Any Driver Policy Car Insurance

Any Driver Policy Car Insurance: A Comprehensive Overview

Having car insurance is one of the most important things you can do to protect yourself, your family, and your assets. With an any driver policy car insurance, you can feel more secure knowing that anyone you allow to drive your car is covered in the event of an accident. This type of policy is also called a named driver policy, and it can provide you with extensive coverage if you are in an accident.

What is an Any Driver Policy?

An any driver policy is a type of car insurance that allows any person you allow to drive your car to be covered in the event of an accident. This type of policy is beneficial for those who often have multiple people driving their car, such as a family with multiple drivers or a carpool with friends. This type of policy will cover any driver who has your permission to drive your car, regardless of age, gender, or experience.

What Does an Any Driver Policy Cover?

An any driver policy will cover any and all costs associated with an accident, including medical bills, car repair costs, and legal fees. This type of policy also provides coverage for any damage done to another person’s property, as well as liability coverage in the event that you are sued by the other party. Additionally, your any driver policy may include collision coverage, which pays for damage to your vehicle caused by an accident.

What Are the Benefits of an Any Driver Policy?

An any driver policy provides several benefits, including the peace of mind that any driver you allow to drive your car is insured. This type of policy also allows you to add multiple drivers to your policy without having to pay extra for each one. Additionally, an any driver policy can provide you with a lower premium, as the insurer will assume that you are a responsible driver and that you will only allow those with a safe driving record to drive your car.

What Are the Disadvantages of an Any Driver Policy?

The main disadvantage of an any driver policy is that it can be more expensive than a traditional car insurance policy. Additionally, the insurer will not necessarily know the driving record of the any driver, which could lead to higher premiums if the any driver has a poor record. Finally, an any driver policy may not cover all drivers in the event of an accident, so it is important to read the policy carefully and make sure that all drivers are covered.

Conclusion

An any driver policy car insurance can provide you with extensive coverage in the event of an accident. This type of policy is beneficial for those who often have multiple people driving their car, as it covers all drivers regardless of age, gender, or experience. However, it is important to note that an any driver policy can be more expensive than a traditional car insurance policy, so it is important to shop around and compare rates before making a decision.

Car Insurance, Any Car Any Driver - YouTube

Page for individual images • Quoteinspector.com

Page for individual images • Quoteinspector.com

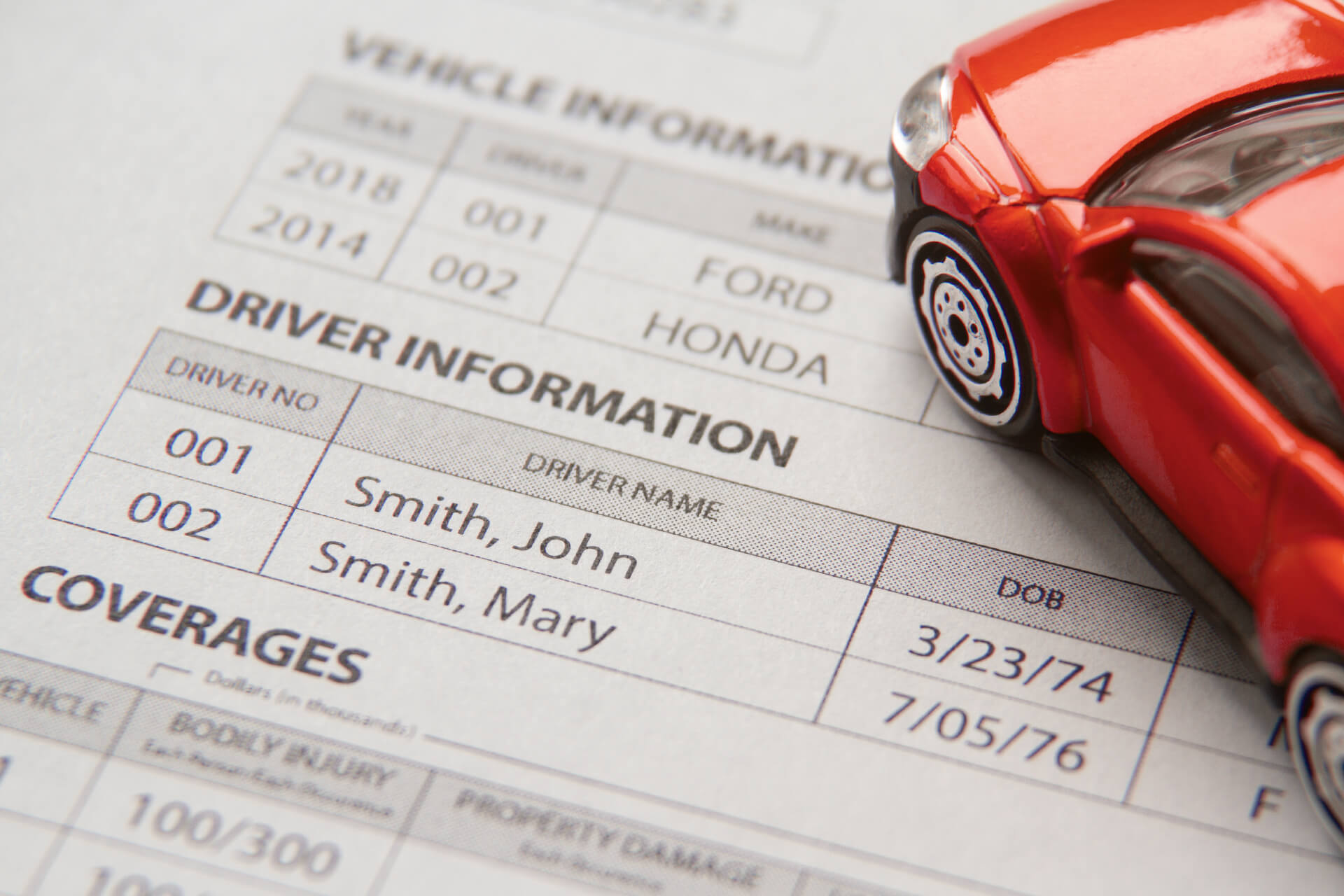

What is an Auto Insurance Policy Declaration Page?