Basic Coverage For Car Insurance

Basic Coverage For Car Insurance

Different Types of Car Insurance

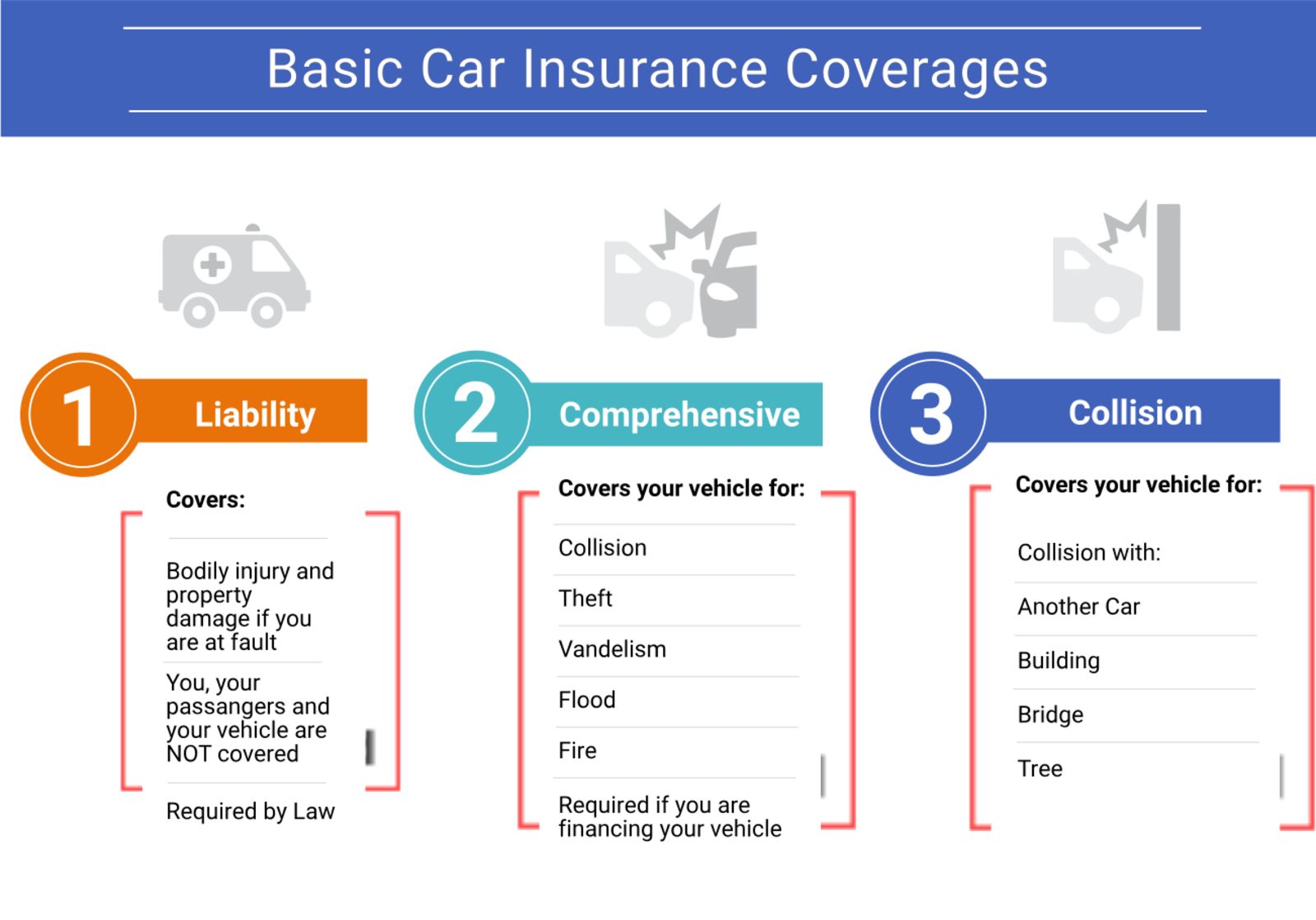

Car insurance is a must-have for anyone who drives a car. It covers a variety of potential liabilities, accidents, and damages that may occur while on the road. Depending on the type of insurance policy, different coverages are available. Generally, there are three main types of car insurance coverage: liability, collision, and comprehensive. Understanding the difference between these types of coverage is essential to determine which type of policy is right for you.

Liability Insurance

Liability insurance provides protection against claims for bodily injury and property damage that you cause to another person or property. It’s the most basic coverage and is required by law in most states. Liability coverage typically includes two parts: bodily injury liability and property damage liability. Bodily injury liability covers medical expenses and legal costs for others if you cause an accident. Property damage liability covers damage to another person’s property, such as their car, if you cause an accident. The minimum amount of liability coverage required varies from state to state.

Collision Insurance

Collision insurance covers damage to your own car if you cause an accident. This type of coverage pays for repairs or replacement of your car if it’s damaged in an accident, regardless of who is at fault. Collision coverage is usually optional, but it’s a good idea to have if you have a car loan or you’re leasing a car, since your lender may require it. It can also be helpful if you’re driving an older car and the repair costs would exceed the value of the car.

Comprehensive Insurance

Comprehensive insurance covers damage to your car from events other than accidents. This includes theft, vandalism, fire, hail, and other disasters. If your car is damaged in any of these events, comprehensive insurance will cover the cost of repairs or replacement. It’s usually optional, but if you have a newer car or a car loan, your lender may require it. If you’re driving an older car, you may consider skipping this coverage, since the cost of the repairs may not be worth the cost of the coverage.

Uninsured Motorist Coverage

Uninsured motorist coverage is optional coverage that pays for medical expenses and other damages if you’re injured in an accident caused by an uninsured driver. It also covers you if you’re hit by a driver who flees the scene. This coverage is usually optional, but it’s a good idea to have it if you can afford it, since it can provide financial protection in the event of an accident.

Choosing the Right Coverage for Your Car

Choosing the right coverage for your car can be overwhelming. It’s important to understand the different types of coverage available and the amount of coverage that’s right for you. You should also compare different policies and companies to make sure you’re getting the best coverage at the best price. It’s also a good idea to review your policy periodically and make sure it still meets your needs.

Choose Deductibles for Car Insurance Coverages [Cheap Quotes]

![Basic Coverage For Car Insurance Choose Deductibles for Car Insurance Coverages [Cheap Quotes]](https://www.carinsurancecomparison.com/Images/f8478c63-basic-types-of-insurance-01-1-medium.jpg)

Basic types of car insurance coverage explained | ABS-CBN News

5 Types of Car Insurance Coverage You Must Know #insurancequotes | Car

One of the most basic types of auto insurance coverage, liability is

Car insurance infographic | 20 Miles North Web Design