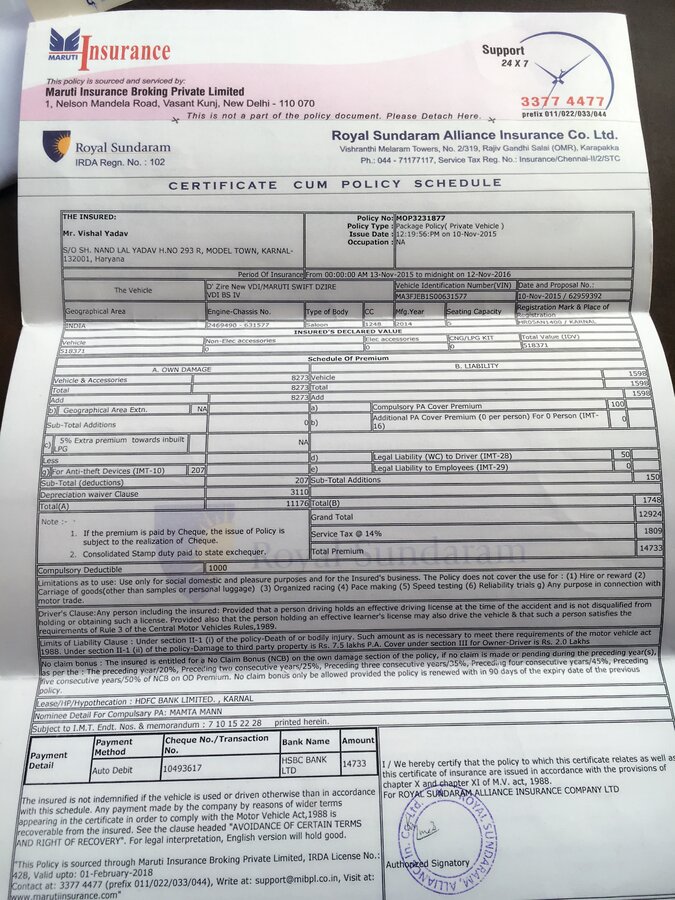

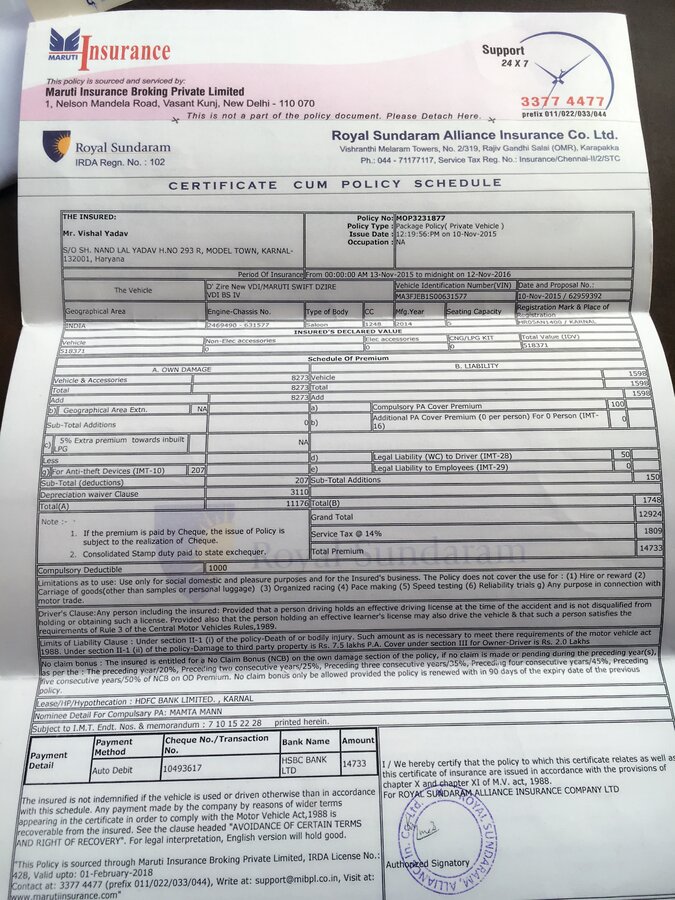

Royal Sundaram Car Insurance Policy Check

Royal Sundaram Car Insurance Policy Check - Everything You Need to Know

What is Royal Sundaram Car Insurance?

Royal Sundaram Car Insurance is a comprehensive car insurance policy offered by Royal Sundaram General Insurance Co. Ltd. It is an online car insurance policy that provides extensive coverage against various risks such as damages caused due to an accident, theft, natural disasters, and third-party liabilities. The policy also provides 24x7 roadside assistance in the event of a car breakdown. Royal Sundaram Car Insurance is a one-stop-shop that provides hassle-free and affordable car insurance solutions.

What Does Royal Sundaram Car Insurance Policy Cover?

Royal Sundaram Car Insurance Policy offers a wide range of coverage options. The policy provides cover against damages caused due to an accident, theft, fire, and natural disasters. It also provides cover against third-party liabilities such as death, bodily injury, and property damage caused to a third party due to the insured vehicle. It also offers personal accident cover for the owner-driver of the vehicle. The policy also provides cover for medical expenses incurred due to an accident.

What is the Process for Royal Sundaram Car Insurance Policy Check?

The process for Royal Sundaram Car Insurance Policy check is simple and straightforward. All you need to do is to visit the official website of Royal Sundaram and fill in the necessary details such as car model, registration number, and the sum insured. Once you have submitted the details, the website will provide you with a variety of plans that you can choose from. You can also compare different plans and select the one that best suits your needs. After selecting the plan, you can make the payment online and get the policy instantly.

What are the Benefits of Royal Sundaram Car Insurance Policy?

Royal Sundaram Car Insurance Policy offers several benefits to its customers. It provides comprehensive coverage against various risks such as damages caused due to an accident, theft, natural disasters, and third-party liabilities. The policy also provides 24x7 roadside assistance in the event of a car breakdown. It offers cashless settlement at more than 3,500 network garages across India. It also offers coverage for electrical and non-electrical accessories such as stereo systems, fog lamps, and airbags. It also offers a no-claim bonus in case of no claim made during a policy year.

How to Make a Claim under Royal Sundaram Car Insurance Policy?

In case of an accident or a theft, you need to contact Royal Sundaram’s toll-free number and register your claim. You will need to provide all the necessary details such as the date, time, and location of the incident, as well as the details of the insured vehicle. You will also need to provide the details of the third-party involved in the incident. Once the claim is registered, Royal Sundaram will send one of its representatives to assess the damages and provide you with the necessary assistance.

Conclusion

Royal Sundaram Car Insurance Policy provides comprehensive coverage against various risks such as damages caused due to an accident, theft, natural disasters, and third-party liabilities. It also provides 24x7 roadside assistance in the event of a car breakdown. The claim process is simple and hassle-free. Thus, if you are looking for an affordable and comprehensive car insurance policy, then Royal Sundaram Car Insurance Policy is an ideal choice.

Royal Sundaram Car Insurance — Complaint against dealer

Automobile Insurance Queries? Ask me - Page 145 - Team-BHP

Swift Dzrie Vdi Rightful Insurance claim denied - Beware of Royal

Royal Sundaram giving 40% discount on insurance - Page 2 - Team-BHP

Royal Sundaram Insurance Renewal (Learn how to renew your policy)