Intact Insurance Car Write Off

What is Intact Insurance Car Write Off?

Intact Insurance Car Write Off is a process when an insurance company decides a vehicle is too damaged, or too expensive to repair. The vehicle is considered “totaled” and the insurance company will pay the owner the the cash value of the vehicle. After this, the vehicle is written off, meaning it can no longer be driven and must be sold off as scrap or parts.

When a vehicle is written off, it is often difficult for the owner to accept. After all, the vehicle was often not just a vehicle, but an extension of the owner’s personality, a symbol of their freedom and independence. But, when an insurance company declares a vehicle a write off, there is often little that can be done to dispute the decision.

How Does Intact Insurance Decide a Vehicle is a Write Off?

Intact Insurance, like all insurance companies, has a set of criteria which must be met before a vehicle can be declared a write off. The first and most important criterion is the cost of repairs. If the repairs will cost more than the value of the vehicle, then the vehicle will be declared a write off.

Other factors also come into play when an insurance company is deciding whether or not a vehicle is a write off. These can include the age and condition of the vehicle, the availability of parts, and the safety of the vehicle. If any of these criteria are not met, then the vehicle will be declared a write off.

What Happens After a Vehicle is Written Off?

Once a vehicle is declared a write off, the insurance company will pay the owner the cash value of the vehicle. This amount is usually less than the full value of the vehicle, as the insurance company takes into account the age and condition of the vehicle. After this, the vehicle must be sold off as scrap or parts.

The owner of the vehicle will be given a certificate of destruction, which is proof that the vehicle has been written off. The certificate must then be presented to the Department of Motor Vehicles, who will revoke the registration of the vehicle.

What Can I Do if I Disagree With the Write Off?

If you disagree with the decision of the insurance company, you have the right to dispute the decision. In most cases, the insurance company will have an internal appeals process, and you can use this to make your case. However, it is important to note that the decision of the insurance company is final.

If you are still not satisfied, you may wish to speak to a lawyer who specializes in insurance law. A lawyer can help you to understand your rights and can help you to get the compensation you deserve.

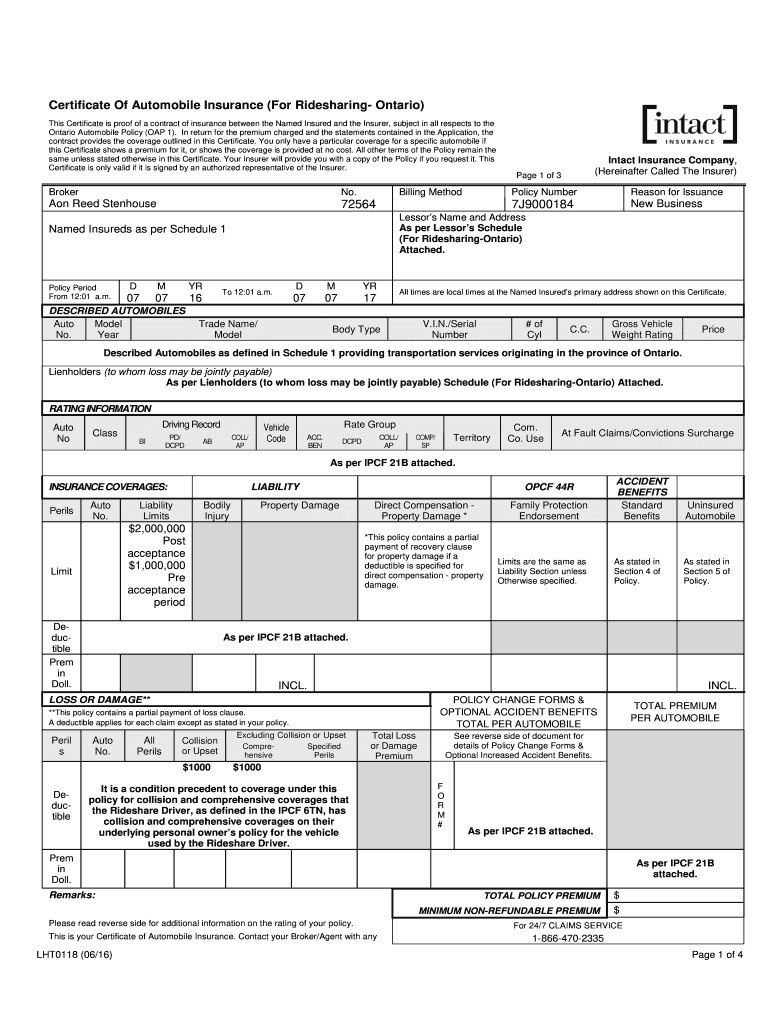

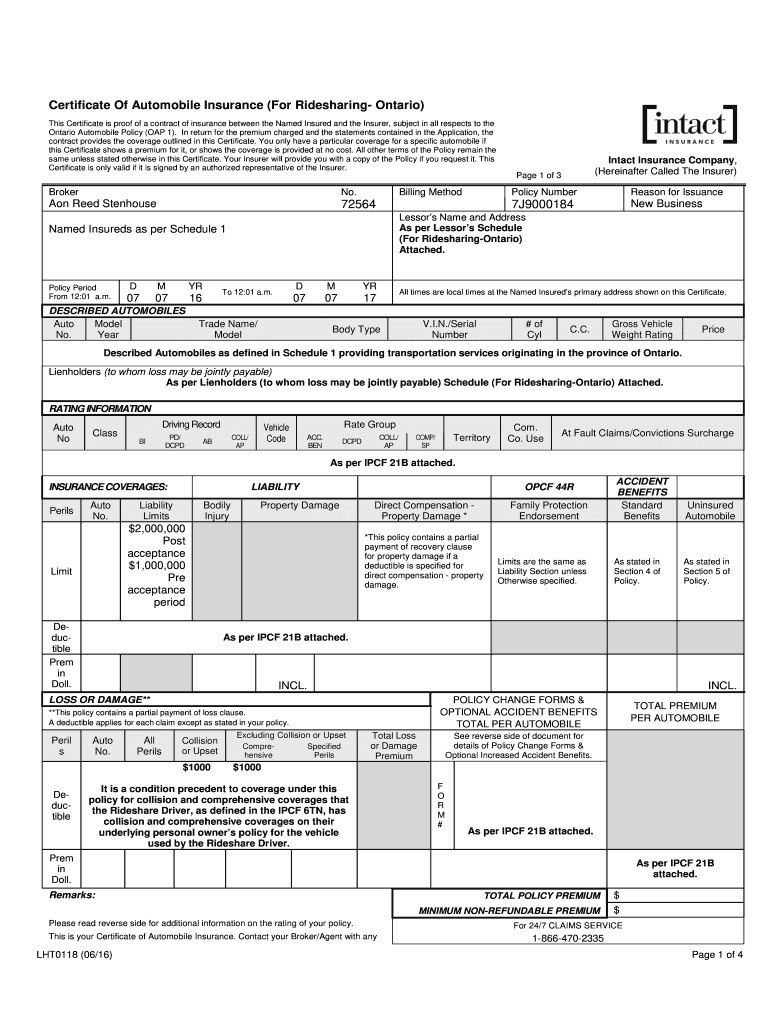

Canada Intact Insurance LHT0118 2016 - Fill and Sign Printable Template

Claims & Partners | Lomonte & Collings Insurance Services

Intact Home Insurance Review August 2020 | Finder Canada.

Intact buys specialty insurer and MGU from Princeton Holdings for C$1bn

Intact Financial Corporation completes acquisition of RSA Insurance