Car Insurance For High Risk Drivers Georgia

Saturday, February 18, 2023

Edit

Car Insurance For High Risk Drivers in Georgia

What is High Risk Driving?

High-risk driving is when a driver has been deemed to be a greater risk to insure. Drivers who are deemed high-risk typically have a history of traffic violations or accidents, or have had their license suspended or revoked. In Georgia, these drivers are required to purchase high-risk or “non-standard” auto insurance.

What Does High Risk Auto Insurance Cover?

High-risk auto insurance generally covers the same things as standard auto insurance. It includes: liability coverage for bodily injury and property damage, uninsured/underinsured motorist coverage, and medical payments coverage. It may also include comprehensive and collision coverage, which covers the costs of repair or replacement of the insured vehicle due to an accident.

Who Qualifies as a High-Risk Driver in Georgia?

Generally, drivers who have had their license suspended or revoked, or who have multiple traffic violations or at-fault accidents within a three year period, are considered high-risk drivers in Georgia. Drivers who are under the age of 25 are also considered high-risk due to their lack of experience behind the wheel.

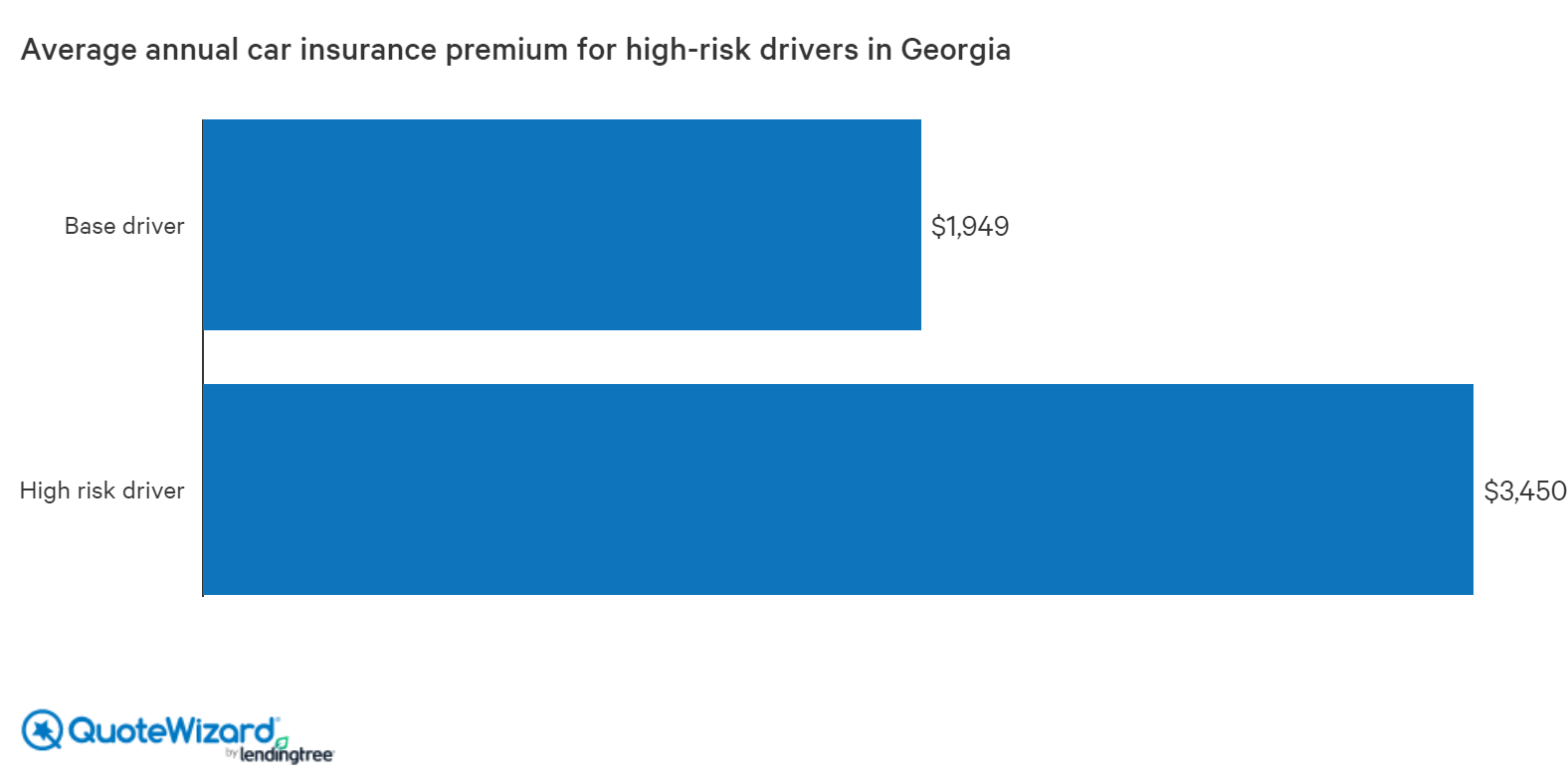

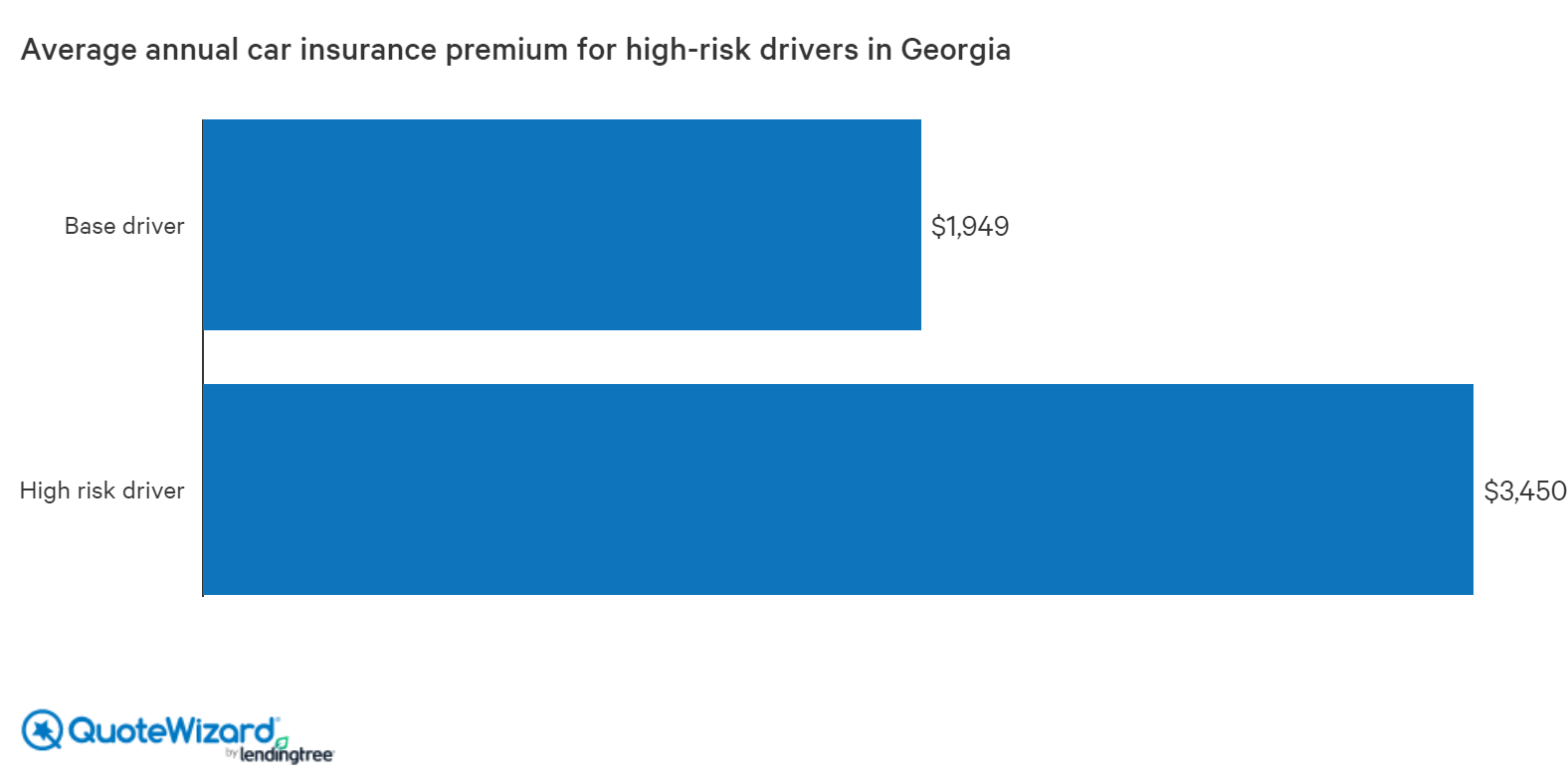

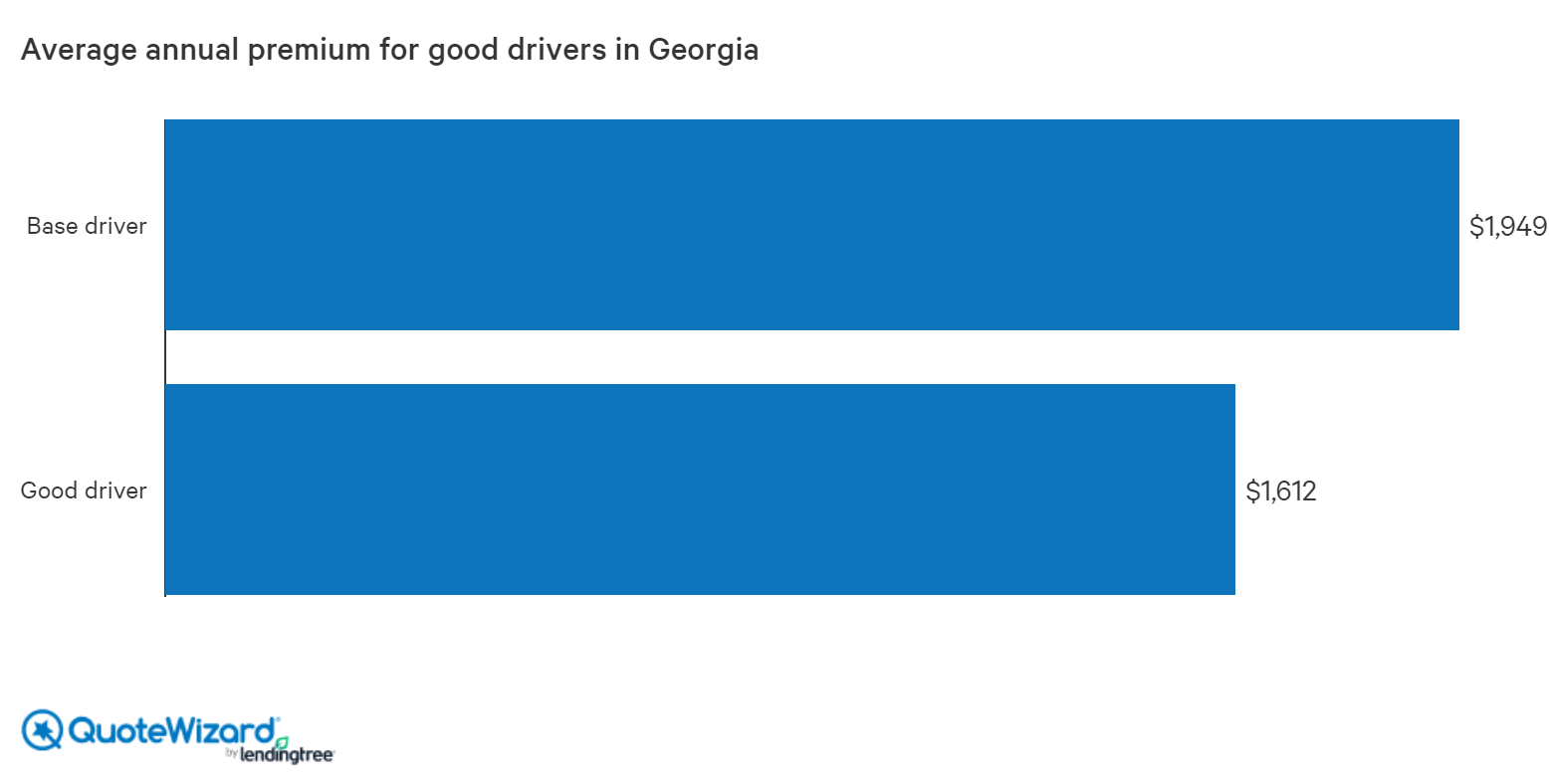

How Much Does High-Risk Auto Insurance Cost in Georgia?

The cost of high-risk auto insurance in Georgia can vary greatly depending on the driver’s individual circumstances. Factors such as the driver’s age, driving history, and type of vehicle all play a role in determining the cost of the insurance policy. Generally, high-risk drivers can expect to pay higher premiums than standard drivers.

How Can High-Risk Drivers Lower their Insurance Costs in Georgia?

High-risk drivers in Georgia have a few options for lowering their insurance costs. One option is to take a defensive driving course, which may qualify the driver for a discount in the premium. Additionally, high-risk drivers may be able to reduce their premiums by raising their deductible, or by purchasing a vehicle with a higher safety rating.

Finally, high-risk drivers may want to consider obtaining an older vehicle, as these typically cost less to insure than newer models. Additionally, drivers may be able to reduce their premiums by limiting their mileage or by bundling their auto insurance policy with other policies, such as home or life insurance.

Getting the Best Deal on High-Risk Auto Insurance in Georgia

High-risk drivers in Georgia have a few options for finding the best deal on auto insurance. One option is to shop around and compare quotes from multiple insurance providers. Additionally, drivers may want to consider using an independent insurance agent who can help them find the best rates.

Finally, drivers may want to consider increasing their deductibles or reducing their coverage. While this may result in a lower premium, it is important to remember that reducing coverage or raising deductibles can also leave drivers with less protection in the event of an accident.

Finding Cheap Car Insurance in Georgia | QuoteWizard

Finding Cheap Car Insurance in Georgia | QuoteWizard

Where To Get Car Insurance For High Risk Drivers - designermumtaz

Best Cheap Car Insurance In Georgia 2021 – Forbes Advisor

High Risk Auto Insurance Online – Haibae Insurance Class