Does Auto Insurance Go With The Car Or The Driver

Does Auto Insurance Go With The Car Or The Driver?

What is Auto Insurance?

Auto insurance is a type of insurance policy that helps protect you financially in an event of an accident involving your vehicle. It covers you for a variety of losses and liabilities that can arise from an accident, such as medical expenses, property damage, and legal expenses. Depending on the type of policy you get, auto insurance can also cover other types of losses, such as towing and labor costs, damage to your vehicle, and rental car reimbursement.

Does Auto Insurance Go With The Car Or The Driver?

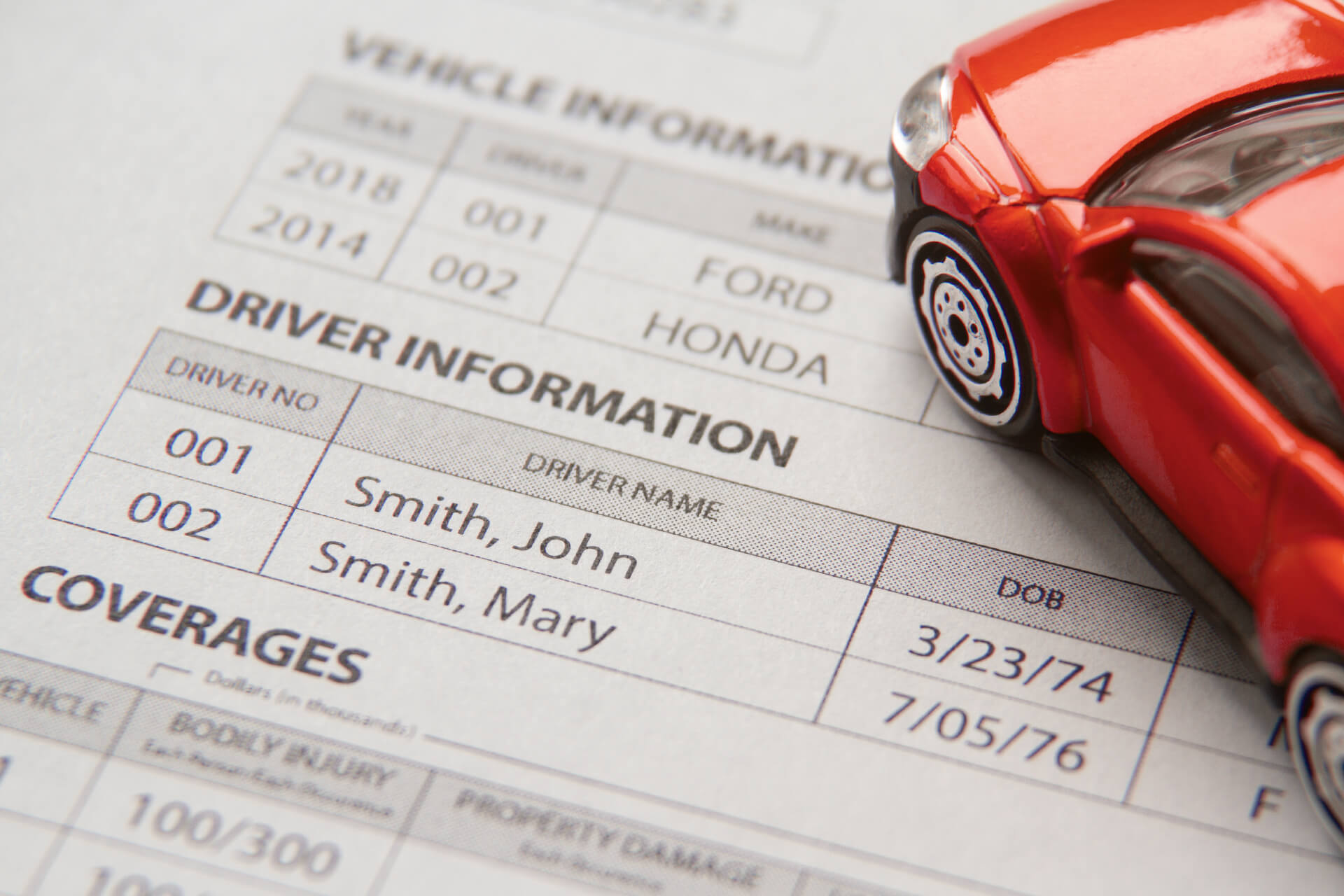

The answer to this question is that auto insurance goes with the car and the driver. When you purchase an auto insurance policy, you are usually buying coverage for the vehicle and the driver. This means that the insurance company will provide coverage to both the car and the driver in the event of an accident. However, it is important to note that the coverage may vary depending on the type of policy you have, so it is important to read the policy and make sure that you understand what type of coverage you have.

How Much Does Auto Insurance Cost?

The cost of auto insurance can vary significantly depending on a number of factors, such as the type of vehicle you have, the coverage you choose, and your driving record. Generally, the more coverage you choose, the higher the cost. That said, there are a few things you can do to help keep costs down. For example, if you have a good driving record, you may be eligible for discounts on your auto insurance premiums. Additionally, you may be able to save money by purchasing multiple policies with the same insurance company.

What Types of Auto Insurance are Available?

There are a variety of different types of auto insurance, including liability, collision, comprehensive, medical, and uninsured motorist coverage. Depending on the type of policy you have, the coverage can vary significantly. Liability coverage, for example, covers you for any damages you cause to another person or property in an accident. Collision and comprehensive coverage, on the other hand, covers damages to your own car in an accident. Medical and uninsured motorist coverage can provide coverage for medical expenses for you and your passengers in the event of an accident.

Conclusion

Auto insurance is an important type of insurance that helps protect you financially in the event of an accident. When you purchase an auto insurance policy, you are usually buying coverage for the car and the driver. The cost of auto insurance can vary significantly depending on a number of factors, such as the type of vehicle you have, the coverage you choose, and your driving record. Additionally, there are a variety of different types of auto insurance, including liability, collision, comprehensive, medical, and uninsured motorist coverage. It is important to understand the type of coverage you have and make sure that it meets your needs.

Top 10 Auto Insurance Infographics

Car insurance infographic | 20 Miles North Web Design

Page for individual images • Quoteinspector.com

Car Insurance - Online Insurance Quote