How Much A Month Is Car Insurance

How Much A Month Is Car Insurance?

Introduction

Car insurance is an essential expense for every driver. The cost of car insurance is determined by a variety of factors, including the type of car, the age of the driver, and the driver's driving record. Every state has its own laws when it comes to car insurance, so it is important to understand the laws in your state before purchasing a policy. The cost of car insurance can vary greatly, so it is important to compare different policies to find the best rate. In this article, we'll look at the average cost of car insurance per month and how you can save money on your car insurance.

Factors That Determine Insurance Costs

The cost of car insurance is determined by a variety of factors, including the type of car you drive, your age, your driving record, and the amount of coverage you need. The type of car you drive can affect the cost of your car insurance. Generally, cars with more safety features and higher safety ratings are cheaper to insure than cars with fewer safety features. In addition, the age of the driver can also affect the cost of car insurance. Generally, younger drivers tend to pay more for car insurance than older drivers, as they are considered to be a higher risk. Your driving record is also a factor in determining the cost of your car insurance. Drivers with poor driving records tend to pay more for car insurance than drivers with good driving records. Finally, the amount of coverage you need will also affect the cost of your car insurance.

Average Cost of Car Insurance per Month

The average cost of car insurance per month can vary significantly depending on the factors mentioned above. According to the Insurance Information Institute, the average cost of car insurance in the United States in 2020 was around $1,555 per year. This works out to approximately $130 per month. However, the actual cost of car insurance per month can vary significantly from one driver to the next. Some drivers may pay less than $100 per month for car insurance, while others may pay more than $200 per month for car insurance.

Saving Money on Car Insurance

There are several ways to save money on car insurance. One of the easiest ways to save money is to compare different policies and companies to find the best rate. You can also save money by increasing your deductible, which is the amount you pay out of pocket before your insurance kicks in. Additionally, if you have a good driving record, you can qualify for discounts on your car insurance. Finally, you can save money by bundling your car insurance with other policies, such as homeowners or renters insurance.

Conclusion

The cost of car insurance can vary significantly from one driver to the next. Factors such as the type of car, the age of the driver, and the driver's driving record can all affect the cost of car insurance. The average cost of car insurance in the United States is around $130 per month. However, the actual cost of car insurance per month can vary significantly from one driver to the next. There are several ways to save money on car insurance, such as comparing policies and companies, increasing your deductible, and qualifying for discounts. By taking the time to compare different policies and companies, you can save money on your car insurance.

How Much Is Car Insurance Per Month For A 18 Year Old ~ news word

How Much Is Car Insurance Per Month For A 18 Year Old ~ news word

Average Price Of Car Insurance Per Month - designby4d

Midland Tx Auto Insurance: Average Auto Insurance Rates By Car

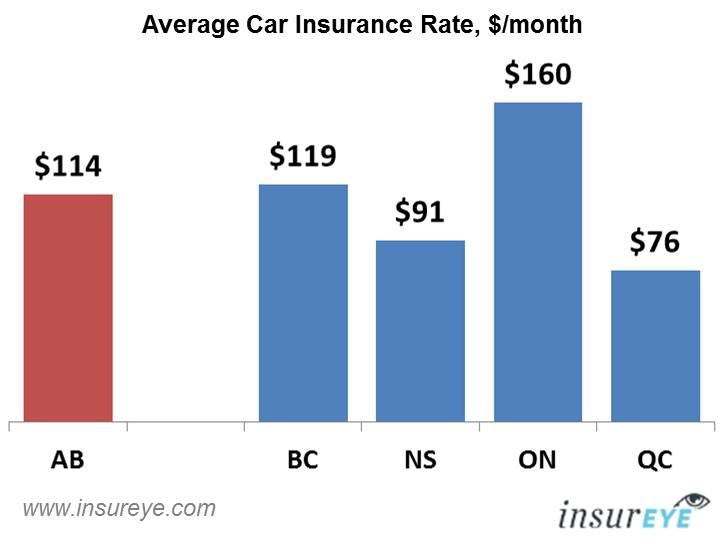

Car Insurance Alberta | Average Rate is $114 per month