Does Direct Line Offer Gap Insurance

Thursday, March 9, 2023

Edit

Does Direct Line Offer Gap Insurance?

What is Gap Insurance?

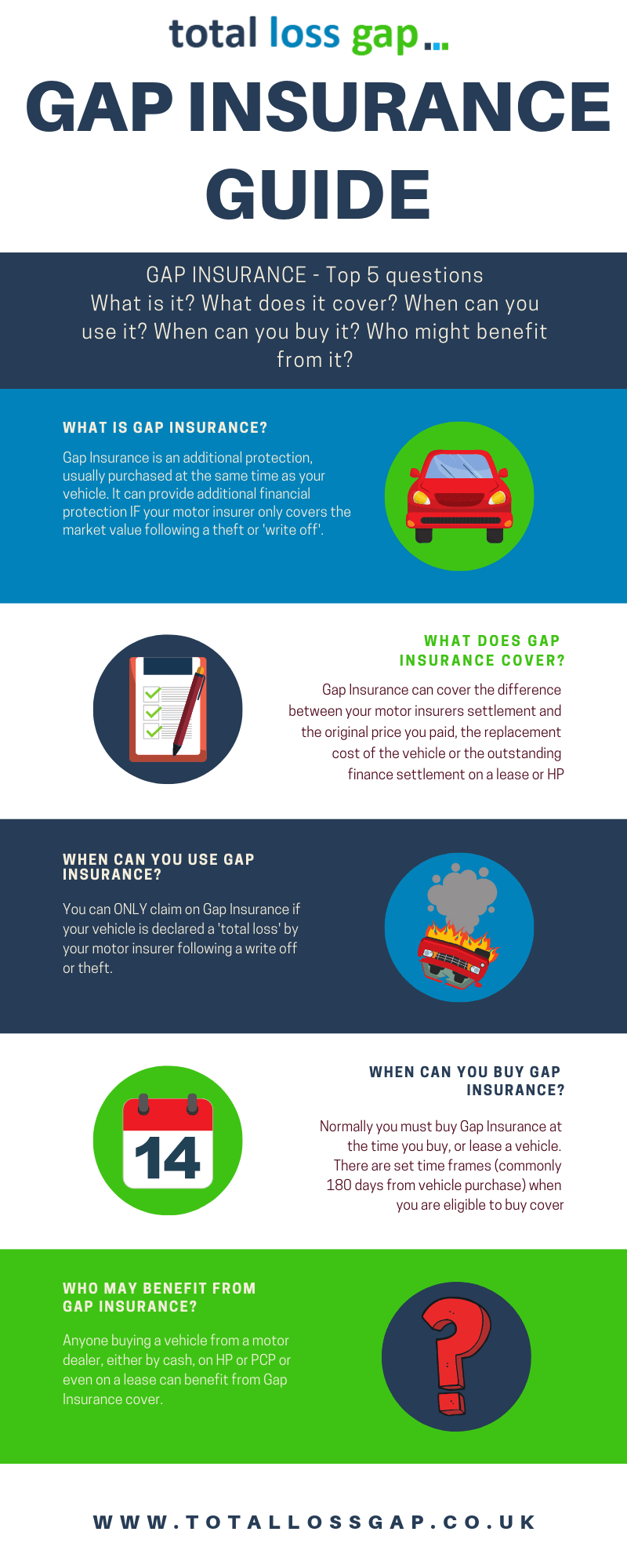

Gap insurance, also known as loan/lease payoff coverage, is a type of auto insurance that helps cover the difference between what you owe on a vehicle loan or lease and what the car is worth in the event of a total loss. It's often offered to drivers who are leasing or financing a vehicle, and can be especially helpful if you're making a large down payment and would be responsible for a considerable amount of money in the event of a total loss.

What Does Direct Line Offer?

Direct Line, one of the UK's leading car insurance providers, offers a range of gap insurance policies. These policies cover the shortfall between the amount you owe on the loan or lease and the current market value of the vehicle. Direct Line's policies are available for both new and used cars, and can be tailored to meet your individual needs.

What Types of Coverage Does Direct Line Offer?

Direct Line's gap insurance policies offer a range of coverage options. The most basic form of coverage is Return to Invoice (RTI) insurance, which covers the difference between the current market value of a car and the original invoice price. This can be especially useful if you're buying a new car, as it ensures you're not left out of pocket if the car is written off or stolen.

Direct Line also offers Vehicle Replacement Insurance, which covers the cost of replacing a vehicle with a new one of the same make and model if it's written off or stolen. This is especially handy if you're buying a high-end car, as it ensures you're not left without a vehicle if the worst happens.

What Other Benefits Does Direct Line Offer?

Direct Line's gap insurance policies come with a range of other benefits. These include:

- A guaranteed buy-back option, which allows you to return the policy if you don't need it after a certain period (usually 12 to 24 months).

- A no-claims bonus, which rewards you for not making a claim on your policy.

- A courtesy car, which allows you to continue to use your car while it's being repaired.

- Flexible payment options, including monthly payments and pay-as-you-go.

How Much Does Direct Line's Gap Insurance Cost?

Direct Line's gap insurance policies are competitively priced and vary depending on the vehicle and the level of coverage you choose. Generally, policies start from around £75 and can be tailored to meet your individual needs.

Conclusion

Gap insurance can be an invaluable investment for drivers who are leasing or financing a vehicle. Direct Line offers a range of competitively priced gap insurance policies that can be tailored to meet your individual needs. These policies offer a range of coverage options, as well as other benefits such as a guaranteed buy-back option, no-claims bonus and courtesy car. So if you're looking for gap insurance, Direct Line could be the perfect option for you.

What Is Gap Insurance? - Lexington Law

What is Gap Insurance? Infographic

GAP Insurance Infographic | Drive Freedom Smart

GAP Insurance - Explained in a Complete Guide | TotalLossGap

So, who exactly is in the coverage gap? - Care4Carolina