Cheapest Auto Insurance Liability Only

Monday, March 13, 2023

Edit

Cheapest Auto Insurance Liability Only for Smart Shoppers

What is Auto Insurance Liability Only?

Auto insurance liability only is an insurance policy that provides coverage for your financial responsibility when you cause damage to someone else’s car or property. Liability only insurance is required in almost every state. It covers medical bills and property damage, but it does not cover repairs to your own vehicle. Liability only insurance can be a great option for people who own older cars and don’t want to pay for comprehensive insurance.

How to Find the Cheapest Auto Insurance Liability Only

The best way to find the cheapest auto insurance liability only is to shop around. Start by comparing quotes from multiple insurance companies. Get quotes from different types of insurers, such as traditional insurers and online-only insurers. You should also compare the deductibles and coverage levels offered by each insurer. Additionally, consider the discounts that each insurer offers. Many insurers offer discounts for things like safe driving, being a good student, and having multiple policies with the same company.

What to Look for in Auto Insurance Liability Only

When shopping for auto insurance liability only, it is important to look for coverage that meets your needs. It is important to consider the amount of coverage you need, as well as the types of coverage offered by each insurer. Additionally, make sure to read the fine print of each policy. Make sure to find out what types of incidents are covered and what is excluded. Also, make sure to ask about any additional fees, such as administrative fees and cancellation fees.

What are the Benefits of Auto Insurance Liability Only?

One of the main benefits of auto insurance liability only is that it is much cheaper than comprehensive coverage. This type of coverage is also a great option for people who own older cars that are not worth much. Additionally, liability only insurance does not require you to pay for repairs to your own car if you are at fault for an accident. This can save you a lot of money in the long run.

What is the Best Way to Save on Auto Insurance Liability Only?

The best way to save on auto insurance liability only is to shop around and compare quotes from multiple insurance companies. Additionally, take advantage of any discounts offered by the insurer. Many insurers offer discounts for things like safe driving, being a good student, and having multiple policies with the same company. Additionally, consider raising your deductible. This can help you save on your monthly premiums.

Conclusion

Auto insurance liability only is a great option for people who own older cars and don’t want to pay for comprehensive coverage. It can also be much cheaper than comprehensive coverage. To find the cheapest auto insurance liability only, it is important to shop around and compare quotes from multiple insurers. Additionally, take advantage of any discounts offered by the insurer and consider raising your deductible. By following these steps, you can save a lot of money on your auto insurance.

PPT - Cheapest Liability Car Insurance Texas PowerPoint Presentation

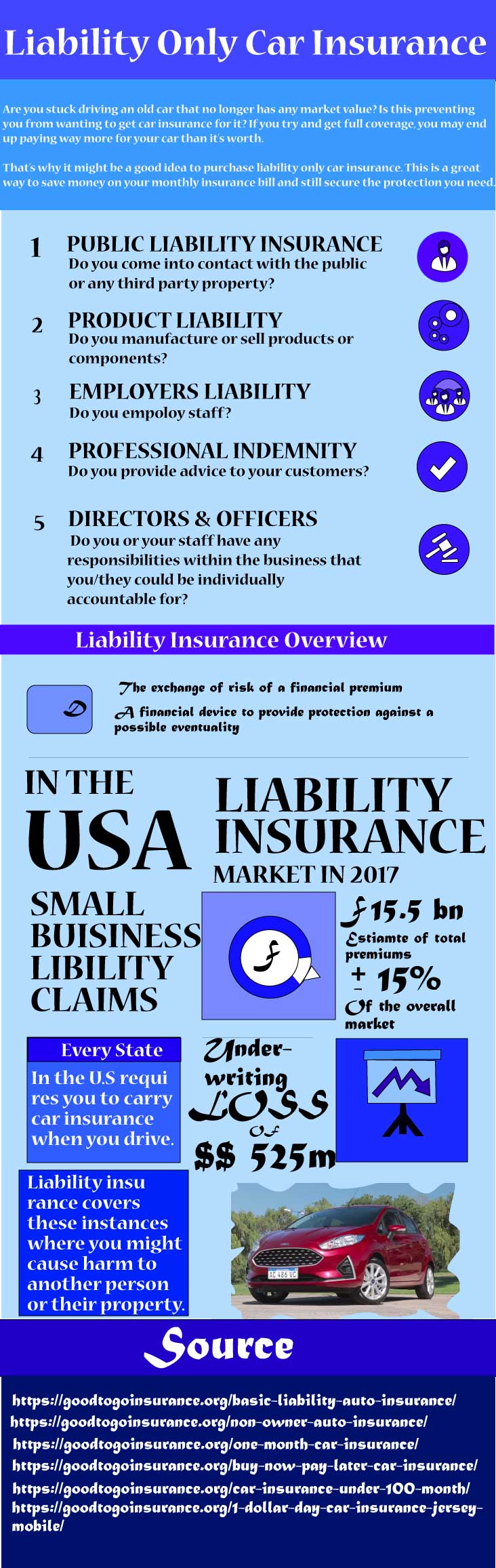

Liability Only Car Insurance | Liability goodtogo car insurance

cheap liability only car insurance | Life insurance quotes, Term life

Where to Get the Best Cheap Car Insurance | GOBankingRates

Find cheap car insurance in 8 easy steps • InsureMeta in 2020 | Cheap