Car Insurance Own Damage Philippines

Understanding Car Insurance and Own Damage in the Philippines

What is Car Insurance?

Car insurance is a type of insurance that protects against financial loss in the event of an accident or theft. It is an agreement between the insurer and the insured that the insurer will pay for any losses, damages, or costs incurred by the insured as a result of an accident or theft. Car insurance can cover a variety of things, such as collision coverage, liability coverage, medical payments coverage, and even rental car reimbursement. It is important to understand the different types of car insurance available and the differences between them.

What is Own Damage?

Own damage insurance is a type of car insurance coverage that covers the cost of repairing or replacing your vehicle if it is damaged in an accident. This type of coverage is typically required by law in the Philippines. Own damage coverage can also serve to protect you from financial liability if you cause an accident and someone else is injured or their property is damaged. The coverage can also provide protection if your car is stolen or damaged by a natural disaster, such as a flood or earthquake.

What Does Own Damage Cover in the Philippines?

Own damage coverage in the Philippines can cover a variety of different scenarios. It can cover the cost of repairing or replacing your vehicle if it is damaged in an accident. It can also provide protection if your car is stolen or damaged by a natural disaster, such as a flood or earthquake. Additionally, own damage coverage can provide protection if you cause an accident and someone else is injured or their property is damaged.

What Are the Benefits of Own Damage Insurance?

Own damage insurance provides a number of benefits to drivers in the Philippines. It can help you avoid financial liability if you cause an accident and someone else is injured or their property is damaged. It can also help cover the cost of repairing or replacing your vehicle if it is damaged in an accident. Additionally, own damage insurance can provide protection if your car is stolen or damaged by a natural disaster, such as a flood or earthquake.

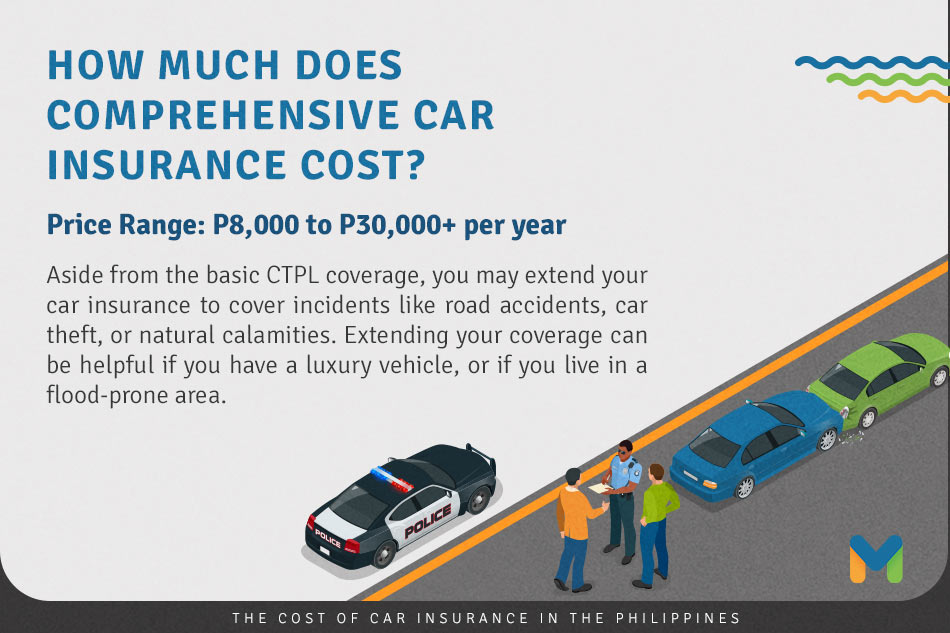

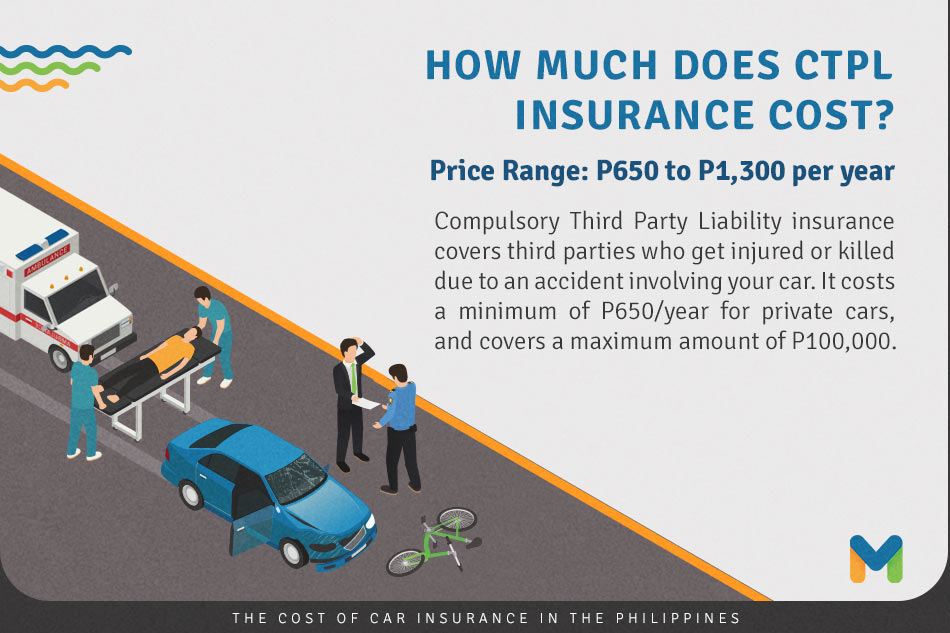

How Much Does Own Damage Insurance Cost in the Philippines?

The cost of own damage insurance in the Philippines varies depending on the type of policy you choose and the amount of coverage you need. Generally, the cost of own damage insurance is determined by the type of car you drive, your driving record, and the amount of coverage you choose. Additionally, insurance companies may offer discounts for drivers who have a good driving record and who maintain a clean vehicle.

What Other Types of Car Insurance are Available in the Philippines?

In addition to own damage insurance, there are a variety of other types of car insurance available in the Philippines. These include collision coverage, liability coverage, medical payments coverage, and even rental car reimbursement. It is important to understand the different types of car insurance available and the differences between them.

Own damage motor insurance can now be bought separately | Mint

Own Damage Cover in Car Insurance Policy

The cost of car insurance in the Philippines | ABS-CBN News

Car Insurance Philippines | Etiqa Life and General Assurance

The cost of car insurance in the Philippines | ABS-CBN News