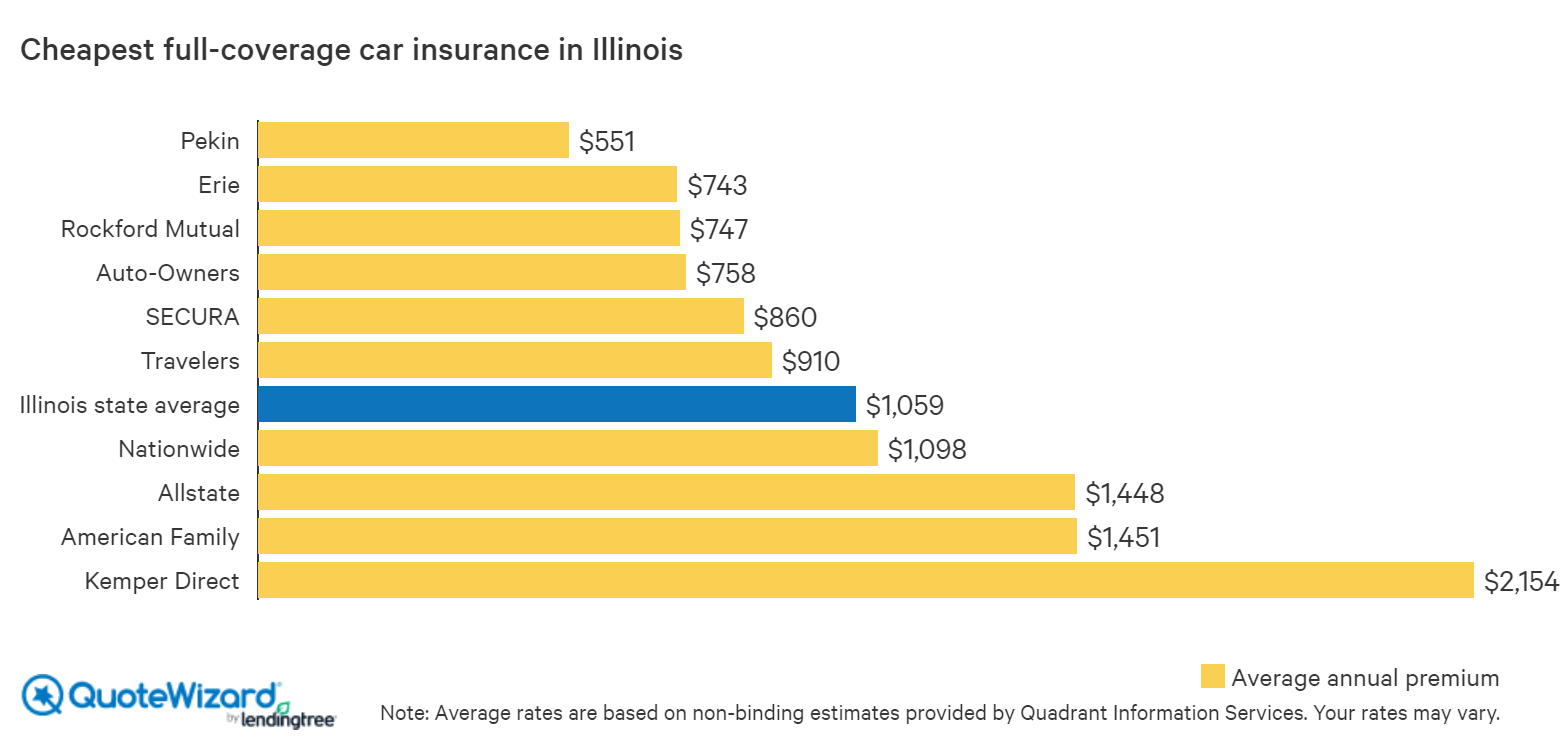

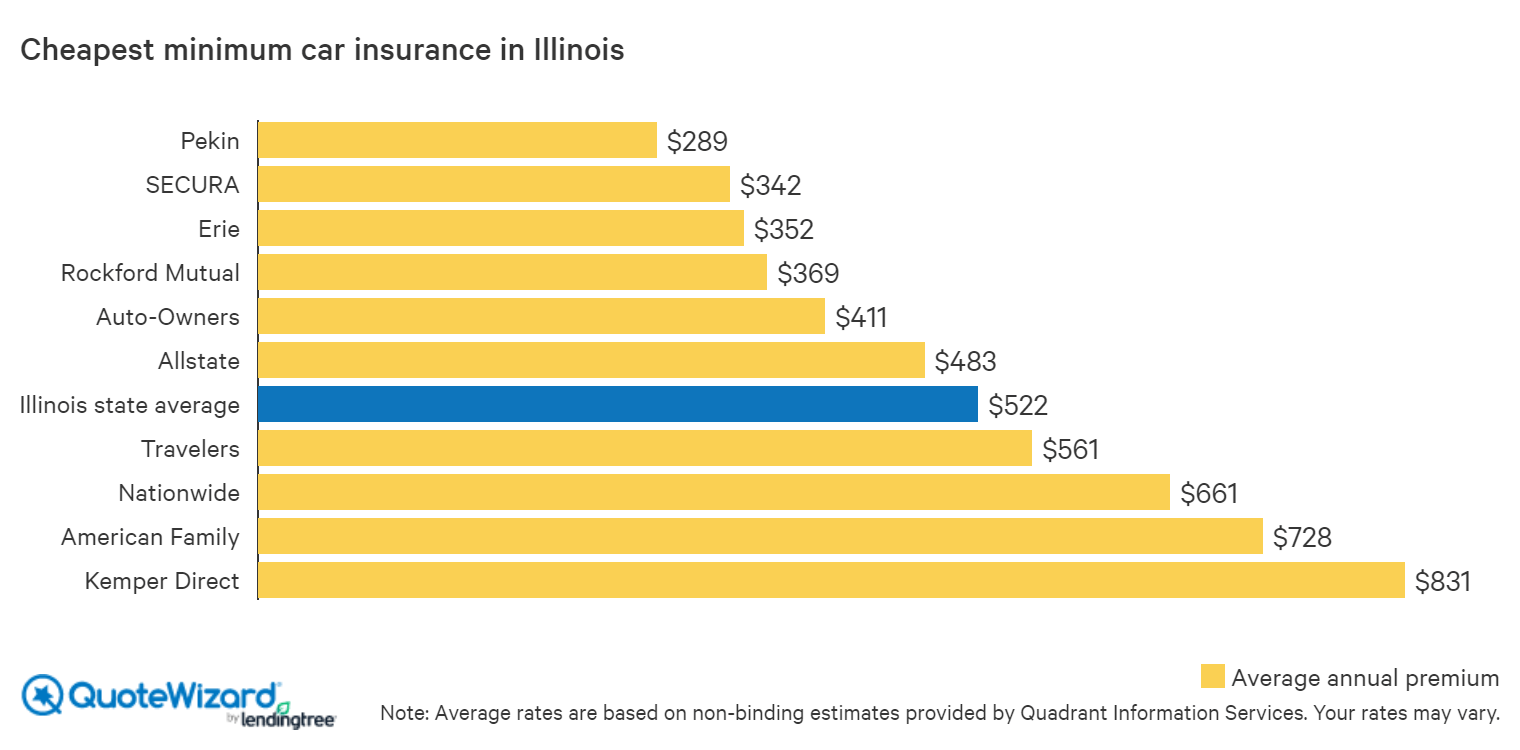

The first step in finding the lowest possible prices for Illinois car insurance is to shop around. There are a lot of different insurance companies out there, and each one has different rates for their policies. It’s important to compare different companies and policies to make sure you’re getting the best deal. There are a few different ways to do this. You can call different companies to get quotes, or you can use an online comparison tool to quickly compare rates from multiple providers. This can save you time and money.

Consider Bundling

Another way to save money on car insurance in Illinois is to consider bundling. Bundling is when you combine more than one type of insurance, such as car and home insurance, into one policy. Doing this can often save you money, because many insurance companies offer discounts for bundling policies. It’s important to make sure you’re getting the best deal on each policy before you bundle, as bundling can sometimes lead to a higher overall rate.

Raise Your Deductible

Raising your deductible is another way to save money on car insurance in Illinois. A deductible is the amount of money you have to pay out of pocket before your insurance kicks in. The higher your deductible, the lower your monthly premiums will be. However, it’s important to make sure you can afford to pay the deductible if you do have an accident. If you can, raising your deductible can be a great way to save on your car insurance premiums.

Take Advantage of Discounts

Finally, make sure you’re taking advantage of all the discounts available to you. Many insurance companies offer discounts for things like having a clean driving record, taking defensive driving classes, or having a car that is equipped with safety features. Make sure you’re aware of all the discounts available to you and take full advantage of them to get the lowest possible rates for your car insurance in Illinois.

Finding low cost car insurance in Illinois doesn’t have to be a hassle

Finding low cost car insurance in Illinois doesn’t have to be a hassle. By shopping around, considering bundling, raising your deductible, and taking advantage of any discounts you may qualify for, you can find the best rates for car insurance in the state. With a little bit of research, you can save yourself a lot of money and get the coverage you need to stay safe on the road.

How Much is Car Insurance in Pennsylvania? (Rates + Top 100 Cheapest)

Find Cheap Car Insurance in Illinois | QuoteWizard

Who Has the Cheapest Car Insurance Quotes in Chicago, IL? - ValuePenguin

Find Cheap Car Insurance in Illinois | QuoteWizard

How Much Does SR22 Cost in Illinois