Geico Mechanical Breakdown Insurance Reviews

Geico Mechanical Breakdown Insurance Reviews

What is Geico Mechanical Breakdown Insurance?

Geico Mechanical Breakdown Insurance (MBI) is an auto insurance product that helps cover the cost of repairing or replacing mechanical parts of a vehicle if they fail due to normal wear and tear. This type of insurance is designed to help drivers who may not be able to afford the cost of a major repair. It can be purchased as a standalone policy or added to an existing Geico auto policy. Geico MBI policies are available for cars, motorcycles, motor homes, and recreational vehicles.

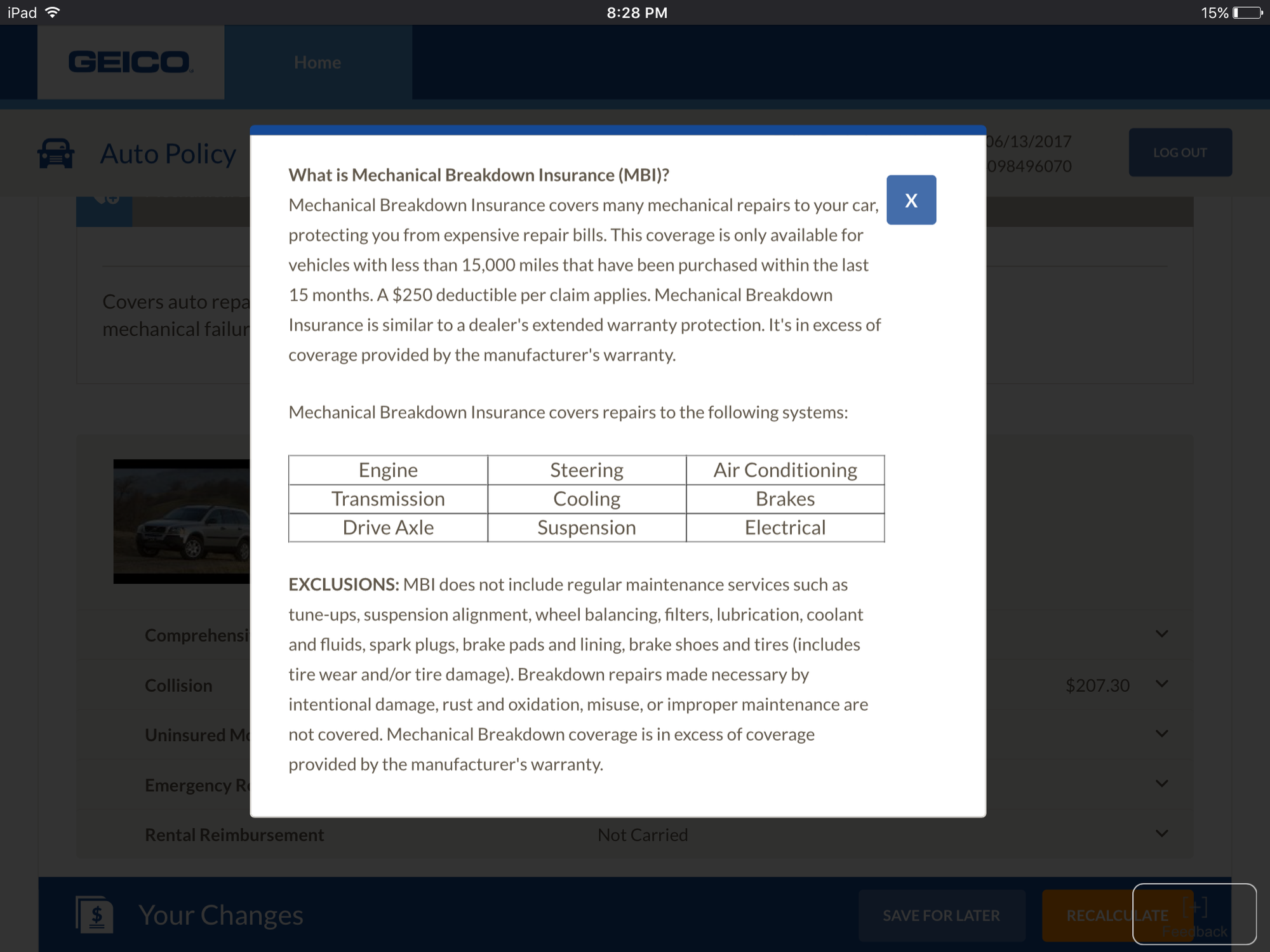

What Does Geico Mechanical Breakdown Insurance Cover?

Geico MBI policies cover a variety of mechanical components, including the engine, transmission, brakes, and suspension. The policy will also cover the cost of replacing or repairing any of these components if they become damaged due to normal wear and tear. The coverage can be customized to meet the needs of the individual driver. For example, a policy can be tailored to cover only certain components or to provide coverage for a specific dollar amount.

What Are the Benefits of Geico Mechanical Breakdown Insurance?

One of the main benefits of Geico MBI is that it can help to reduce the overall cost of repairs. If a vehicle is covered by a Geico MBI policy, the policyholder will only be responsible for paying the deductible, which is typically a small percentage of the repair cost. This can be significantly less than what they would have to pay if they had to cover the entire cost of repairs out of pocket.

Are There Any Drawbacks to Geico Mechanical Breakdown Insurance?

The main drawback of Geico MBI is that it can be expensive. Depending on the level of coverage purchased, the policyholder may be responsible for paying a large deductible. Additionally, the coverage may not include the cost of certain parts, such as airbags or windshields, or the cost of labor for repairs. Therefore, it is important for drivers to understand exactly what is covered by their policy before purchasing.

What Should I Consider Before Purchasing Geico Mechanical Breakdown Insurance?

Before purchasing a Geico MBI policy, drivers should consider their budget and the age and condition of their vehicle. For example, if the vehicle is older or has high mileage, the driver may not be able to afford the cost of such a policy. Additionally, drivers should compare the coverage offered by different providers to ensure they are getting the best value for their money.

Conclusion

Geico Mechanical Breakdown Insurance can be a great way to protect yourself financially if something goes wrong with your vehicle. However, it is important to consider the cost of the policy and the coverage offered before purchasing. By doing so, you can ensure you are getting the best value for your money and that you are adequately protected in case of an emergency.

GEICO Insurance Review: My Experience Using GEICO

Thoughts on Geico's Mechanical Breakdown insurance? - CorvetteForum

Geico Mechanical Breakdown Insurance Review (2022)

GEICO CAR INSURANCE REVIEWS 2017

Browser Steckrübe Fremder geico mechanical breakdown insurance Alaska