General Liability Insurance Vs Business Owners Policy

General Liability Insurance Vs Business Owners Policy

What is General Liability Insurance?

General Liability Insurance, also known as Commercial Liability Insurance, is an insurance policy designed to protect businesses from third party claims, such as bodily injury, property damage, and other types of losses. It is often referred to as the “umbrella” of insurance policies, as it covers the broadest range of potential liabilities. It is important to understand that General Liability Insurance is not a substitute for other types of insurance, such as property insurance, workers’ compensation, or professional liability. It is simply an additional layer of protection for businesses.

What Does General Liability Insurance Cover?

General Liability Insurance covers a wide range of potential liabilities, including: bodily injury, property damage, personal injury, advertising injury, and medical payments. It also covers legal defense costs in the event of a lawsuit. Depending on the policy, the coverage may also include additional items, such as the cost of defending a lawsuit and settlement costs.

What is a Business Owners Policy (BOP)?

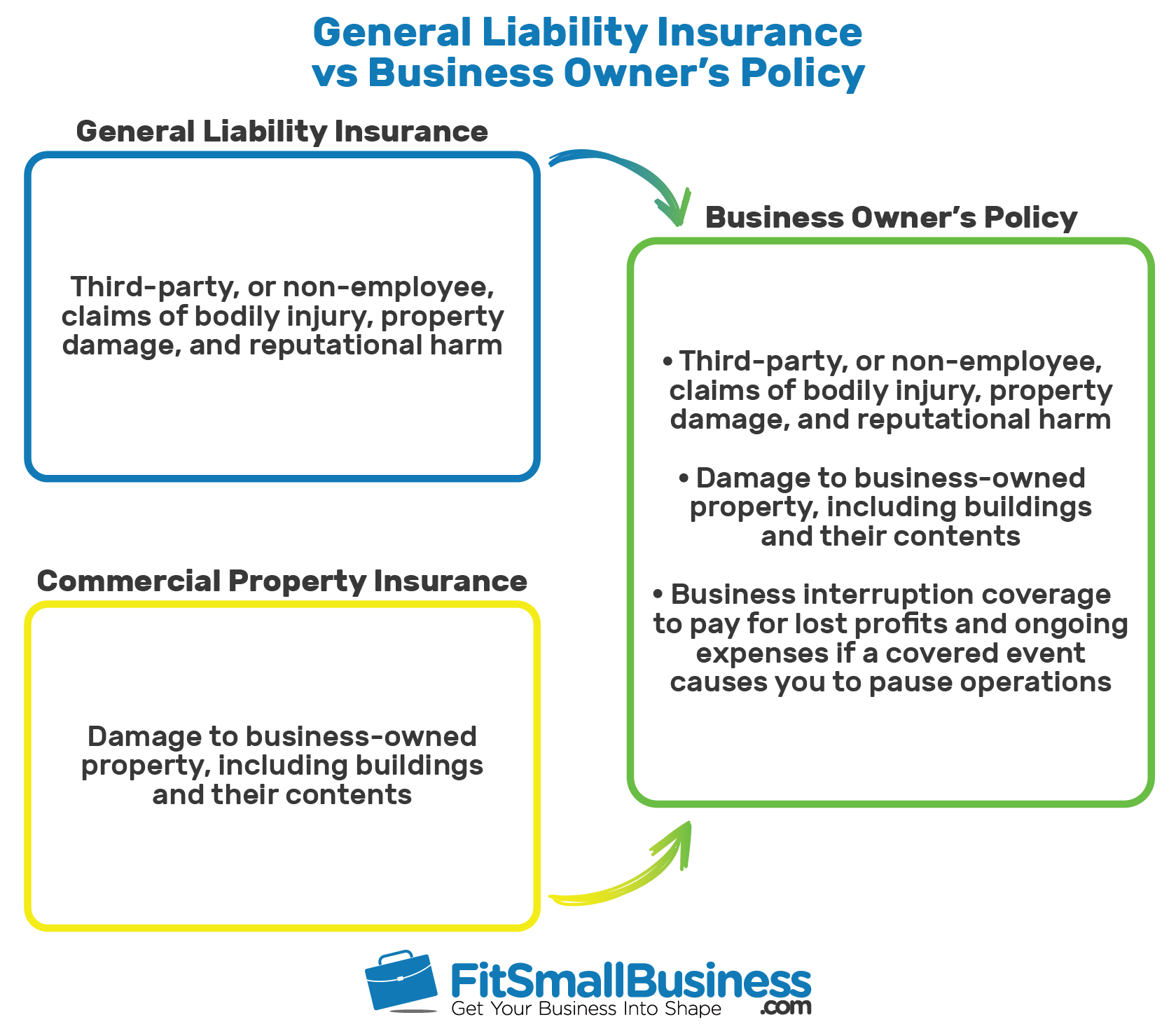

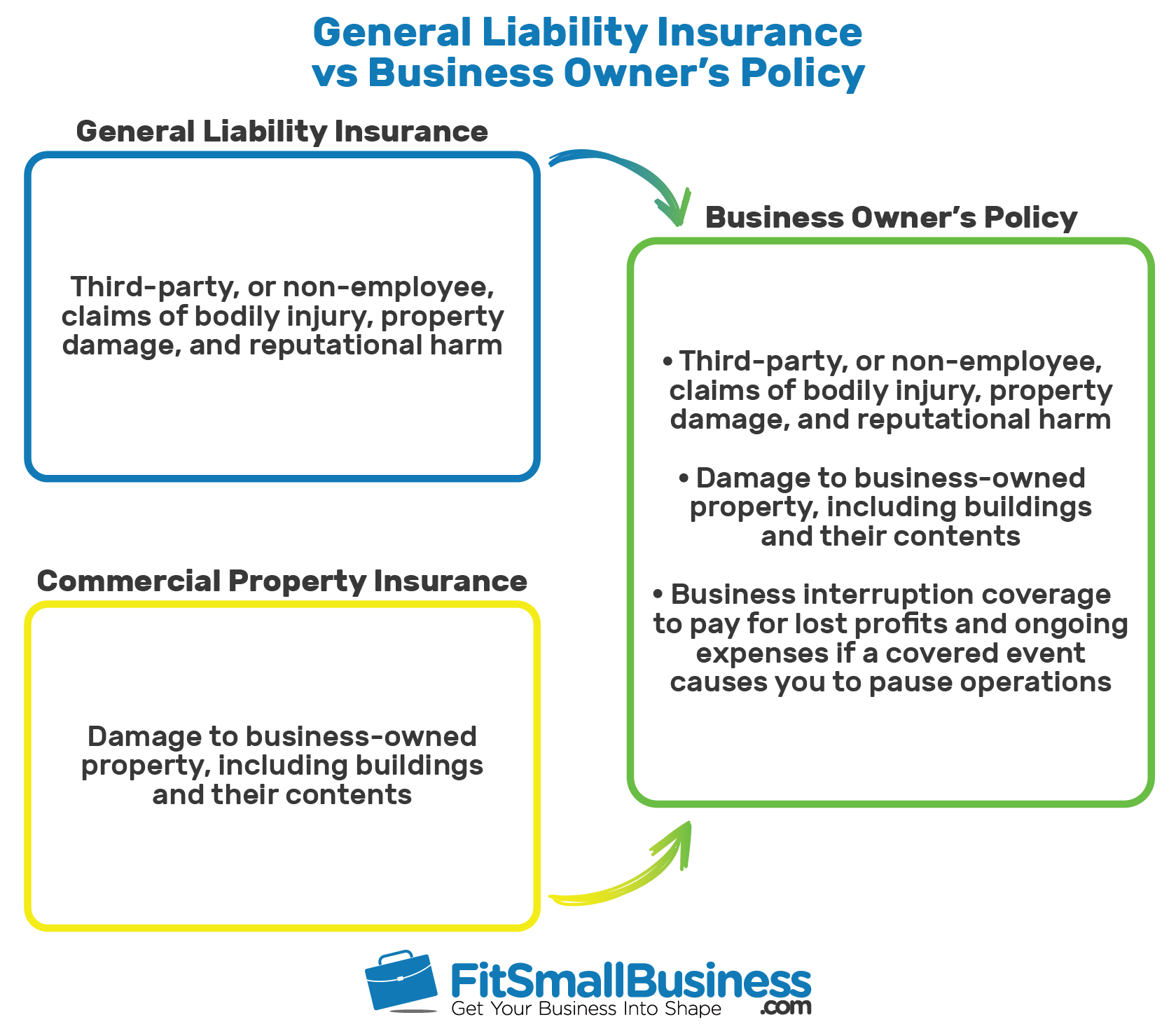

A Business Owners Policy (BOP) is a package policy designed to provide coverage for a wide range of business-related liabilities. It typically includes coverage for property, general liability, and business interruption. Depending on the policy, the coverage may also include additional items, such as liability for data breach, employee benefits, and cyber liability.

What Does a BOP Cover?

A BOP typically includes three main types of coverage: property insurance, general liability insurance, and business interruption insurance. Property insurance covers physical property owned by the business, such as buildings, furniture, equipment, and inventory. General liability insurance provides protection from third party claims, such as bodily injury, property damage, and personal injury. Business interruption insurance provides coverage for lost income due to the interruption of business operations.

Which is Better: General Liability Insurance or a Business Owners Policy?

The answer to this question will depend on the specific needs of the business. For many businesses, a BOP may be the better option, as it combines the coverage of multiple policies into one package. However, for businesses that require additional coverage, such as data breach, cyber liability, or employee benefits, a separate policy may be necessary. Ultimately, it is important to speak to an insurance agent to determine which policy is best for the business.

Conclusion

General Liability Insurance and Business Owners Policies are both important forms of insurance coverage for businesses. General Liability Insurance provides protection from third party claims, while a BOP provides coverage for a variety of business-related liabilities. Depending on the specific needs of the business, either policy may be the better option. It is important to speak to an insurance agent to determine which policy is best for the needs of the business.

General Liability Insurance vs Business Owner’s Policy

December 2017 - Presidio Insurance

How Much Does Professional Liability Insurance Cost?

General Liability vs Professional Liability Insurance: Which Is Right

PPT - General Liability Insurance Policy protects your Business