Senior Care Plan Life Insurance

Senior Care Plan Life Insurance - A Comprehensive Guide

What is Senior Care Plan Life Insurance?

Senior Care Plan Life Insurance is a type of life insurance policy specifically designed to provide financial security for elderly individuals and their families. It is designed to provide a lump sum payment to the policyholder’s designated beneficiaries upon their death. The policy also includes a guaranteed death benefit, which is a guaranteed amount that the policyholder’s beneficiaries will receive regardless of the policyholder’s age or health condition at the time of death. Senior Care Plan Life Insurance also includes additional benefits such as a waiver of premium, which allows the policyholder to keep their premiums current even if they are unable to pay due to a disability or illness.

Who Should Consider Getting Senior Care Plan Life Insurance?

Senior Care Plan Life Insurance is ideal for elderly individuals who are looking to provide financial security and peace of mind to their family. It is also a good choice for those who are looking to have their funeral expenses taken care of in the event of their death. The policy also provides a lump sum payment to the policyholder’s designated beneficiaries, which can be used to cover expenses such as medical bills, funeral expenses, and other costs associated with the policyholder’s death.

What Are the Benefits of Senior Care Plan Life Insurance?

Senior Care Plan Life Insurance provides a number of benefits for elderly individuals and their families. The policy includes a guaranteed death benefit, which is a guaranteed amount that the policyholder’s beneficiaries will receive regardless of the policyholder’s age or health condition at the time of death. The policy also includes a waiver of premium, which allows the policyholder to keep their premiums current even if they are unable to pay due to a disability or illness. In addition, the policy also provides the policyholder with a lump sum payment to their designated beneficiaries, which can be used to cover expenses such as medical bills, funeral expenses, and other costs associated with the policyholder’s death.

What Are the Downsides of Senior Care Plan Life Insurance?

The main downside of Senior Care Plan Life Insurance is that the policy is only available to elderly individuals and their families. Therefore, it is not a suitable option for younger individuals. In addition, the policy does not provide any form of investment return, so it should not be considered a long-term investment option. Finally, the premiums for the policy are typically higher than those of other life insurance policies.

Is Senior Care Plan Life Insurance Right for Me?

Senior Care Plan Life Insurance is a good option for elderly individuals and their families who are looking for a way to provide financial security and peace of mind. The policy provides a guaranteed death benefit, a waiver of premium, and a lump sum payment to the policyholder’s designated beneficiaries, which can be used to cover expenses such as medical bills, funeral expenses, and other costs associated with the policyholder’s death. However, it is important to remember that the policy is only available to elderly individuals and their families, and the premiums for the policy are typically higher than those of other life insurance policies. Therefore, it is important to carefully consider all of the options before deciding if Senior Care Plan Life Insurance is right for you.

Review Of Senior Care Plan Life Insurance Reviews References | US Folder

Angel Care Insurance Services TV Spot, 'Senior Care Plan' - iSpot.tv

Cctv Commercial Systems: Senior Life Insurance Tv Commercial

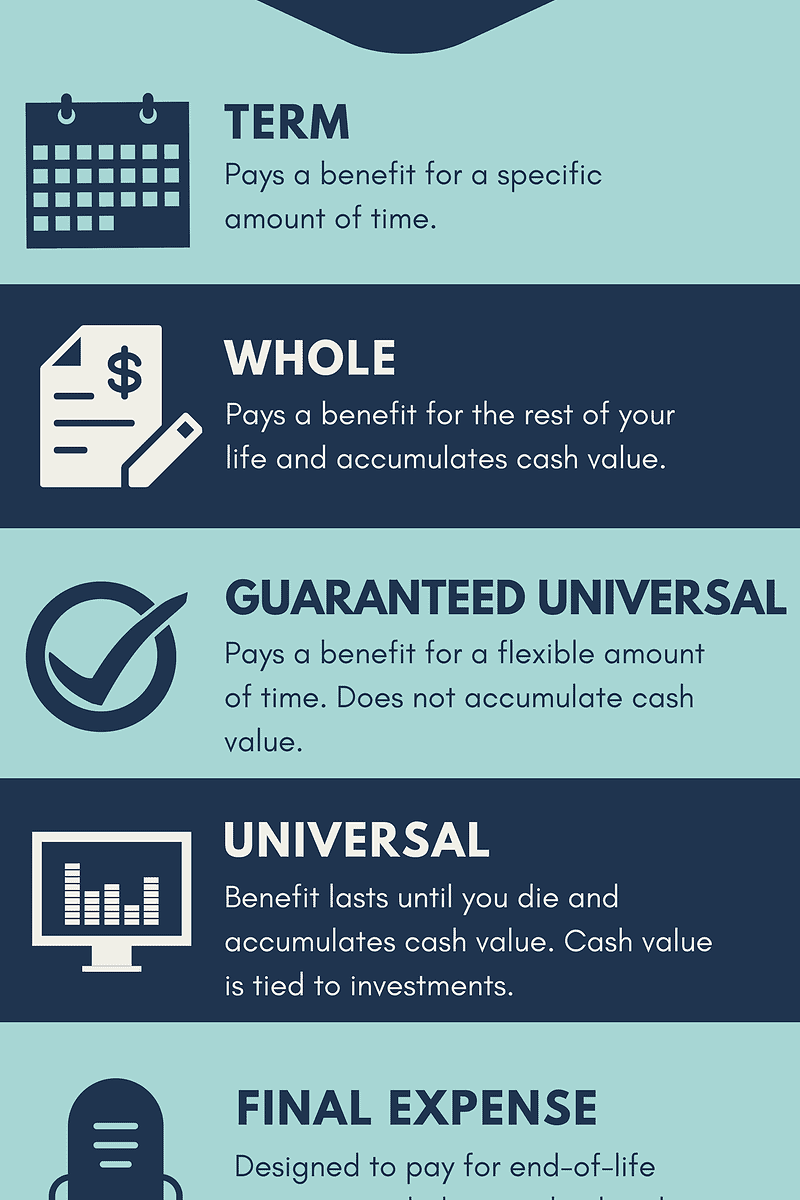

5 Types Of Life Insurance For Seniors (Instant Quotes) - Life Insurance

Open Care Senior Plan Life Insurance Coverage