Best Car Insurance For Dui

Best Car Insurance for DUI

Overview of DUI

Driving under the influence (DUI) is a criminal offense in the U.S. that involves operating a vehicle while under the influence of drugs or alcohol. According to the National Highway Traffic Safety Administration (NHTSA), in 2019, there were over 10,000 DUI-related fatalities in the United States. DUI offenses can result in a loss of driving privileges, expensive fines and even jail time. In addition to the legal repercussions, a DUI can also affect a person’s ability to obtain car insurance.

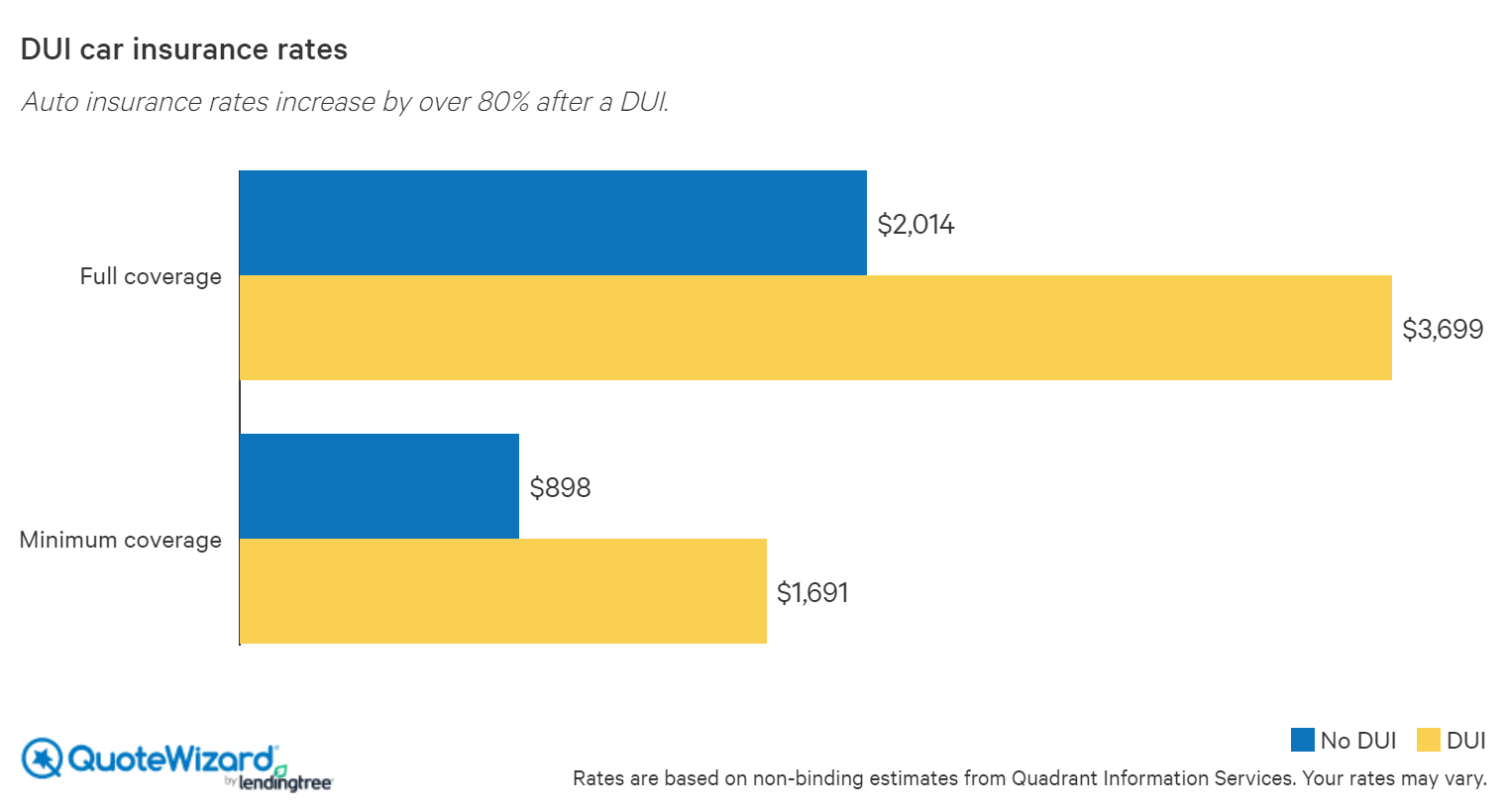

The Impact of DUI on Car Insurance

Having a DUI on your driving record can lead to significant increases in car insurance premiums. As a “high-risk driver,” you may be required to pay more for coverage, and some insurers may even decline to provide coverage. This can make it difficult to find an insurance provider that offers affordable rates. Additionally, many car insurance companies will require you to maintain an SR-22 form, which is an official document that certifies that you have liability insurance.

Finding Car Insurance After a DUI

If you have recently been convicted of a DUI, you may be wondering how to find car insurance. The first step is to shop around and compare rates from different car insurance providers. You should also look for insurance companies that specialize in providing coverage to high-risk drivers. These companies may be more likely to provide you with an affordable policy.

Tips for Finding Affordable Car Insurance After a DUI

When searching for car insurance after a DUI, there are a few tips that can help you find the most affordable coverage. First, you should look for discounts that are available to high-risk drivers. Many insurers offer discounts for completing a defensive driving course, for having a clean driving record for a certain period of time, or for having certain safety features installed in your vehicle. Additionally, you may be able to reduce your premiums by increasing your deductible.

Conclusion

Having a DUI on your driving record can make it difficult to find affordable car insurance. However, by shopping around and looking for discounts, you may be able to find a policy that fits your budget. Additionally, you should consider taking a defensive driving course, which may help you save money on your car insurance premiums. By taking the necessary steps to reduce your risk, you can find a car insurance policy that meets your needs.

Best Insurance For DUI: Cost and Companies (2022)

DUI Insurance and a Way To Save - Insurance.com | Car insurance, Cheap

7 Things You Need to Know About Car Insurance | The Summit Express

Get the Best Cheap DUI Car Insurance | QuoteWizard

The Best Car Insurance Companies You Can Find - Read MT