Home Insurance Third Party Liability

What is Home Insurance Third Party Liability?

Home insurance third party liability is the most important part of any homeowner’s insurance policy. It is a type of insurance coverage that protects the insured from any damages or injuries that may occur on their premises due to the negligence of another person or party. This type of coverage is essential for all homeowners, as it ensures that they are financially protected in the event of an accident or injury.

Third party liability coverage helps to cover the costs associated with medical expenses, legal fees, and property damage that may arise as a result of a third party’s negligence. This type of coverage is usually included in the basic home insurance policy, but it is important for homeowners to understand the details of their policy to ensure that they are adequately protected.

What Does Home Insurance Third Party Liability Cover?

Home insurance third party liability coverage typically covers the costs associated with medical expenses, legal fees, and property damage in the event of an accident or injury. The coverage is not limited to just the actual damages that occur on the insured’s premises, but can also cover any damages that occur off-site as a result of the insured’s negligence. This type of coverage is important as it helps to ensure that the homeowner is financially secure in the event of an unexpected accident or injury.

Home insurance third party liability also covers the costs associated with defending the insured against any claims that may arise from the accident or injury. This type of coverage is especially important for homeowners that may be held liable for any damages that occur on their property due to the negligence of another party. Without this type of coverage, the homeowner could be held personally responsible for the costs associated with the accident or injury, which could be financially devastating.

Who Does Home Insurance Third Party Liability Cover?

Home insurance third party liability coverage typically covers the homeowner, as well as any family members that live in the home. This type of coverage is also applicable to any other individuals that may be on the property, such as visitors or tenants. Home insurance third party liability coverage is important for all homeowners, as it ensures that they are financially secure in the event of an unexpected accident or injury.

It is important to note that home insurance third party liability coverage does not cover any damages or injuries that may occur due to the homeowner’s own negligence. This type of coverage is only applicable to damages or injuries that occur as a result of the negligence of another person or party. The homeowner should always ensure that they are adequately covered in the event of an unexpected accident or injury.

What are the Benefits of Home Insurance Third Party Liability?

Home insurance third party liability coverage is essential for all homeowners, as it helps to protect them from any unexpected costs that may arise from an accident or injury on their property. This type of coverage ensures that the homeowner is financially secure in the event of an unexpected accident or injury, and can help to cover the costs associated with medical expenses, legal fees, and property damage. Home insurance third party liability coverage is also beneficial as it helps to protect the homeowner from any claims that may arise from the accident or injury.

It is important to note that home insurance third party liability coverage does not cover any damages or injuries that may occur due to the homeowner’s own negligence. Therefore, it is important for homeowners to ensure that they are adequately covered in the event of an unexpected accident or injury. Home insurance third party liability coverage is an essential part of any homeowner’s insurance policy, and is a wise investment for any homeowner.

Conclusion

Home insurance third party liability is an essential part of any homeowner’s insurance policy. It is a type of coverage that protects the insured from any damages or injuries that may occur on their premises due to the negligence of another person or party. This type of coverage typically covers the costs associated with medical expenses, legal fees, and property damage, and can also help to protect the homeowner from any claims that may arise from the accident or injury. Home insurance third party liability coverage is an important part of any homeowner’s insurance policy, and is a wise investment for any homeowner.

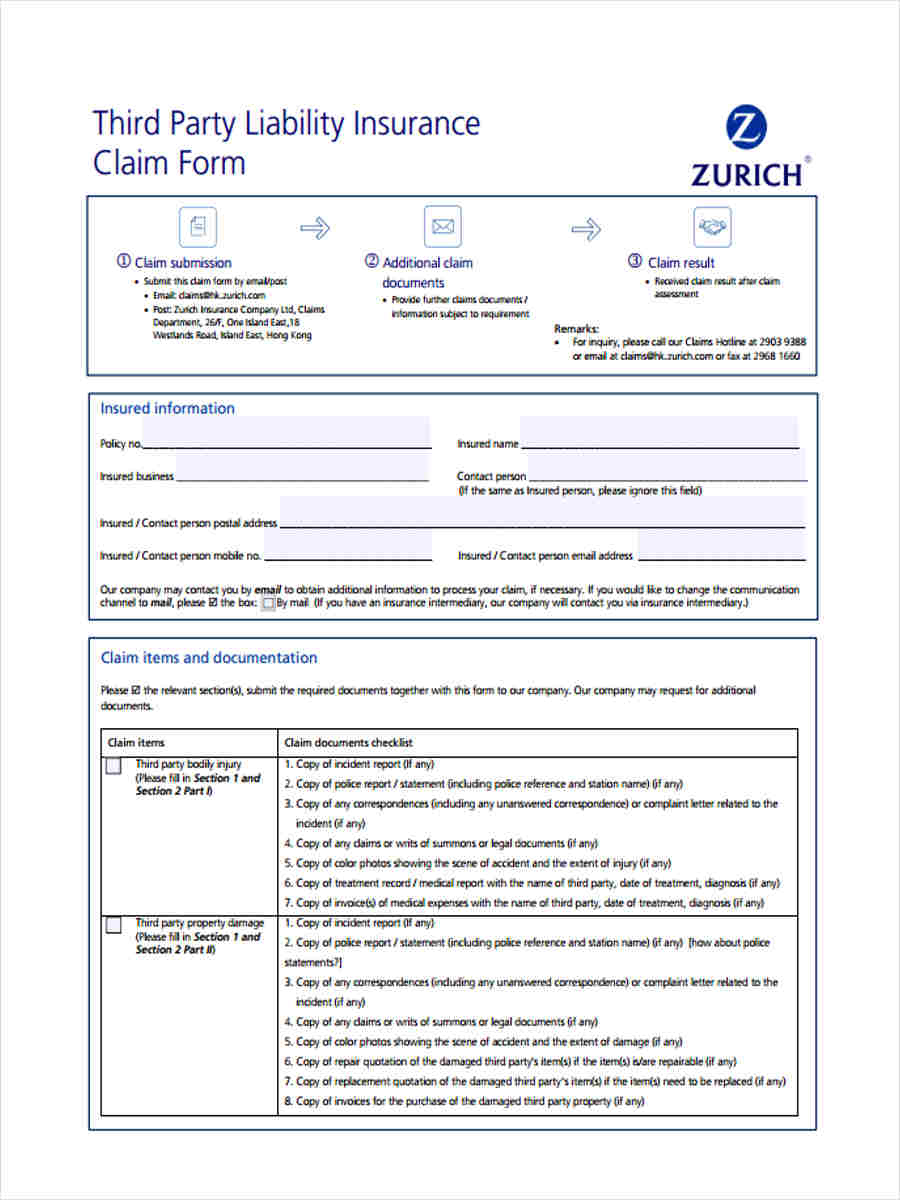

FREE 5+ Third Party Liability Forms in MS Word | PDF

Third Party Liability Insurance In Dubai - Dubai Online Insurance

What Is Third-party Insurance?