State Farm Named Non Owner Policy

State Farm Non Owner Policy: What You Need to Know

State Farm is one of the largest and most recognizable providers of insurance policies in the United States. They offer a range of policies, from auto to home and life insurance. One of the lesser-known types of policies they provide is the State Farm Non Owner Policy. This type of policy is designed to provide protection for those who do not own a vehicle but still need insurance coverage.

Who Needs a Non-Owner Policy?

A State Farm Non Owner Policy is ideal for those who are not car owners, but still need to drive. This could include those who borrow a vehicle from a family member, rent a car, use a carpool, or take part in a car-sharing program. Without a Non Owner Policy, these individuals may face significant financial risks if they were to be involved in an accident.

What Does a Non Owner Policy Cover?

The State Farm Non Owner Policy is designed to provide basic liability coverage for those who are not car owners. This includes protection for bodily injury, property damage, and medical payments. It also covers uninsured motorist coverage, as well as some types of rental car coverage. Additionally, the policy may cover any damages incurred as a result of a hit-and-run accident.

How Much Does a Non Owner Policy Cost?

The cost of a State Farm Non Owner Policy will vary depending on a variety of factors. This includes the type and amount of coverage needed, as well as the individual's driving record. Generally speaking, a Non Owner Policy is quite affordable, typically ranging from $5-$15 per month. Since these policies do not cover physical damage to the vehicle, they are generally cheaper than traditional auto policies.

What Are the Benefits of a Non-Owner Policy?

A State Farm Non Owner Policy provides peace of mind for those who do not own a vehicle. It ensures that these individuals are covered in the event of an accident, regardless of who owns the car. This type of policy also helps to protect a person's finances, as it can help to pay for medical bills, legal fees, and other costs associated with an accident.

Finding the Right Non Owner Policy

When choosing a State Farm Non Owner Policy, it is important to consider your individual needs and budget. You should also look into the different types of coverage available, such as liability, uninsured motorist, and rental car coverage. It is also a good idea to compare different policies to make sure you are getting the best deal. With the right policy in place, you can feel secure knowing that you are protected no matter who owns the car.

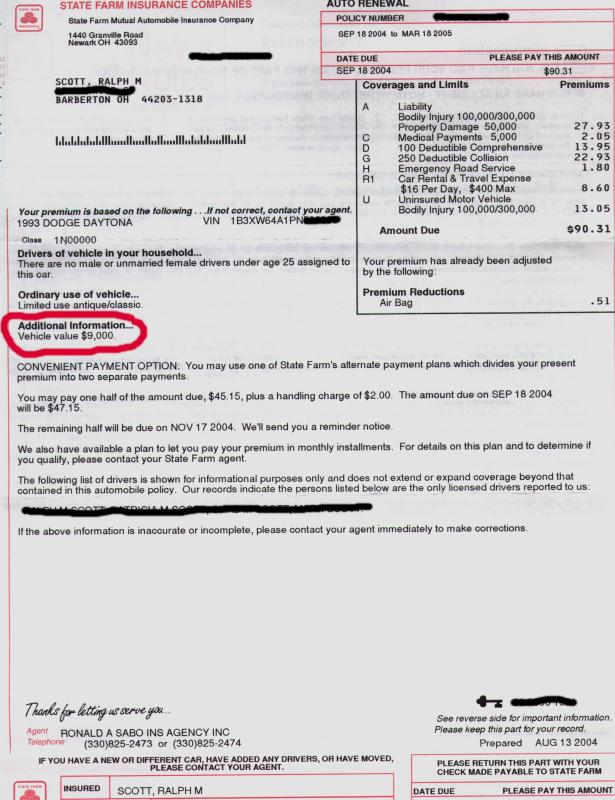

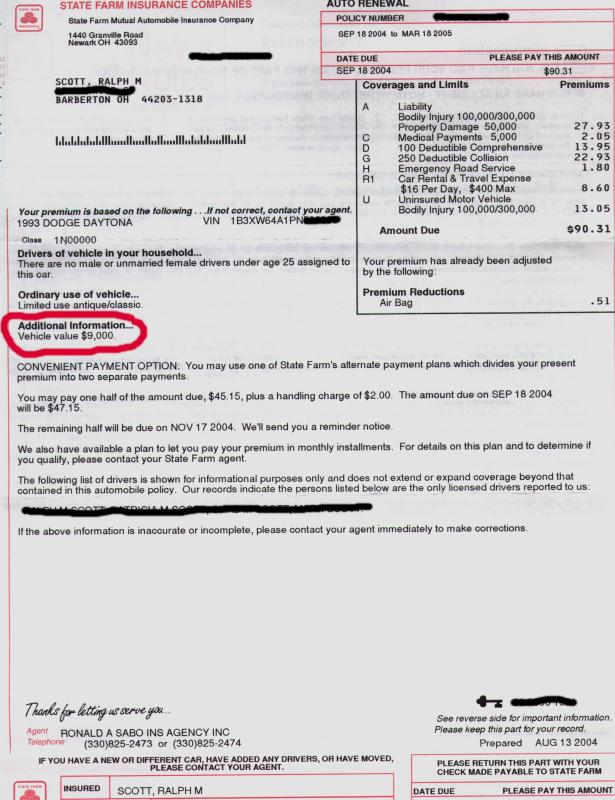

State Farm Ins Policy.jpg photo - Ralph Scott photos at pbase.com

State Farm was started in 1922 for farmers: the founder, George Jacob

State Farm Responds to Outrage After Denying Coverage to Motorcycle Clubs

State Farm Insurance Policy - State Farm Insurance Companies1947 Ad