Adding A Second Person To Car Insurance

Sunday, February 12, 2023

Edit

Adding A Second Person To Car Insurance

Why You Might Add A Second Person?

If you’re considering adding a second person to your car insurance, it’s likely because you’re looking to save money. Adding an additional driver to your policy can often reduce your insurance costs, as long as the second person is a responsible driver with a good record.

Many people add a second person to their car insurance policy to reduce the costs of their premiums. For example, if you’re married, you may want to add your spouse to your policy to save money. Or, if you’re a student, you might add a parent to your policy in order to get a better rate.

Another reason to add a second person to your car insurance is to provide coverage for other drivers. If you’re frequently taking friends or family members out for a drive, having them listed on your policy can help protect them in case of an accident.

What You Need To Know About Adding A Second Person

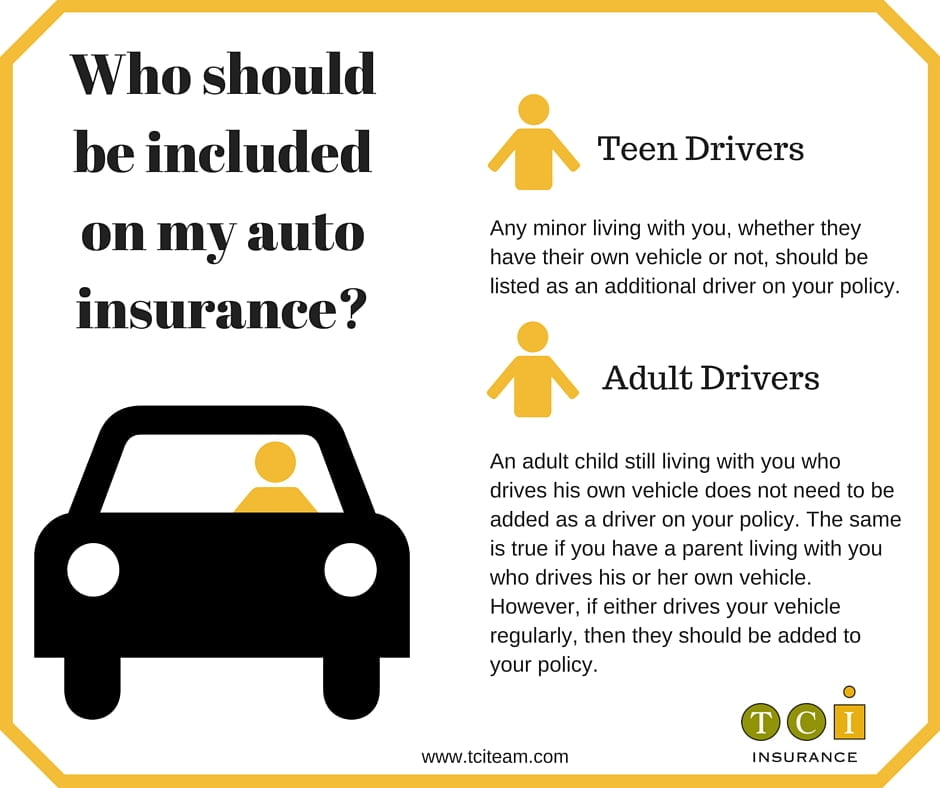

When you’re looking to add a second person to your car insurance, there are a few things you need to know. First, you need to make sure that the person you’re adding is eligible to be added. Generally, they must have a valid driver’s license and a good driving record.

You should also consider the type of coverage you’re getting. If you’re adding a second person to your policy, you may need to increase the amount of coverage you have. This is especially true if you’re adding a young driver, as they’re considered to be a greater risk and will likely need more coverage.

Finally, you need to make sure that you’re getting the best rate for the coverage you’re getting. Shop around and compare rates from different insurers to make sure you’re getting a good deal.

What Are The Benefits Of Adding A Second Person?

Adding a second person to your car insurance policy can have several benefits. As mentioned, it can often reduce your premiums, as having an additional driver on the policy can lower your risk in the eyes of the insurer.

Having a second person listed on your policy can also provide peace of mind. If you frequently take friends or family members out for a drive, knowing they’re covered in case of an accident can give you extra assurance.

Finally, having a second person on your policy can help if you ever need to make a claim. Having an additional driver on your policy can help ensure that your claim is processed quickly and smoothly.

How To Add A Second Person To Your Policy

Adding a second person to your car insurance policy is typically a simple process. Start by contacting your insurance provider and letting them know that you’d like to add an additional driver to your policy.

Your insurer will then ask for information about the additional driver, such as their name, address, and driver’s license number. They may also ask for information about the vehicle that the additional driver will be driving. Once you’ve provided all the necessary information, your insurance provider will update your policy to include the additional driver.

Final Thoughts

Adding a second person to your car insurance policy can be a great way to lower your premiums and provide coverage for other drivers. However, it’s important to make sure you’re getting the best rate for the coverage you’re getting. Shop around and compare rates from different insurers before making a decision.

Also, make sure you understand the type of coverage you’re getting and the amount of coverage you need. Adding a young driver or an additional vehicle to your policy may require you to increase the amount of coverage you have.

By taking the time to understand the process and shop around for the best rate, you can ensure that you’re getting the best deal for adding a second person to your car insurance policy.

Second car insurance: how much cost it? | americaninsurance.com

Adding Child To Car Insurance Policy : Joint Car Insurance

Adding a Teen Driver to Your Auto Insurance Policy: What You Need to

Used Car Insurance| Second Hand Car Insurance - Finserv MARKETS

How Much Car Insurance Do I Need? - YouTube