Cost Of Breakdown Cover With Direct Line

Friday, March 24, 2023

Edit

Cost Of Breakdown Cover With Direct Line

What Is Breakdown Cover?

Breakdown cover is a form of insurance cover that helps you in the event that your car breakdowns. It is designed to provide you with assistance when your car stops working, especially when you are away from home. Most breakdown cover policies will provide you with roadside assistance, free towing, repairs and sometimes even an alternative vehicle. As breakdowns can be costly and inconvenient, breakdown cover can be very helpful in times of need.

What Does Direct Line Offer?

Direct Line is a leading provider of breakdown cover in the UK. They offer three different levels of cover: Standard, Comprehensive and Premier. The Standard cover offers roadside assistance and home start as standard, plus European cover and onward travel. The Comprehensive cover includes all of the features offered in the Standard cover, plus cover for accidental damage, breakdown cover for your caravan or trailer, and even cover for your pets. The Premier cover includes all of the features of the Comprehensive cover, plus cover for your courtesy car and personal accident cover.

How Much Does Direct Line Breakdown Cover Cost?

The cost of breakdown cover with Direct Line will depend on the type of cover you choose, as well as the level of cover you require. For example, the Standard cover starts from as little as £32 per year and the Comprehensive cover from £52 per year. The Premier cover is the most expensive and starts from £82 per year. You can also pay for your breakdown cover monthly, which can make the cost more manageable.

What Other Benefits Does Direct Line Offer?

Direct Line also offers a range of additional benefits that can be added to your breakdown cover policy. These include personal accident cover, a courtesy car, and cover for your caravan or trailer. Depending on the level of cover you choose, these additional benefits may be included in the policy or may be available at an extra cost.

Is Direct Line Breakdown Cover Worth It?

Direct Line breakdown cover is certainly worth considering if you are looking for a reliable and affordable breakdown cover policy. They offer a range of cover levels and additional benefits, so you can tailor your policy to suit your individual needs. The cost of Direct Line breakdown cover is competitive compared to other providers and you can pay for your policy in monthly instalments. Overall, Direct Line breakdown cover is a good option for those looking for reliable and affordable breakdown cover.

Conclusion

Direct Line breakdown cover is a great option for those looking for reliable and affordable cover. They offer a range of cover levels and additional benefits, so you can tailor your policy to suit your individual needs. The cost of Direct Line breakdown cover is competitive compared to other providers and you can pay for your policy in monthly instalments. It is certainly worth considering if you are looking for breakdown cover.

Pin on For the home

Pin on Breakdown Cover

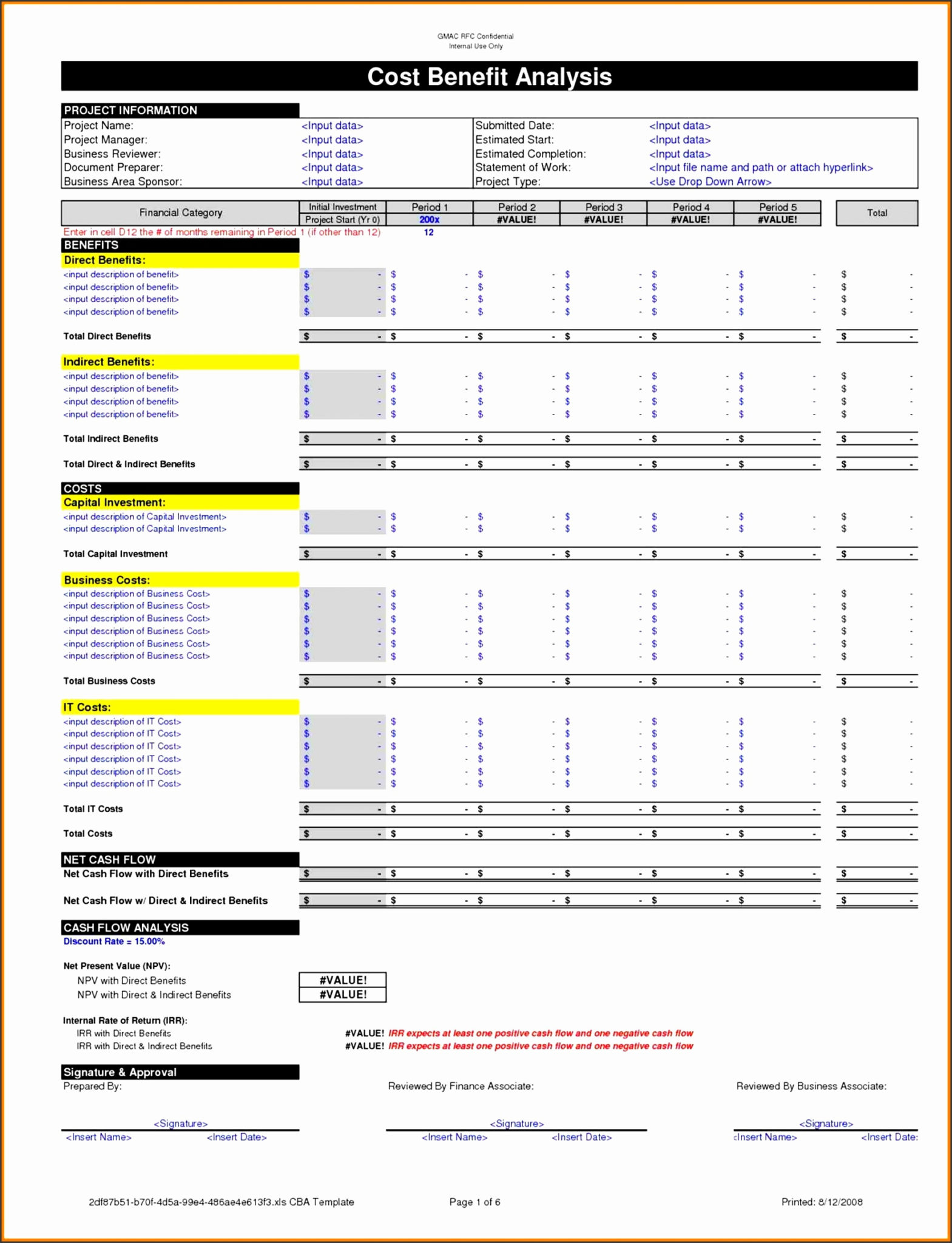

Cost Breakdown Template

cost breakdown template — excelxo.com

These are the 8 best car breakdown cover providers, as recommended by